RIYADH: Jordan has maintained its long-term sovereign credit rating at “BB-” with a stable outlook, according to S&P Global, underscoring the country’s resilience despite heightened regional security challenges.

In its latest assessment, the US-based ratings agency attributed the decision to Jordan’s macroeconomic stability, steady progress on financial and structural reforms, and continued international support, the state-run Petra news agency reported.

The outlook is further reinforced by improving fiscal performance. Official data show domestic revenues climbed 3.6 percent in the first half of 2025 to 4.67 billion dinars ($6.59 billion), supported by government measures to bolster public finances.

This increase of about 164.7 million dinars coincided with a reduction in public debt, which fell to 35.3 billion dinars, or 90.9 percent of gross domestic product, down from 92.7 percent in May, according to Central Bank of Jordan figures.

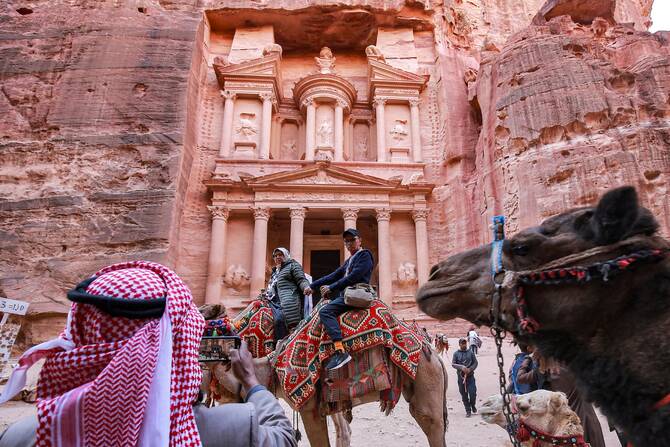

S&P expects Jordan’s economy to expand 2.6 percent in 2025, aided by a rebound in the travel and tourism industry, shifting regional dynamics, and a gradual pickup in trade with Syria and Iraq.

Growth is projected to accelerate to 3 percent in 2026 and 3.1 percent in 2027. The agency also forecasts the consolidated budget deficit will narrow from 2.8 percent of GDP in 2024 to 2.4 percent in 2025, with the debt-to-GDP ratio on a downward path over the medium term.

The agency noted that the Jordanian dinar’s peg to the US dollar has been instrumental in controlling inflation and maintaining monetary stability. Inflation is expected to hover around 2 percent in 2025, staying within manageable levels.

Finance Minister Abdul Hakim Al-Shibli has reiterated the government’s commitment to lowering the public debt ratio to 80 percent of GDP by 2028 under an IMF-backed reform program. He said the plan is designed to reinforce fiscal and economic stability, support sustainable growth, and protect citizens from additional financial burdens.

Jordan’s reform drive has gained momentum following the IMF’s completion of the third review of its Extended Fund Facility in June.

At the same time, the fund approved a new 48-month, $700 million Resilience and Sustainability Facility, aimed at boosting long-term resilience in the energy, water, and health sectors while advancing climate and pandemic preparedness.