RIYADH: Saudi Arabia’s non-oil exports saw an annual rise of 3.3 percent in the first quarter of 2024, fueled by an increase in the value of re-exports, according to official data.

According to the General Authority for Statistics, while national non-oil exports experienced a slight dip of 5.2 percent, the value of re-exported goods surged by 31.5 percent during the same period.

This trend underscores Saudi Arabia’s burgeoning role as a logistical hub – a key goal of the Kingdom’s Vision 2030 economic diversification strategy.

Leveraging its strategic geographic location at the crossroads of Europe, Asia, and Africa, the Kingdom has invested heavily in its transport and logistics infrastructure.

Major projects such as the expansion of pivotal ports and the establishment of logistics zones like the King Salman Energy Park are designed to streamline the movement of goods and enhance supply chain efficiency.

Moreover, Saudi Arabia has hosted numerous international forums and conferences, such as the Supply Chain and Logistics Conference, to attract global investors and foster dialogue on advancements in the sector.

On another note, a 4.9 percent uptick in merchandise exports in March of this year underlined the resilience of the Kingdom’s export sector amidst global economic fluctuations.

China emerged as a pivotal destination for Saudi exports, absorbing 14.9 percent of the total in the first quarter of 2024, and 16.4 percent of the total shipment during March alone.

The nation also ranked first for the Kingdom’s imports in March, constituting 21.2 percent of the total imports, followed by the US with 8.7 percent and the UAE with 6.9 percent.

Despite a decline, chemical products remained a significant portion of non-oil exports, constituting 25.1 percent of this sector in the first three months of 2024, and 28.1 percent of total shipments in March alone.

This underscores the Kingdom’s focus on leveraging its petrochemical industry, a key pillar of Vision 2030.

In a separate bulletin, GASTAT highlighted that non-oil exports and re-exports in March rose by 2.9 percent compared to February, and slipped by 0.8 percent compared to March 2023.

While national non-oil exports, excluding re-exports, saw an annual decrease of 6.3 percent in March, the value of re-exported goods increased by 17.6 percent during the same period.

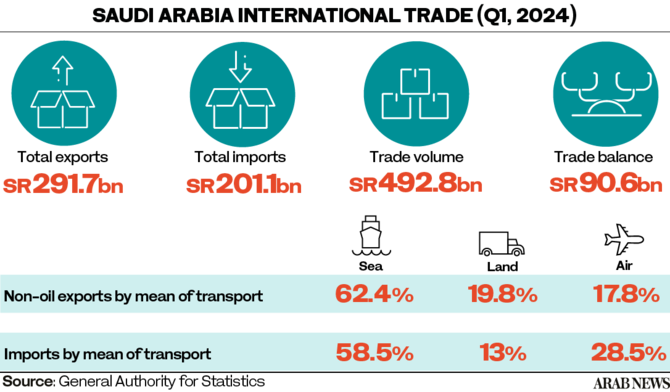

During the first quarter of 2024, the proportion of oil exports out of the total value declined from 78.2 percent to 76.1 percent. Imports, on the other hand, increased by 6.4 percent.

In the first quarter, compared to the same period in 2023, both merchandise exports and non-oil exports, including re-exports, decreased by 1.4 percent and 0.2 percent respectively.

Meanwhile, imports saw a 0.3 percent decline, resulting in a 3.8 percent decrease in the merchandise trade balance surplus.

In March, merchandise exports declined by 5.9 percent, largely driven by a 7.3 percent decrease in oil exports, leading to a drop in the proportion of oil exports from 78.1 percent to 76.9 percent compared to March 2023.

Conversely, imports increased by 1 percent, while the surplus of the merchandise trade balance decreased by 17.2 percent compared to March 2023.

This period also witnessed a slight decrease in the ratio of non-oil exports, including re-exports, to imports, which fell to 34.7 percent from 35.8 percent in the previous year, attributed to a significant increase in imports by 6.4 percent, compared to a 3.3 percent rise in non-oil exports.

In the first three months of this year, China was the leading source of the Kingdom’s imports at 20.9 percent, followed by the US at 8.1 percent and the UAE at 6.8 percent. Imports from these and other top sources accounted for 63.4 percent of the total.

King Abdulaziz Sea Port in Dammam was the major entry point for goods into the Kingdom, accounting for 27.4 percent of total imports.

Other key ports included Jeddah Islamic Port with 18.8 percent, King Khalid International Airport in Riyadh with 14.2 percent, King Abdulaziz International Airport in Jeddah with 8.1 percent, and King Fahad International Airport in Dammam with 6.1 percent.

Together, these five ports handled 74.6 percent of the Kingdom’s total merchandise imports.

According to GASTAT, primary imported goods include machinery, electrical equipment, and parts, constituting 24.1 percent of total imports, rising by 21.4 percent from March 2023.

King Abdulaziz Sea Port in Dammam played a vital role as one of the primary ports for goods entering the Kingdom, comprising 28.9 percent of total imports.

Other significant entry points included Jeddah Islamic Port, King Khalid International Airport in Riyadh, King Abdulaziz International Airport, and King Fahad International Airport in Dammam.

Together, these five ports accounted for 76.3 percent of the Kingdom’s total merchandise imports in March.