RIYADH: Jordan spent nearly $500 million on water-related projects and programs in 2025, stepping up investment in supply infrastructure, wastewater treatment and renewable energy, according to official data.

Spending during the year covered large-scale strategic projects as well as upgrades to water networks, wastewater facilities, water harvesting systems and digital infrastructure, the Jordan News Agency, or Petra, reported, citing data from the Ministry of Water and Irrigation.

The scale of investment reflects the government’s focus on strengthening national water security, improving service quality, and advancing sustainable solutions to address water scarcity and climate change challenges.

The spending aligns with Jordan’s National Water Strategy 2023–2040, which aims to achieve water security through integrated resource management, reduce water losses from about 50 percent to less than 25 percent by 2040, expand non-conventional water sources, improve irrigation efficiency, and develop major infrastructure projects such as the National Water Carrier to meet rising demand.

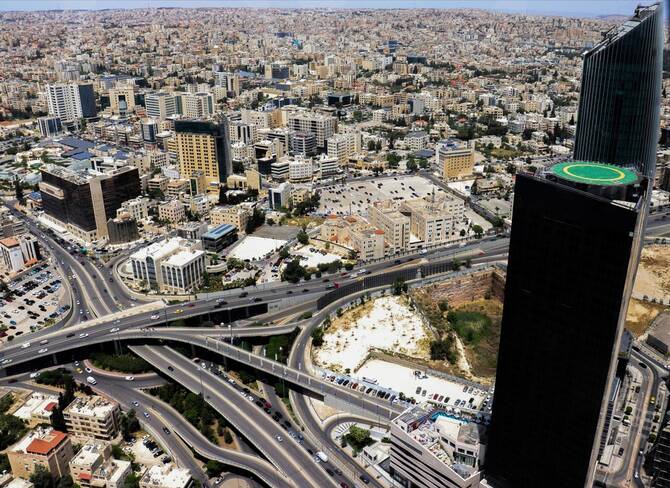

“The ministry’s achievements in 2025 marked a qualitative shift in the management of the water sector through continued progress in implementing the National Carrier Project for desalination and water conveyance from Aqaba to Amman,” Petra stated.

It added: “The project contract was signed, 11 annexes to the agreement were completed, and grants and international support were secured, most notably a Dutch grant of €31 million ($36.5 million) as part of a broader €100 million support package for the water sector.”

To enhance water supply, the ministry and its affiliated entities implemented rehabilitation and upgrade projects across several governorates. These included the Bani Kinana District water system improvement project, valued at nearly $60 million, as well as network upgrades in Tafilah worth 6.1 million Jordanian dinars, Petra and Maan at 6.8 million dinars, and Ramtha at €21.36 million.

To enhance water supply, the ministry and its affiliated bodies carried out rehabilitation and upgrade projects across various governorates. These included the Bani Kinana District water system improvement project, valued at nearly $60 million, along with network upgrades in Tafilah at 6.1 million Jordanian dinar ($8.6 million), Petra/Maan at 6.8 million dinars, and Ramtha at €21.36 million ($25.15 million).

Other projects included upgrading the Mashtaba water networks in Jerash governorate at a cost of $10.34 million, rehabilitating seven wells in the Kafrein area for $1.19 million, and refurbishing the Abu Al-Zeighan wells desalination plant at a cost of $36 million.

The ministry also intensified work on wastewater infrastructure, executing and signing agreements for several key projects. These included the Hakama–Irbid wastewater project, valued at 11.37 million dinars. Wastewater initiatives in northeast Balqa were worth €60 million.

Additional projects in west Irbid and southwest Amman cost $27.7 million. The ministry also expanded the Samra wastewater treatment plant and improved water sources at a cost of $46 million. Upgrades to the Ain Ghazal plant were supported by a $3 million grant, along with an additional €708,700 grant.

As part of efforts to reduce operational energy costs and improve sustainability, the ministry implemented renewable energy projects, including the operation of a 2-megawatt photovoltaic solar project for the Disi Water Project and solar installations at the Zara–Ma’in plant at a cost of 1.2 million dinars. One of these projects received a silver award for solar energy projects in the UAE in October.

In the area of water harvesting and risk management, the ministry completed the design and implementation of 15 water harvesting facilities and received water harvesting structures and ponds with a combined storage capacity exceeding 2.1 million cubic meters. It also established 120 water harvesting units in Karak governorate, awarded a tender for ponds in Mafraq governorate with a capacity of 125,000 cubic meters, prepared national flood intensity maps, and launched dam risk assessment tools.

Institutional and regional cooperation also expanded during the year. This included the signing of 10 investment agreements in the central and southern Jordan Valley, six agreements delegating water distribution management to water user associations, ongoing project discussions with international partners, a Jordanian-Syrian agreement on the fair allocation of Yarmouk Basin waters, and Jordan’s formal membership in the International Commission on Large Dams in May.