ISLAMABAD: Iraq’s Consul General Maher Mjhid Jejan has proposed a sea link between Pakistan’s southern port city of Karachi and Basra in a bid to improve logistics and strengthen trade routes, the Karachi Chamber of Commerce and Industry (KCCI) said on Wednesday.

Relations between Pakistan and Iraq have received a boost with a number of ministerial-level exchanges in recent years. The two countries have held discussions on enhancing defense and law enforcement cooperation, focusing on counterterrorism, counternarcotics and intelligence-sharing. Pakistan has attempted to strengthen trade, investment and cooperation in priority sectors with regional allies in recent months as it attempts to attract international investment to achieve sustainable economic growth.

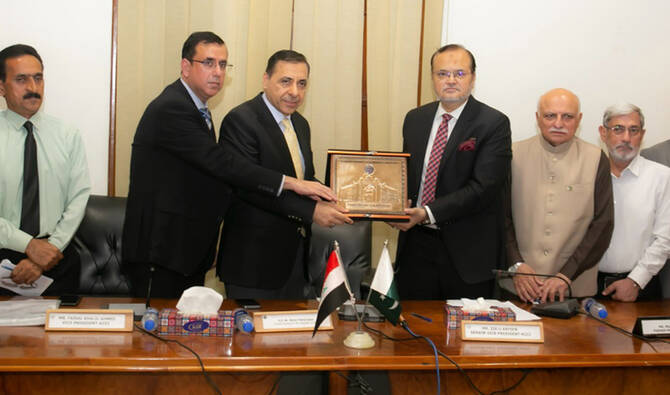

Jejan visited the KCCI’s office on Wednesday during which he met the organization’s leadership. Talks between the two sides focused on strengthening business relations between and encouraging investment.

“He also proposed that a sea link between Basra and Karachi could play a key role in bringing the business communities of both countries closer together,” the KCCI said in a statement. “This connection could improve logistics and strengthen trade routes.”

Jejan said Iraq has introduced new investment laws designed to attract foreign investors, adding that these laws will be shared with the KCCI to help Pakistani businesses understand the opportunities available.

“He recognized the high quality of Pakistani products and expressed hope that Pakistani exporters and investors will explore the Iraqi market more actively,” the statement said.

The Iraqi consul general said his country is witnessing rapid development and offers immense potential for trade and investment. He encouraged Pakistani businessmen to visit Iraq and see first-hand the “peaceful and stable environment” in the country.

KCCI Senior Vice President Zia ul Arfeen told Jejan that Pakistan’s exports to Iraq stood at $54.29 million in FY24 while its imports from Iraq amounted to $145.46 million.

“He said that this trade volume is far below the actual potential and emphasized the need for both countries to simplify customs procedures, promote ease of doing business, and expand the range of tradable goods and services,” the KCCI said.

Arfeen said establishing an oil pipeline between Basra and Pakistan’s southwestern coastal city of Gwadar could create an important trade corridor for Iraq to access other Asian markets.

Iraq proposes sea link between Karachi and Basra to strengthen trade routes

https://arab.news/5bhju

Iraq proposes sea link between Karachi and Basra to strengthen trade routes

- Iraqi Consul General Maher Mjhid Jejan visits Karachi Chamber of Commerce and Industry’s office to meet its leadership

- Jejan hoped Pakistani exporters, investors take advantage of Iraq’s opportunities, explore its market more actively, says KCCI

Islamabad dismisses claims about paying up to 8 percent interest on foreign loans as ‘misleading’

- Pakistan has long relied on external loans to help bridge persistent gaps in public finances and foreign exchange reserves

- Pakistan’s total external debt, liabilities stand at $138 billion at an overall average cost of around 4 percent, ministry says

KARACHI: Pakistan’s finance ministry on Sunday dismissed as “misleading” claims that the country is paying up to 8 percent interest on external loans, saying the overall average cost of external public debt is approximately 4 percent.

Pakistan has long relied on external loans to help bridge persistent gaps in public finances and foreign exchange reserves, driven largely by a narrow tax base, chronic trade deficits, rising debt-servicing costs and repeated balance-of-payments pressures.

Over the decades, successive governments have turned to multilateral and bilateral lenders, including the International Monetary Fund, the World Bank and the Asian Development Bank, to support budgetary needs and shore up foreign exchange reserves.

The finance ministry on Sunday issued a clarification in response to a “recent press commentary” regarding the country’s external debt position and associated interest payments, and said the figures required contextual explanation to ensure accurate understanding of Pakistan’s external debt profile.

“Pakistan’s total external debt and liabilities currently stand at $138 billion. This figure, however, encompasses a broad range of obligations, including public and publicly guaranteed debt, debt of Public Sector Enterprises (both guaranteed and non-guaranteed), bank borrowings, private-sector external debt, and intercompany liabilities to direct investors. It is therefore important to distinguish this aggregate figure from External Public (Government) Debt, which amounts to approximately $92 billion,” it said.

“Of the total External Public Debt, nearly 75 percent comprises concessional and long-term financing obtained from multilateral institutions (excluding the IMF) and bilateral development partners. Only about 7 percent of this debt consists of commercial loans, while another 7 percent relates to long-term Eurobonds. In light of this composition, the claim that Pakistan is paying interest on external loans ‘up to 8 percent’ is misleading.

The overall average cost of External Public Debt is approximately 4 percent, reflecting the predominantly concessional nature of the borrowing portfolio.”

With respect to interest payments, public external debt interest outflows increased from $1.99 billion in Fiscal Year (FY) 2022 to $3.59 billion in FY2025, representing an increase of 80.4 percent, not 84 percent as reported. In absolute terms, interest payments rose by $1.60 billion over this period, not $1.67 billion, it said.

According to the State Bank of Pakistan’s records, Pakistan’s total debt servicing payments to specific creditors during the period under reference were as follows: the IMF received $1.50 billion, of which $580 million constituted interest; Naya Pakistan Certificates payments totaled $1.56 billion, including $94 million in interest; the Asian Development Bank received $1.54 billion, including $615 million in interest; the World Bank received $1.25 billion, including $419 million in interest; and external commercial loans amounted to nearly $3 billion, of which $327 million represented interest payments.

“While interest payments have increased in absolute terms, this rise cannot be attributed solely to an expansion in the debt stock,” the ministry said. “Although the overall debt stock has increased slightly since FY2022, the additional inflows have primarily originated from concessional multilateral sources and the IMF’s Extended Fund Facility (EFF) under the ongoing IMF-supported program.”

Pakistan secured a $7 billion IMF bailout in Sept. 2024 as part of Prime Minister Shehbaz Sharif’s efforts to stabilize the South Asian economy that narrowly averted a default in 2023. The government has since been making efforts to boost trade and bring in foreign investment to consolidate recovery.

“It is also important to note that the increase in interest payments reflects prevailing global interest rate dynamics. In response to the inflation surge of 2021–22, the US Federal Reserve raised the federal funds rate from 0.75-1.00 percent in May 2022 to 5.25–5.50 percent by July 2023. Although rates have since moderated to around 3.75 percent, they remain significantly higher than 2022 levels,” the finance ministry said.

“The government remains committed to prudent debt management, transparency, and the continued strengthening of Pakistan’s macroeconomic stability,” it added.