ALKHOBAR: As Saudi Arabia’s Vision 2030 accelerates, the Kingdom’s rapid transformation is exposing organizations to new layers of forensic risk — from AI-driven cyberattacks to complex compliance demands.

Regional data shows that while opportunities are booming, vulnerabilities are growing just as fast.

Saudi Arabia’s decade of transformation is compressing decades of progress into a few short years, creating both immense opportunity and unprecedented forensic challenges.

AI is transforming the forensic landscape, helping investigators detect fraud, cyberattacks, and compliance risks faster and with greater precision across Saudi Arabia’s digital economy. (StockCake)

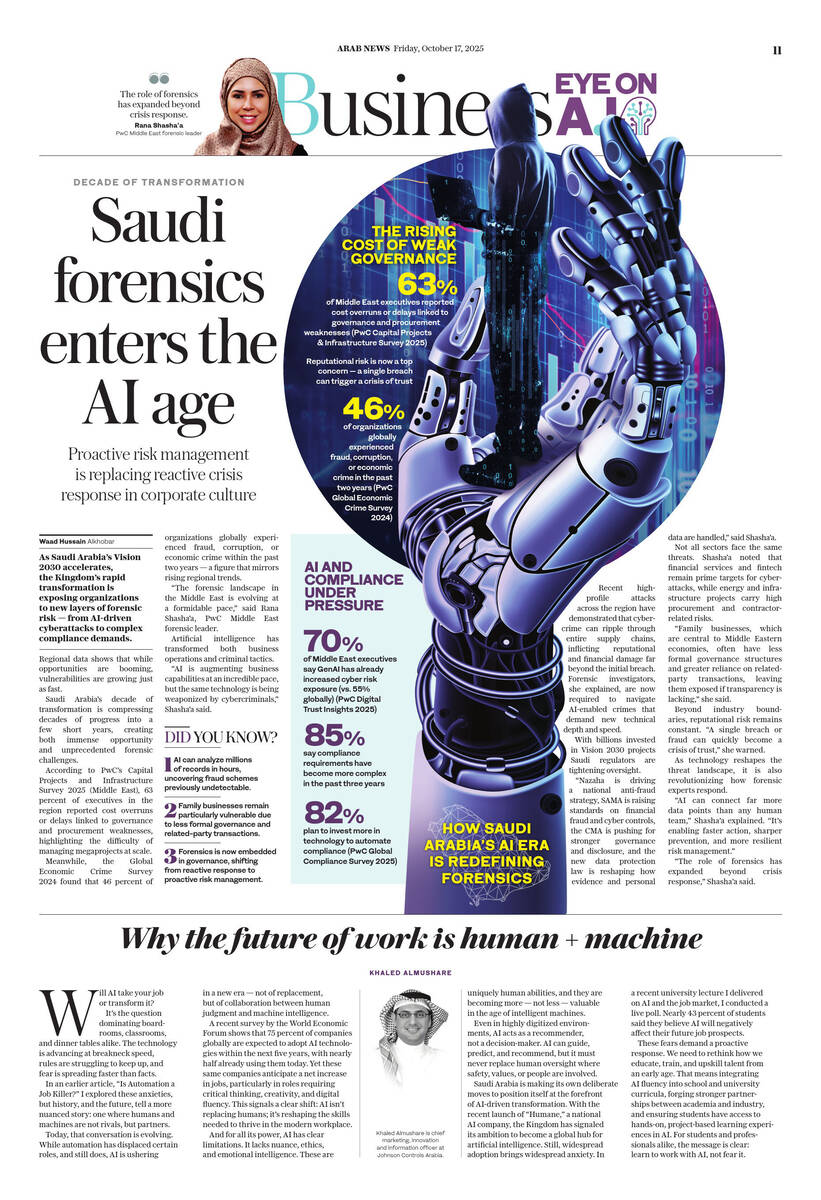

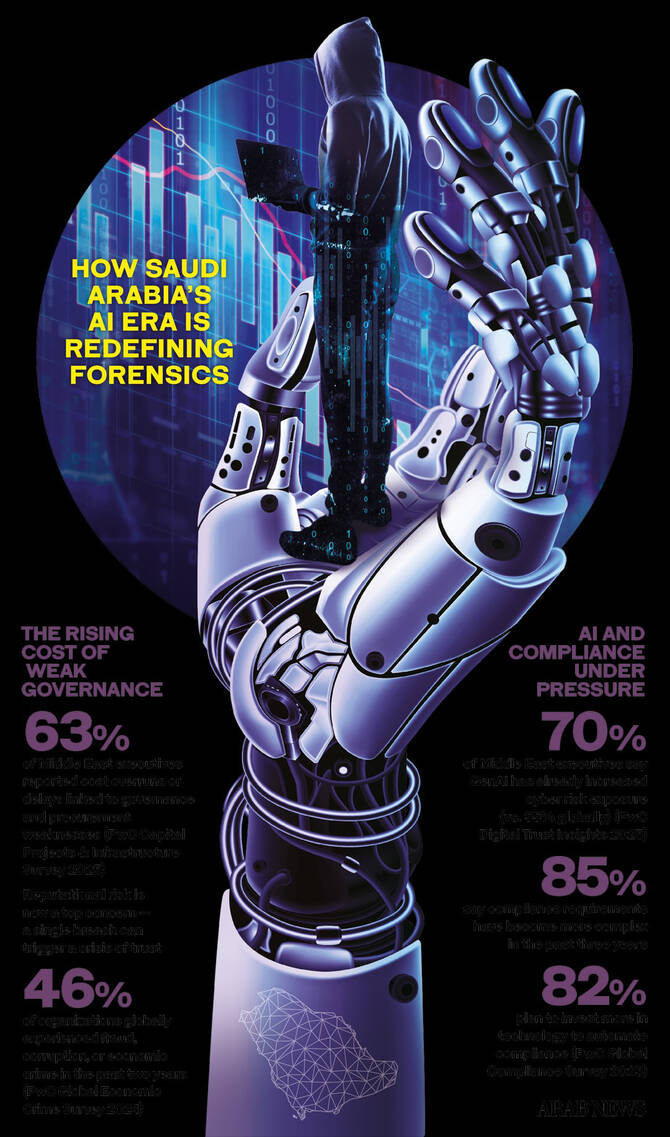

According to PwC’s Capital Projects and Infrastructure Survey 2025 (Middle East), 63 percent of executives in the region reported cost overruns or delays linked to governance and procurement weaknesses, highlighting the difficulty of managing megaprojects at scale.

Meanwhile, the Global Economic Crime Survey 2024 found that 46 percent of organizations globally experienced fraud, corruption, or economic crime within the past two years — a figure that mirrors rising regional trends.

“The forensic landscape in the Middle East is evolving at a formidable pace,” said Rana Shasha’a, PwC Middle East forensic leader. “The sheer scale of investment in megaprojects and infrastructure programs brings exposure to procurement fraud, conflicts of interest, and delivery risks.”

Rana Shasha’a, PwC Middle East Forensic Leader, says the region’s shift toward AI-powered forensics marks a cultural and strategic turning point in how organizations manage risk and build trust. (linked.in)

Artificial intelligence has transformed both business operations and criminal tactics. PwC’s Global Digital Trust Insights: Middle East 2025 shows that 70 percent of Middle East executives believe GenAI has already increased their cyber risk exposure, compared to 55 percent globally.

“AI is augmenting business capabilities at an incredible pace, but the same technology is being weaponized by cybercriminals,” Shasha’a said. “We’re now seeing scalable, hyper-personalized attacks — from GenAI-powered phishing to identity theft and disinformation campaigns.”

Recent high-profile attacks across the region have demonstrated that cybercrime can ripple through entire supply chains, inflicting reputational and financial damage far beyond the initial breach. Forensic investigators, she explained, are now required to navigate AI-enabled crimes that demand new technical depth and speed.

Opinion

This section contains relevant reference points, placed in (Opinion field)

With billions invested in Vision 2030 projects — from giga-developments to fintech expansion — Saudi regulators are tightening oversight.

“Nazaha is driving a national anti-fraud strategy, SAMA is raising standards on financial fraud and cyber controls, the CMA is pushing for stronger governance and disclosure, and the new data protection law is reshaping how evidence and personal data are handled,” said Shasha’a.

These measures signal that compliance is no longer a tick-box exercise. PwC’s Global Compliance Survey 2025 found that 85 percent of executives say compliance requirements have become more complex in the past three years, and 82 percent plan to invest more in technology to automate compliance.

