RIYADH: Saudi Arabia’s culinary heritage is deeply rooted in its diverse landscapes, climates, and tribal traditions — further shaped by centuries of global trade.

Yet both locally and internationally, exposure to authentic Saudi cuisine has long remained limited to a few convenient, accessible formats.

That’s changing, not just in taste but in structure. In July, the Saudi government issued a formal regulatory framework for luxury restaurants, officially classifying fine dining as a distinct category with its own licensing code — requiring on-table service only, the elimination of cashier counters, and a curated, limited number of branded outlets per city.

Each establishment must feature a visible beverage prep station, maintain distinct employee-only rest areas, and meet strict kitchen zoning rules that separate raw, cooked, and served foods to minimize contamination.

By formalizing standards for luxury restaurants, the government aims to elevate service consistency, improve operational quality, and ensure a premium guest experience across the Kingdom.

The new framework will not only protect consumers but also encourage global investment by giving restaurateurs a clear, streamlined path to enter Saudi Arabia’s high-end dining market.

It reflects the broader goals of Vision 2030: to boost tourism, foster entrepreneurship, and position Saudi cities as regional lifestyle destinations.

The Saudi foodservice market is projected to grow from $30.12 billion in 2025 to $44.67 billion by 2030, at a compound annual growth rate of 8.2 percent, according to Mordor Intelligence, a market research firm.

Under Vision 2030, Saudi Arabia is positioning itself as a global culinary destination — supporting local entrepreneurship and attracting international ventures — while reshaping its food and hospitality landscape.

Economic ripple effects

The rise of high-end dining in Saudi Arabia is generating widespread economic ripple effects, starting with job creation across multiple sectors.

According to Elena Caron, corporate services director at Fragomen, demand is growing not only for chefs and service staff, but also for professionals in logistics, supply chain, and technology.

“At the same time, restaurants and hospitality groups must navigate a more complex regulatory environment. Complying with labor laws, meeting Saudization quotas, securing commercial licenses and following foreign investment rules are all essential to ensure legal compliance and long-term business sustainability,” Caron said.

She added that supply chain and food safety standards are also evolving, particularly with the growing emphasis on local sourcing.

“As partnerships with Saudi farms and producers expand, restaurants are expected to meet rigorous food handling and traceability requirements in line with Saudi Food and Drug Authority’s regulations,” she said.

“In this environment, compliance isn’t optional — it’s essential to protect brand integrity and maintain consumer trust.”

Ahmad Al-Zaini, CEO and co-founder of cloud-based restaurant management and point-of-sale platform Foodics, noted that demand for skilled talent is rising across service, logistics, and food production, while the expansion of premium dining is also increasing the need for upscale real estate, smart kitchens, and efficient service systems.

“At Foodics, we’ve seen a clear uptick in demand from premium and fine dining establishments that want operational clarity, advanced analytics, seamless integrations and customer experiences,” he said.

“These businesses are anchors for the recently unlocked premium lifestyles in the Kingdom, and they play a role in attracting a new category of sophisticated investors, operators, and entrepreneurs.”

Alexander Sysoev, founder of international restaurant guide GreatList, an international restaurant guide, described fine dining as a powerful catalyst — driving demand for luxury real estate, elevating local production standards, and generating diverse employment opportunities across the culinary value chain.

“The real shift is cultural,” Sysoev said. “It raises expectations across industries — from education and sourcing to hospitality. Restaurants are no longer just places to eat — they’re becoming part of a national economic strategy.”

Patrick Samaha, partner at Kearney Middle East and Africa, said the Kingdom’s F&B sector grew 15 percent in 2025, creating hundreds of jobs through major restaurant openings in Riyadh and Jeddah.

“This momentum is also reshaping the real estate landscape,” he said, adding: “Premium F&B demand in districts like King Abdullah Financial District and Jeddah’s Corniche surged 20 percent in 2025, prompting developers to integrate signature dining into luxury mixed-use projects.”

Vision 2030’s culinary impact

Fine dining has become a core pillar of Saudi Arabia’s economic transformation under Vision 2030, with government support attracting top global chefs, brands, and investors.

