KARACHI: Pakistan’s central bank cut its key policy rate by 250 basis points to 15 percent on Monday, it said in a statement, for a fourth straight reduction since June, as the country keeps up efforts to revive a sluggish economy with inflation easing.

Most respondents in a Reuters poll last week expected a cut of 200 bps after inflation moved down sharply from a multi-decade high of nearly 40 percent in May 2023, saying reductions were needed to bolster growth.

Average consumer price index inflation in the South Asian country is 8.7 percent in the current financial year, which started in July, the statistics bureau says. The International Monetary Fund (IMF) expects inflation to average 9.5 percent for the year ending June.

Monday’s move follows cuts of 150 bps in June, 100 bps in July, and 200 in September that have taken the rate from an all-time high of 22 percent, set in June 2023 and left unchanged for a year. It takes the total cuts to 700 bps in under five months.

October inflation came in at 7.2 percent, slightly above the government’s expectation of 6 percent to 7 percent. The finance ministry expects inflation to slow further to 5.5 percent to 6.5 percent in November.

However, inflation could pick up again in 2025, driven by electricity and gas price increases after a new $7-billion IMF bailout, and the potential impact of taxes on the retail, wholesale and the farm sector announced in the June budget to take effect in January 2025, some analysts say.

Pakistan central bank cuts key rate by 250 bps to 15%

https://arab.news/zw7n3

Pakistan central bank cuts key rate by 250 bps to 15%

- Monday’s move follows cuts of 150 bps in June, 100 in July and 200 in September

- It takes the total policy rate cuts in the country to 700 bps in under five months