For organizations, this means embedding forensic readiness into operations — from procurement checks to contract oversight — to detect and mitigate risks before they escalate.

Stronger governance frameworks, new data laws, and national anti-fraud strategies are reshaping how Saudi regulators and organizations safeguard integrity in the AI era. (lawdit.co.uk)

Not all sectors face the same threats. Shasha’a noted that financial services and fintech remain prime targets for cyberattacks, while energy and infrastructure projects carry high procurement and contractor-related risks.

“Family businesses, which are central to Middle Eastern economies, often have less formal governance structures and greater reliance on related-party transactions, leaving them exposed if transparency is lacking,” she said.

Beyond industry boundaries, reputational risk remains constant. “A single breach or fraud can quickly become a crisis of trust,” she warned.

As technology reshapes the threat landscape, it is also revolutionizing how forensic experts respond. Forensic teams across the region now rely on AI-driven anomaly detection to sift through millions of records in hours rather than weeks — a leap that has already exposed previously undetectable fraud schemes.

“AI can connect far more data points than any human team,” Shasha’a explained. “It’s enabling faster action, sharper prevention, and more resilient risk management.”

DID YOU KNOW?

• AI can analyze millions of records in hours, uncovering fraud schemes previously undetectable.

• Family businesses remain particularly vulnerable due to less formal governance and related-party transactions.

• Forensics is now embedded in governance, shifting from reactive response to proactive risk management.

In cybercrime cases, AI-driven malware analysis and GenAI-powered forensic chatbots are accelerating investigations while uncovering deeper patterns of misconduct. The result is not just faster response times but a proactive model in which digital forensics becomes integral to governance.

The region’s approach to forensics is shifting fundamentally. What was once a reactive field — stepping in after a crisis — is now a core pillar of corporate resilience.

“The role of forensics has expanded beyond crisis response,” Shasha’a said. “Organizations are embedding forensic thinking into governance, using continuous monitoring, anomaly detection, and tighter controls.”

Financial services and fintech firms face growing exposure to AI-enabled fraud and cyber threats, driving demand for advanced forensic tools and real-time risk detection. (netscribes.com)

This evolution is cultural as much as technical. Leadership teams increasingly view prevention as cheaper and more strategic than remediation, and regulators reinforce this mindset through stricter disclosure and cyber-resilience requirements.

Across the region, the forensic transformation is not just about compliance — it’s about trust.

“The future of forensics in the Middle East will be defined by scale, sophistication, and integration,” Shasha’a concluded.

“Forensics will no longer be a separate response function; it will be built into governance, compliance, and transformation programs as a frontline defense.”

As Saudi Arabia and its neighbors continue to digitize at record speed, the ability to anticipate and neutralize risks will determine which organizations thrive and which fall behind.