JEDDAH: Jordan’s industrial sector emerged as a major contributor to economic performance in 2025, accounting for 39 percent of gross domestic product growth in the second quarter and 92 percent of national exports.

Manufactured exports increased 8.9 percent year on year during the first nine months of 2025, reaching 6.4 billion Jordanian dinars ($9 billion), driven by stronger external demand. The expansion aligns with the country’s Economic Modernization Vision, which aims to position the country as a regional hub for high-value industrial exports, the Jordan News Agency, known as Petra, quoted the Jordan Chamber of Industry President Fathi Jaghbir as saying.

Export growth was broad-based, with eight of 10 industrial subsectors posting gains. Food manufacturing, construction materials, packaging, and engineering industries led performance, supported by expanded market access across Europe, Arab countries, and Africa.

In 2025, Jordanian industrial products reached more than 144 export destinations, including emerging Asian and African markets such as Ethiopia, Djibouti, Thailand, the Philippines, and Pakistan. Arab countries accounted for 42 percent of industrial exports, with Saudi Arabia remaining the largest market at 955 million dinars.

Exports to Syria rose sharply to nearly 174 million dinars, while shipments to Iraq and Lebanon totaled approximately 745 million dinars. Demand from advanced markets also strengthened, with exports to India reaching 859 million dinars and Italy about 141 million dinars.

Industrial output also showed steady improvement. The industrial production index rose 1.47 percent during the first nine months of 2025, led by construction industries at 2.7 percent, packaging at 2.3 percent, and food and livestock-related industries at 1.7 percent.

Employment gains accompanied the sector’s expansion, with more than 6,000 net new manufacturing jobs created during the period, lifting total industrial employment to approximately 270,000 workers. Nearly half of the new jobs were generated in food manufacturing, reflecting export-driven growth.

Jaghbir said industrial exports remain among the economy’s highest value-added activities, noting that every dinar invested generates an estimated 2.17 dinars through employment, logistics, finance, and supply-chain linkages. The sector also plays a critical role in narrowing the trade deficit and supporting macroeconomic stability.

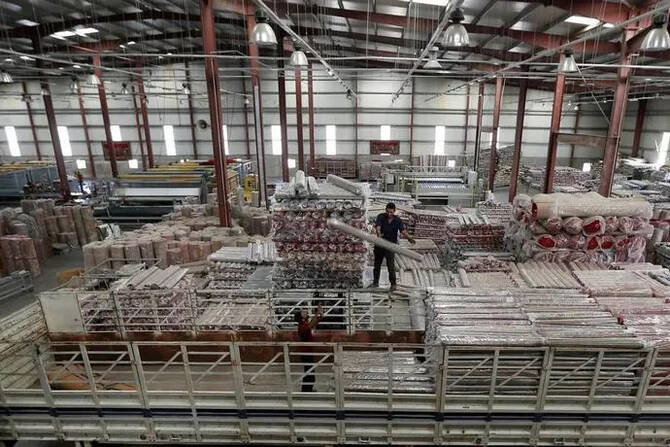

Investment activity accelerated across several subsectors in 2025, including food processing, chemicals, pharmaceuticals, mining, textiles, and leather, as manufacturers expanded capacity and upgraded production lines to meet rising demand.

Jaghbir attributed part of the sector’s momentum to government measures aimed at strengthening competitiveness and improving the business environment. Key steps included freezing reductions in customs duties for selected industries, maintaining exemptions for production inputs, reinstating tariffs on goods with local alternatives, and imposing a 16 percent customs duty on postal parcels to support domestic producers.

Additional incentives in industrial cities and broader structural reforms were also cited as improving the investment climate, reducing operational burdens, and balancing consumer needs with protection of local industries.