Education spending surges 251% as students return from autumn break: SAMA

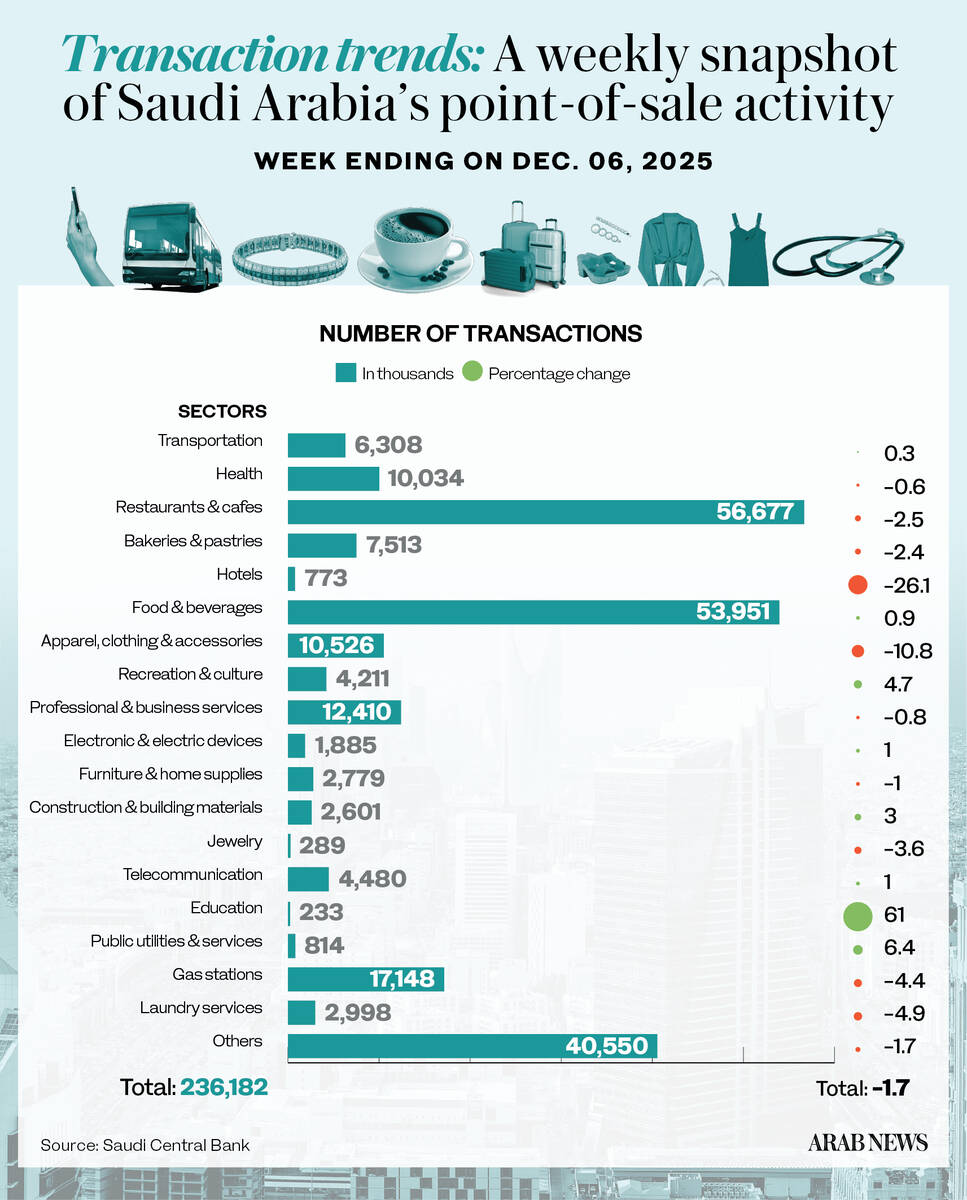

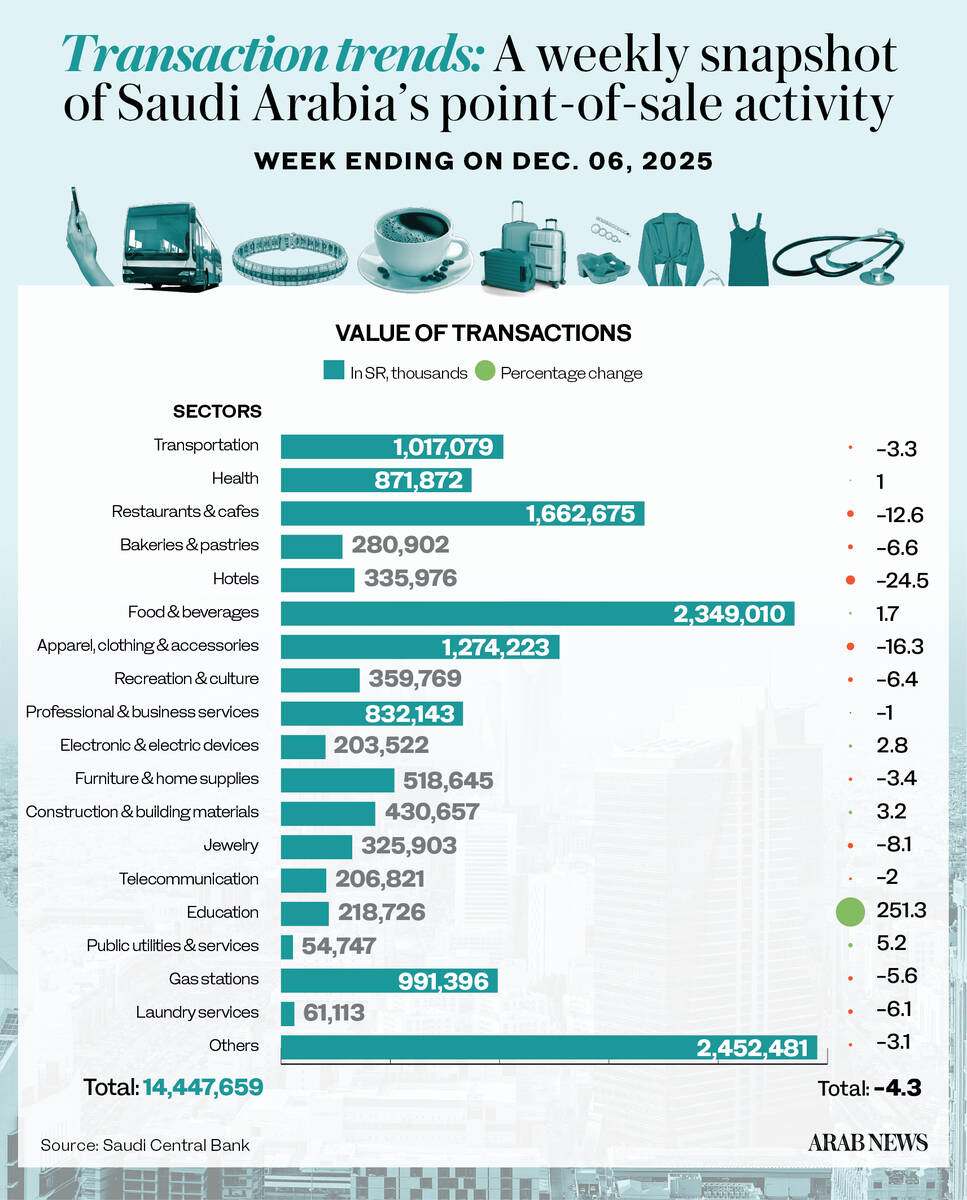

RIYADH: Education spending in Saudi Arabia surged 251.3 percent in the week ending Dec. 6, reflecting the sharp uptick in purchases as students returned from the autumn break.

According to the latest data from the Saudi Central Bank, expenditure in the sector reached SR218.73 million ($58.2 million), with the number of transactions increasing by 61 percent to 233,000.

Despite this surge, overall point-of-sale spending fell 4.3 percent to SR14.45 billion, while the number of transactions dipped 1.7 percent to 236.18 million week on week.

The week saw mixed changes between the sectors. Spending on freight transport, postal and courier services saw the second-biggest uptick at 33.3 percent to SR60.93 million, followed by medical services, which saw an 8.1 percent increase to SR505.35 million.

Expenditure on apparel and clothing saw a decrease of 16.3 percent, followed by a 2 percent reduction in spending on telecommunication.

Jewelry outlays witnessed an 8.1 percent decline to reach SR325.90 million. Data revealed decreases across many other sectors, led by hotels, which saw the largest dip at 24.5 percent to reach SR335.98 million.

Spending on car rentals in the Kingdom fell by 12.6 percent, while airlines saw a 3.7 percent increase to SR46.28 million.

Expenditure on food and beverages saw a 1.7 percent increase to SR2.35 billion, claiming the largest share of the POS. Restaurants and cafes retained the second position despite a 12.6 percent dip to SR1.66 billion.

Saudi Arabia’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 3.9 percent dip to SR4.89 billion, down from SR5.08 billion the previous week.

The number of transactions in the capital settled at 74.16 million, down 1.4 percent week on week.

In Jeddah, transaction values decreased by 5.9 percent to SR1.91 billion, while Dammam reported a 0.8 percent surge to SR713.71 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.