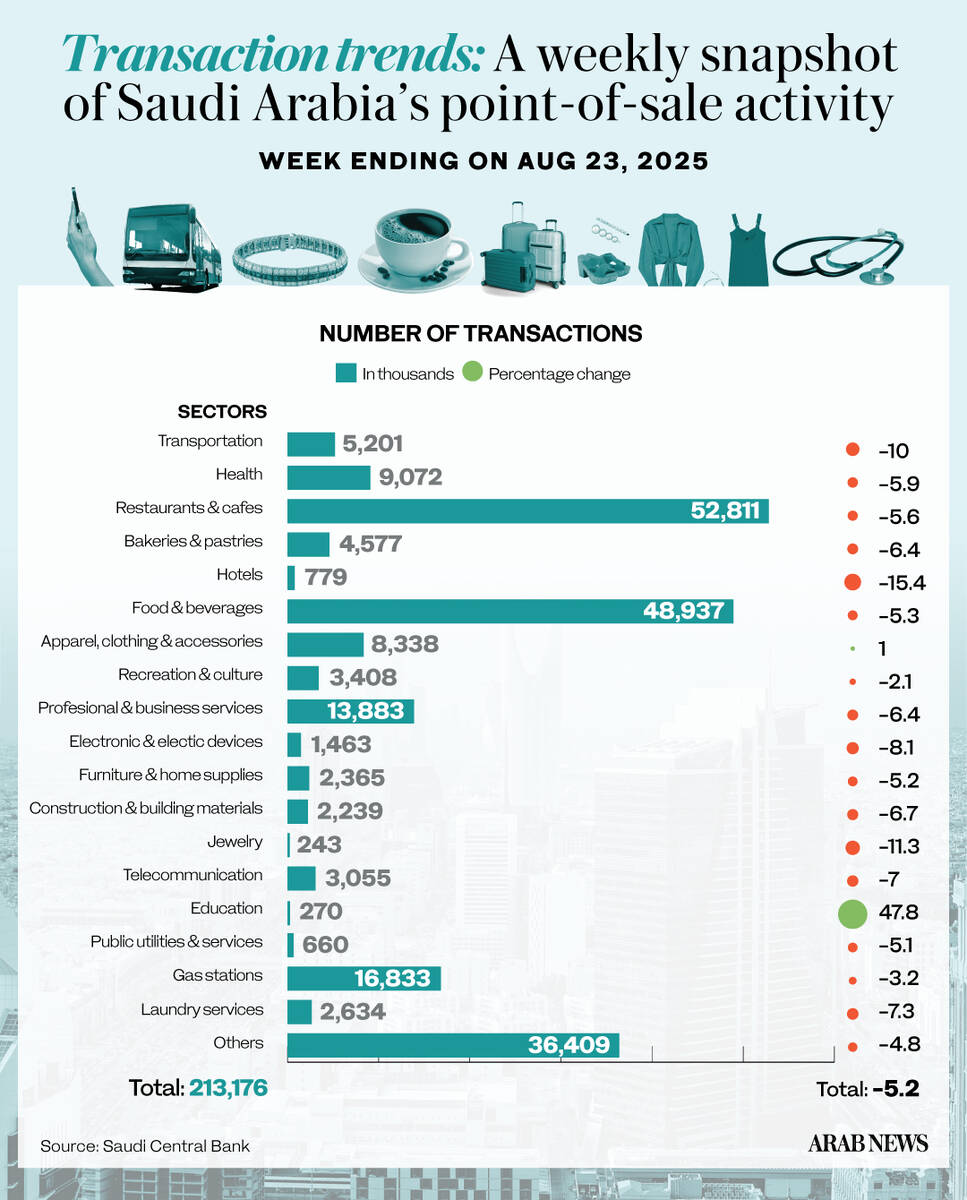

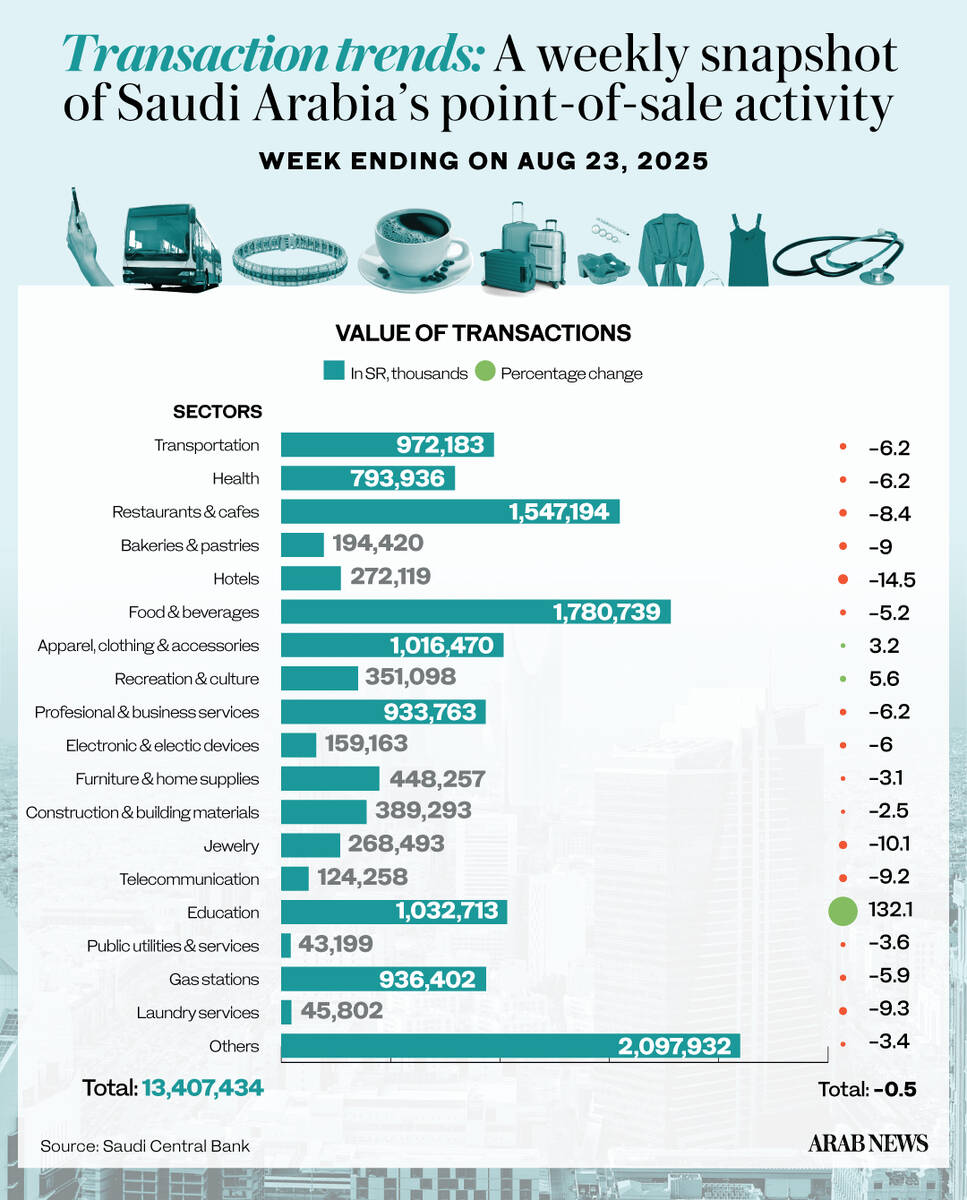

RIYADH: Education spending in Saudi Arabia surged 132.1 percent to SR1.03 billion ($275.2 million) for the week ending Aug. 23, helping to keep total point-of-sale transactions above the SR13 billion mark.

The sector was responsible for the third largest share of this week’s POS value and recorded a 47.8 percent increase in the number of transactions, reaching 270,000.

Education was one of only three sectors that saw positive change across the seven days, with the total POS value seeing a weekly drop of 0.5 percent to stand at SR13.41 billion.

The relatively small fall underscores the resilience of consumer activity across the Kingdom, according to data from the Saudi Central Bank.

Another sector to post an increase was recreation and culture, up 5.6 percent in value terms, although the weekly bulletin showed the two subcategories in that metric registered contrasting fortunes.

Expenditure on books and stationery grew in both value and volume, with spending up 34.5 percent to SR165.14 million, and the number of transactions increasing 40.2 percent to 948,000.

Outlays on recreation dropped by 11.3 percent to SR185.96 million.

The largest percentage decrease across the seven days came in the airlines subcategory, with the value of transactions dropping by 15.8 percent to SR41.82 million. Spending on hotels followed, falling by 14.5 percent to SR272.12 million.

Gas stations saw a 5.9 percent decrease to come in at SR936.40 million.

Food and beverages, the sector with the biggest share of total POS value, recorded a 5.2 percent decrease to SR1.78 billion, while the restaurants and cafes cohort saw an 8.4 percent drop, totaling SR1.55 billion and claiming the second-biggest share of this week’s POS.

The top three categories accounted for approximately 32.52 percent of the week’s total spending, amounting to SR4.36 billion.

Spending on transportation and health both saw 6.2 percent drops, to SR972.18 million and SR793.94 million, respectively. Small decreases were seen in spending on furniture and construction materials at 3.1 percent and 2.5 percent to SR448.26 million and SR389.29 million, respectively.

Geographically, Riyadh dominated POS transactions, with expenses in the capital reaching SR4.90 billion, a 6.8 percent increase from the previous week.

Jeddah followed despite a 2.5 percent dip to SR1.77 billion, while Dammam ranked third, up 6.9 percent to SR671.80 million.