KARACHI: Pakistan and the United Arab Emirates signed key agreements to boost cooperation in mining, railways, banking and infrastructure sectors, the Prime Minister’s Office (PMO) said, as Abu Dhabi Crown Prince Sheikh Khaled bin Mohamed bin Zayed Al Nahyan arrived on his first official visit to Islamabad on Thursday.

The UAE is Pakistan’s third-largest trading partner after China and the United States and a major source of foreign investment, valued at over $10 billion in the last 20 years, according to the Gulf country’s foreign ministry.

The crown prince’s visit came as Pakistan pursues economic diplomacy with several Gulf and Central Asian nations and treads a tricky path to economic recovery while being bolstered by a $7 billion IMF bailout loan.

Pakistan Prime Minister Shebaz Sharif receives Abu Dhabi Crown Prince and Chairman Abu Dhabi Executive Council Sheikh Khaled bin Zayed Al Nahyan at the Nur Khan Airbase in Rawalpindi on February 27, 2025. (PMO)

Sheikh Al Nahyan was accompanied by a high-level delegation of ministers, senior officials and business leaders during his day-long trip to Pakistan. He witnessed the signing of agreements between the two sides with Sharif.

“The MoUs/agreements were signed in the fields of Banking, Mining, Infrastructure development and Railways,” Sharif’s office said in a statement.

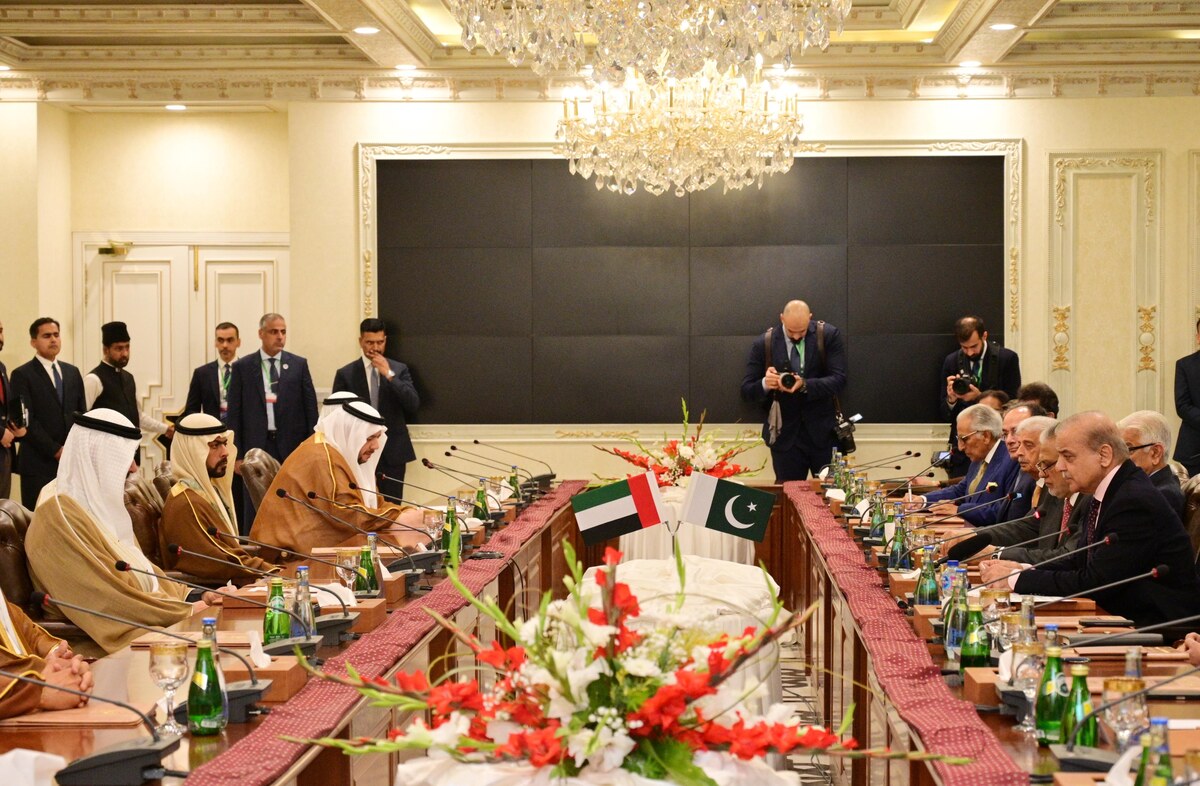

Officials from UAE (left) and Pakistan (right) exchange MOUs as Prime Minister Shebaz Sharif and Abu Dhabi Crown Prince and Chairman Abu Dhabi Executive Council Sheikh Khaled bin Zayed Al Nahyan attend the ceremony at the Prime Minister Office in Islamabad on February 27, 2025. (PMO)

Sharif’s office said that the Pakistani prime minister informed the crown prince of his discussions on the Uzbekistan-Afghanistan-Pakistan Railway Line in Tashkent this week.

“He further said that the project will benefit the ports of Gwadar and Abu Dhabi and would prove to be a game changer for the whole region,” the PMO said.

Sharif praised the UAE’s support for Pakistan in various fields, the PMO said, adding that he appreciated UAE’s “keen interest” in expanding its investment portfolio in Pakistan.

Abu Dhabi Crown Prince and Chairman Abu Dhabi Executive Council Sheikh Khaled bin Zayed Al Nahyan (first, left) and Pakistan Prime Minister Shehbaz Sharif (first, right) lead Pakistan and UAE delegation during a meeting at the Prime Minister Office in Islamabad on February 27, 2025. (PMO)

The crown prince had arrived in Islamabad on Thursday afternoon where he was received by the premier and President Asif Ali Zardari.

President Zardari later conferred Pakistan’s highest civilian award, the Nishan-e-Pakistan, on the Abu Dhabi crown prince in a ceremony attended by Sharif and top government officials.

Sheikh Al Nahyan left after witnessing the signing of the agreements with Sharif. He was seen off by the Pakistani prime minister.

Speaking to Arab News, an analyst and former government official described the visit as a “positive” development.

“If a high level official like the crown prince is visiting Pakistan that means they must be bringing something important in hand for our country,” Ashfaq Tola, Pakistan’s former state minister for resource mobilization, said.

He advised that Pakistan seek joint ventures with the UAE in its agro-based economy and encourage investment in Pakistan’s export-related sectors to improve the South Asian country’s forex earnings. He also said investors from the Gulf state could benefit from mining sector projects like the Reko Diq gold and copper reserves, along with the oil exploration and tourism sectors.

Pakistan and the UAE have stepped up efforts in recent years to strengthen economic relations. Last year the two countries signed multiple agreements exceeding $3 billion for cooperation in railways, economic zones, and infrastructure development.

Policymakers in Pakistan consider the UAE an optimal export destination due to its geographical proximity, which minimizes transportation and freight costs while facilitating commercial transactions.

The UAE is also home to more than a million Pakistani expatriates, making it the second-largest Pakistani expatriate community worldwide and a major source of foreign workers’ remittances.