According to Caron, a new generation of Saudi culinary entrepreneurs is rising.

“Vision 2030 has empowered them to launch dining concepts that reflect local culture while meeting global standards,” she said.

Al-Zaini added that global brands are expanding into Saudi Arabia to tap new audiences, which in turn is raising service standards and fostering competition across the value chain.

“This has led to a rise in homegrown restaurateurs investing in premium concepts, training local talent, and demanding more reliable infrastructure for their operations,” he said.

Sysoev agreed, emphasizing that Saudi Arabia is emerging as a high-potential culinary market.

“For local entrepreneurs, it brings legitimacy, infrastructure, and — most importantly — a sense of momentum,” he said. “They no longer need to prove that fine dining is possible. Now, they’re proving they can lead.”

Samaha noted that recent reforms and giga-projects have fast-tracked international investment, with brands like COYA and Le Petit Chef entering the market. In the first half of 2025 alone, seven major openings were recorded.

“Vision 2030 is cultivating local talent, despite the influx of international brands and concepts,” he said, adding: “Initiatives like the Culinary Incubator and Human Capability Development Program trained over 4,500 Saudis in hospitality and culinary arts in 2025, enabling a new generation of entrepreneurs to emerge.”

He added that distinctly Saudi fine dining concepts are now emerging — blending local heritage with global techniques to redefine the Kingdom’s culinary identity.

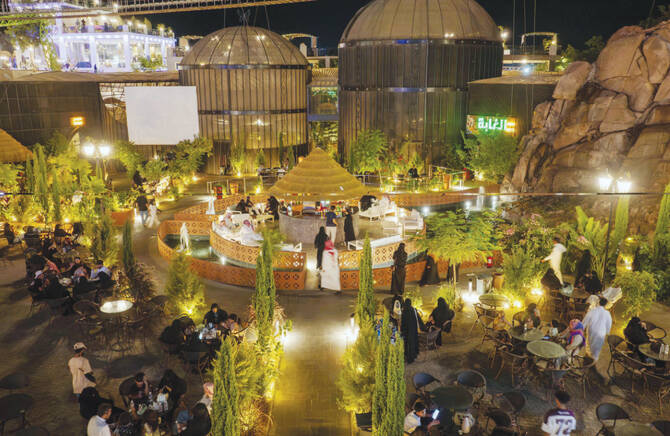

Riyadh and Jeddah lead the way

Looking ahead, industry leaders agree that Riyadh and Jeddah will remain at the forefront of Saudi Arabia’s fine dining evolution.

Al-Zaini pointed to the Kingdom’s tech-savvy, affluent youth as key drivers of demand for globally inspired yet locally grounded dining experiences.

“This creates the perfect opportunity for restaurateurs to experiment with the plethora of technologies at their disposal today, from interactive culinary displays to personalized dishes, and gastronomical explorations with local ingredients from the Kingdom’s vast agricultural landscape,” he said.

Sysoev noted that while AI can optimize menus and personalize service, true value lies in originality and cultural context.

He projected that soon Saudi Arabia will not be copying Western models — it will be crafting its own.

“That means a stronger focus on local ingredients, sustainability, and chef-driven concepts with a distinct point of view. Cities like Riyadh and Jeddah don’t need to follow the hype — their power will come from building identity. That’s how they’ll stand out on the global culinary map,” Sysoev said.

According to Samaha, three key trends are shaping the future of fine dining in the Kingdom: innovation, sustainability, and cultural storytelling.

He said restaurants are using AI and smart tech to personalize guest experiences. Sustainability is now central, with zero-waste kitchens, local sourcing, and green initiatives like AlUla’s solar-powered Desert Bloom project.

“Third, fine dining in the Kingdom is evolving into a platform for cultural expression. Events like Layali Diriyah and the Riyadh Food Art Festival position cuisine as a medium for storytelling, identity, and destination branding,” he said.

As Saudi Arabia reimagines its tourism and lifestyle sectors, fine dining is no longer just about food — it is a strategic lever for economic diversification, cultural diplomacy, and global identity.