RIYADH: Saudi Finance Minister Mohammed Al-Jadaan confirmed on Wednesday that the government will maintain expansionary spending in the 2026 budget, emphasizing stability and medium-term planning.

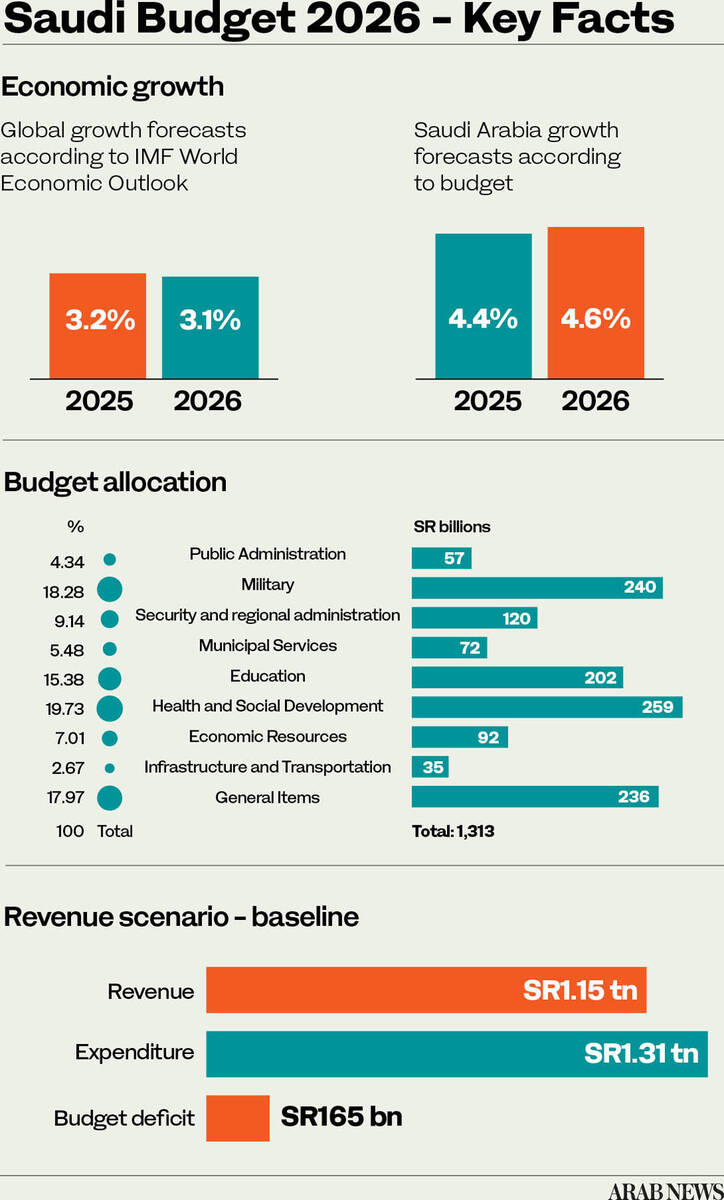

He said total expenditure is expected to reach SR1.31 trillion ($348.9 billion) in 2026 and rise to about SR1.41 trillion by 2028, with revenue growth supported by accelerated economic expansion.

During a Dec. 3 press conference after the approval of the 2026 budget, Al-Jadaan stated: “Despite all spending on major strategies and projects, the government continues to focus on and improve basic services to enhance services provided to citizens, including education, health, social services, and municipal services, which are set to reach SR533 billion in 2026.”

He explained that the next stage — maximizing impact — will begin early next year, requiring significant work from both the government and private sector.

Al-Jadaan highlighted Crown Prince Mohammed bin Salman’s statement on the budget, which reviewed Vision 2030 achievements, government focus on citizens, and future directions, including the third phase of the Vision. He said: “Ninety-three percent of the targeted Vision 2030 performance indicators have been achieved or are on track, while 85 percent of initiatives have been completed or are progressing as planned. 299 Vision indicators have already met their targets ahead of 2030.”

He reviewed the 2025 budget, with expenditures of roughly SR1.33 trillion, revenues of about SR1.09 trillion, and a deficit of approximately SR245 billion. He noted: "Last year I spoke, and I will repeat briefly, that the budget deficit differs based on its uses. For us in Saudi Arabia in this period… the deficit was a targeted strategic deficit, based on a government policy… even if we need to borrow.”

“The goal is for this borrowing of SR245 billion to achieve a return higher than its cost, and that is what is happening in the Kingdom. The growth in the economy today, especially in the non-oil economy, averages 5 percent over the past four or five years.”

He added: “The returns from most of the spending we are undertaking now will come after years, not now. Therefore, it may be good for us to continue… in 2026, 2027, and 2028, increasing spending as long as the return on this spending is higher than the cost of borrowing.”

Al-Jadaan emphasized that citizens remain the government’s priority: “The cornerstone of the government’s work is the citizen and what benefits them directly or indirectly through projects and strategies that create job opportunities and ensure security, stability, peace, and prosperity.”

He highlighted the structural transformations since Vision 2030, including a 40 percent increase in private investment’s share of GDP and non-oil activity’s rise to 55.4 percent. He called this growth “unprecedented” and noted that the tourism sector’s trade surplus is increasing, while the budget deficit is moving toward a surplus.

Al-Jadaan pointed out that the number of micro, small, and medium enterprises has grown from 500,000 to 1.7 million, generating 1.2 million jobs. He said the government will continue supporting sector growth, particularly in AI, technology, and government tech, while pursuing revenue growth through economic expansion and private sector enablement.

He noted that international rating agencies recognize Saudi Arabia’s approach, affirming or upgrading the Kingdom’s rating despite rising debt and deficit. Al-Jadaan projected real GDP growth of 4.4 percent in 2025, with nominal GDP reaching SR5.6 trillion by 2028, and stressed that inflation remains among the lowest globally.

On long-term economic returns, he said: “Some returns are achieved quickly, while others take many years, especially in infrastructure projects such as roads, airports, and railways. Some phases may show temporary negative returns due to the import of equipment and materials, but the real gains become evident over subsequent years and decades.”

He noted that full sustainability has not yet been reached, with revenues still affected by oil prices. Vision 2030 aims to maximize non-oil revenues while using oil wealth to build a robust economy for future generations. He also highlighted the Public Investment Fund’s growth from SR150 billion to over SR800 billion: “The PIF does not distribute dividends to the government. The goal is long-term investment for future generations.”

Regarding government revenues, he said all income except the White Land tax is deposited into the unified treasury and allocated to designated accounts, such as Social Security. White Land tax revenues fund housing development. On health and education, spending will exceed SR460 billion in 2026, and privatization will not reduce services for citizens.

Al-Jadaan confirmed Saudi Arabia’s economic policy is based on “productive debt” and pledged continued focus on industry, tourism, transport and logistics, technology (including AI), water, and energy over the next five years. He added: “The Saudi government will handle inflation prudently… rates are among the lowest internationally.”