RIYADH: Saudi Arabia’s point-of-sale spending increased by 7.7 percent to reach SR13.2 billion ($3.51 billion) from June 30 to July 6, with the greatest rise coming in hotel payments, according to official data.

The latest release from the Saudi Central Bank, also known as SAMA, revealed that the transaction value in this sector, which accounts for only 0.39 percent of the total number of payments, saw a 17.9 percent surge reaching SR259.7 million.

POS spending in the Kingdom regained momentum in the week commencing June 23, after dipping in the previous seven-day period to SR8.34 billion – coinciding with the Eid al-Adha vacation period.

Saudi-based economist Talat Hafiz explained in an interview with Arab News that “spending is usually less during such vacations,” as Saudis go to perform Hajj compared to normal days when they visit shopping malls and restaurants for entertainment.

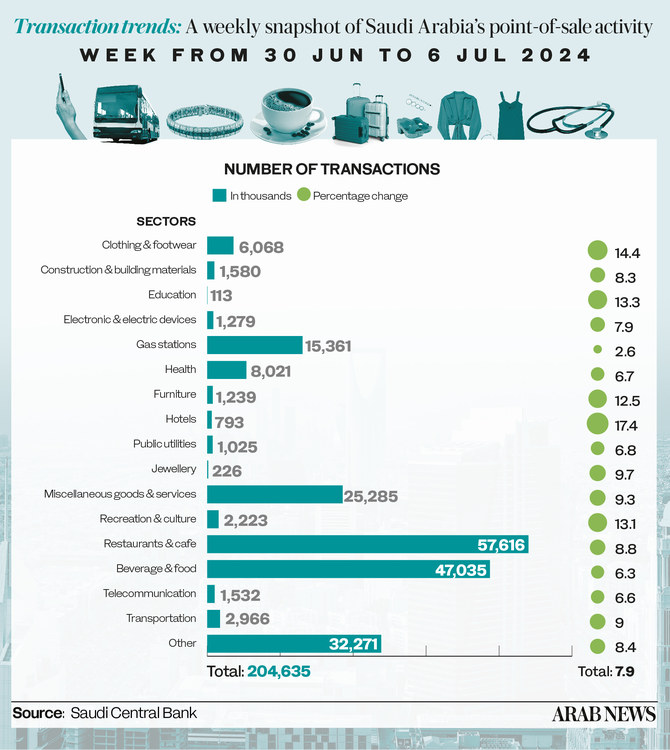

Data from SAMA for the week beginning June 30 showed that spending on education surged by 14.1 percent to reach SR113 million, the second-highest increase compared to the previous week.

Spending on miscellaneous goods and services came in third place and took over the third-highest share of the POS, recording a 10.1 percent surge, reaching SR1.76 billion.

Saudi spending on food and beverages constituted the highest share of the POS and witnessed an 8.8 percent rise, reaching SR2.05 billion compared to SR1.88 billion in the previous week.

This came alongside spending in restaurants and cafes, reaching SR1.96 billion, and constituting the second-largest share with a surge of 9 percent compared to the previous week.

POS spending on public utilities witnessed the smallest climb this week, recording a 3.2 percent increase, reaching SR74.7 million.

Gas stations experienced the second-smallest rise in POS transaction value, increasing by 4.2 percent to SR869.6 million. Spending on electronics and electric devices witnessed the third-smallest surge, with a 4.3 percent increase, reaching SR229.9 million.

According to data from SAMA, 32.09 percent of POS spending occurred in Riyadh, with the total transaction value reaching SR4.26 billion, representing a 7.5 percent increase from the previous week, when it was SR3.96 billion.

Riyadh has expanded into a major growth hub, with Spinneys recently debuting its flagship 43,520 sq. ft. outlet at La Strada Yard, marking the start of its expansion in Riyadh and Jeddah to meet increasing demand for high-quality groceries in Saudi Arabia.

Spending in Jeddah followed, accounting for 14 percent of the total and reaching SR1.86 billion, marking a 8.9 percent weekly positive change.

Moreover, spending in Dammam surged by 7.5 percent to reach SR623.6 million, the third-largest share of this week’s POS.

The most significant positive change was spotted in Abha, with a 13.5 percent surge, reaching SR235.5 million.

This week, Makkah saw no decrease; spending increased by 8 percent to SR479.4 million, following a 1.1 percent decline the previous week.