RIYADH: Saudi Arabia’s point-of-sale transactions dipped to SR11.6 billion ($3.09 billion) between Aug. 18 and 24, reflecting a 14.1 percent decrease from the previous week, official data showed.

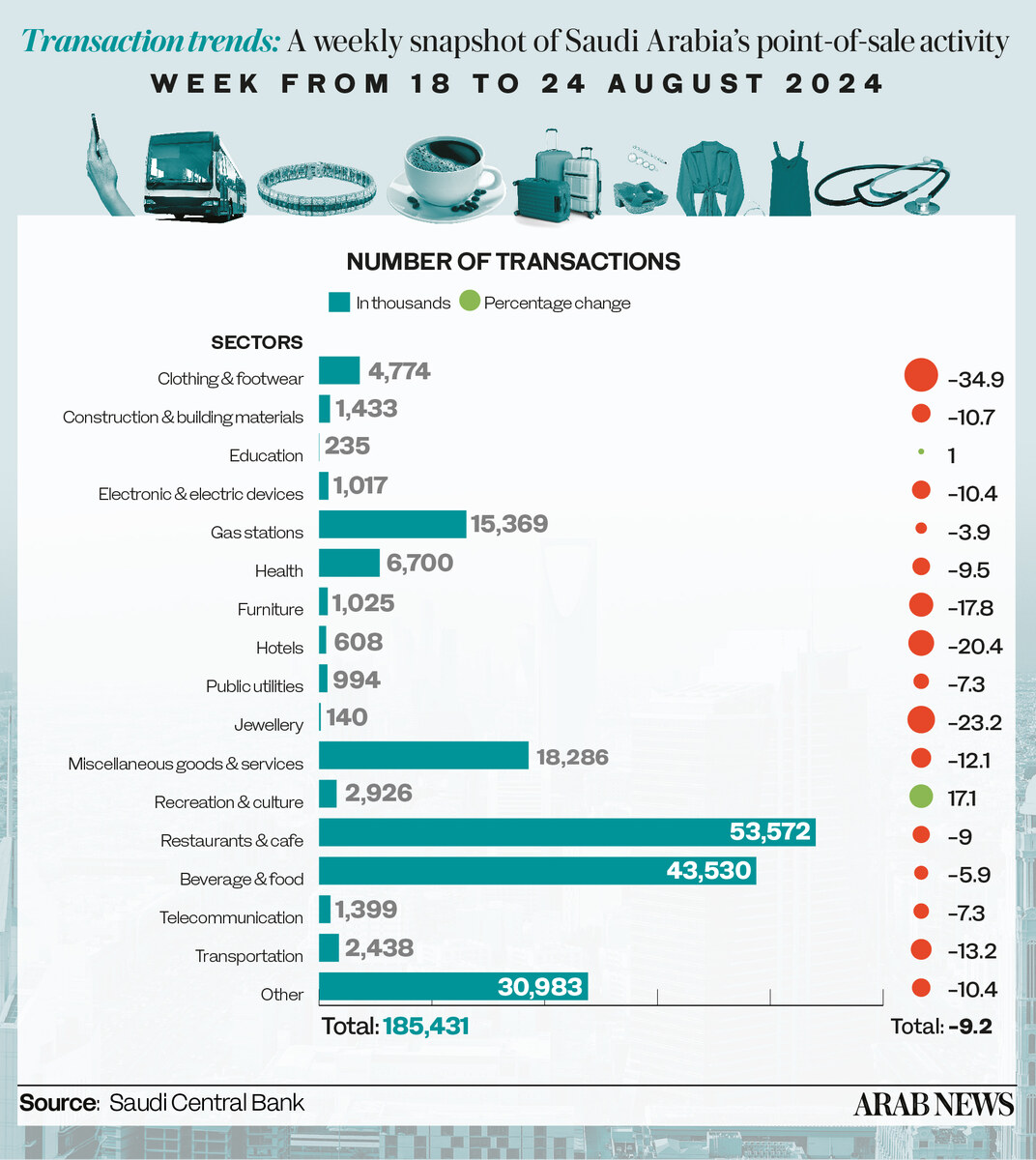

According to the latest figures from the Saudi Central Bank, also known as SAMA, spending on clothing and footwear led to a negative change, recording the highest decrease at 35.7 percent, with total transactions reaching SR599.4 million.

This week marks the first time the education sector has seen a decrease in spending after surging for four consecutive weeks, coinciding with the start of the academic year on Aug. 18.

During the Aug. 18-24 period, spending in the education sector saw the second biggest decline at 16.9 percent to SR840.7 million.

Hotel spending followed in third place with a 15.9 percent negative change, reaching SR224.6 million.

The top three biggest shares of this week’s POS included restaurants and cafes with SR1.59 billion spent, a 14.8 percent decrease from last week; food and beverages with SR1.54 billion spent, down by 11.3 percent compared to the previous week; and miscellaneous goods and services with SR1.25 billion spent, dipping by 14.9 percent from the week before.

Spending in the top three largest categories accounted for 37.7 percent, or SR4.38 billion, of this week’s total value.

At 5.2 percent, the smallest decline occurred in spending on construction and building materials, reducing the total amount to SR315 million.

Expenditures on transportation came in second place, dipping 7.2 percent to SR723.4 million. In the third place, recreation and culture declined by 7.6 percent to SR294 million.

Geographically, Riyadh dominated POS transactions, representing 36.4 percent of the total, with spending in the capital reaching SR4.17 billion — a 9.7 percent decrease from the previous week.

Jeddah followed with SR1.69 billion, accounting for 14.8 percent of the total, and Dammam came in third at SR590 million, down 11.3 percent.

Abha saw the most significant decrease for the second week, down 24.8 percent to SR159.5 million. Hail and Makkah also experienced continuous declines, with expenditure dropping 15.9 percent to SR168.2 million and 18.2 percent to SR445.3 million, respectively.

Regarding the number of transactions, Abha recorded the highest decrease at 19.5 percent, reaching 2,971, followed by Madinah with a 12.4 percent decrease, reaching 7,453.