KARACHI: The Pakistan Stock Exchange (PSX) on Monday hit a new all-time high of 69,620 points, equity analysts said, attributing it to hopes of the Saudi crown prince’s visit to Pakistan and investment in the Reko Diq gold mine project.

The benchmark KSE100 index crossed the psychological barrier of 69,000 points by gaining 1,203 points, or 1.76 percent, which is highest increase after January 01, 2024.

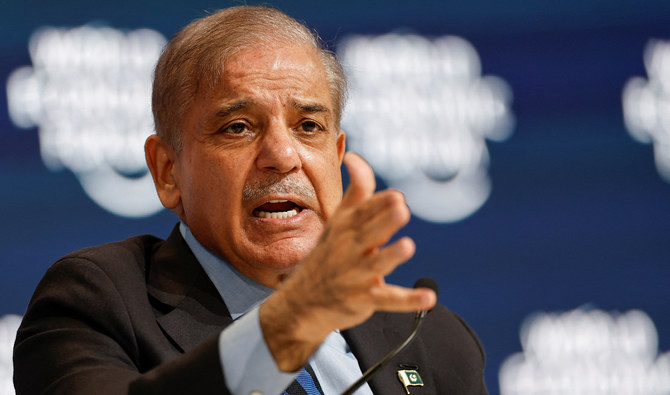

It followed Prime Minister Shehbaz Sharif’s visit to Saudi Arabia where he met with Crown Prince Mohammed bin Salman and other officials.

This was the Pakistani prime minister’s first foreign trip since forming a coalition government in February this year.

“The basic reason of continuation of the bullish market is the recent visit of PM to Saudi Arabia, where he held an important meeting with the crown prince and the Saudi interest in Pakistan is clear, particularly $1 billion investment in Reko Diq project,” Sheheryar Butt, portfolio manager at Karachi-based Darson Securities, told Arab News.

Although there has been no official confirmation of it, Pakistani media reports have suggested the Kingdom is interested in investing about $1 billion in the Reko Diq gold and copper mine located in Pakistan’s southwestern Balochistan province.

One of the largest undeveloped copper-gold projects in the world, Reko Diq is owned 50 percent by Canada-based Barrick Gold Corporation, 25 percent by three federal state-owned enterprises, 15 percent by Balochistan on a fully funded basis, and 10 percent by Balochistan on a free carried basis, according to Barrick.

Butt said the market stakeholders were also expecting that the Saudi crown prince might visit Pakistan after Eid Al-Fitr, which boosted investor confidence.

“It is very much likely that the Saudi Crown Prince may visit Pakistan after Eid, following the Pakistan prime minister’s Saudi tour,” he said.

Market sentiments, according to Butt, were also buoyed by foreign investment in equity and money market, while inflows of financial results of companies also played a key role in the bullish close.

Samiullah Tariq, director at Pakistan Kuwait Investment Company, believed the bullish trend also resulted from hopes of a new International Monetary Fund (IMF) loan program.

“Apart from PM’s Saudi visit which is expected to materialize some investment deals, the optimism at the IMF front is also propelling the stocks to new highs,” Tariq told Arab News.

The South Asian nation is formulating a proposal to present to the IMF for a more extensive loan program, with an anticipated size of $7-9 billion. This follows a staff-level agreement between Pakistan and the IMF on the final review of a $3 billion Stand-By Arrangement (SBA), paving the way for the release of $1.1 billion by the lender this month.

Ali Nawaz, CEO of Chase Securities, said the bullish trend could be attributed to a combination of factors, including positive economic news flow like the IMF agreement, which had instilled confidence in investors.

“Additionally, increased buying from both local and foreign investors has driven up stock prices due to higher demand,” he said.

Nawaz, however, was uncertain about the sustainability of the current rally.

“Global economic conditions and the continuation of positive domestic reforms will play a significant role in determining the PSX’s future performance,” he added.

The stock market confidence was also boosted by the appreciation of the Pakistan’s currency which continues to stabilize against United States (US) dollar.

The greenback has come down to around Rs280 since the Pakistani authorities took serious actions against dollar smuggling and hoarding.

The US dollar is currently trading at around Rs277 for buying and Rs279 for selling in the open market, according to Exchange Companies Association of Pakistan (ECAP). It is trading at Rs277.95 in the interbank market.

“The strict action taken by the country’s army chief against smuggling of dollars to Afghanistan and hoarding and manipulation of currency by certain banks is yielding results,” Malik Bostan, the ECAP chairman, told Arab News.

Bostan said exporters were coming in large numbers to convert their proceeds in local currency due to fear of further depreciation of greenback.

“We expect that the currency would further appreciate against dollar and may stabilize around Rs250 in the interbank and open markets,” he added.

Hopes of Saudi crown prince’s visit, Reko Diq investment propel Pakistan stocks to new all-time high

https://arab.news/n3jaw

Hopes of Saudi crown prince’s visit, Reko Diq investment propel Pakistan stocks to new all-time high

- The benchmark index recorded its highest-ever closing at 69,620 points, after gaining 1,203 points on Monday

- Analysts say optimism on IMF front, foreign investment in government securities also drove bullish sentiment

Death toll from heavy rains in northwestern Pakistan surges to 92

- Heavy rains in Pakistan’s northwest have injured 110, destroyed 4,200 houses since Apr. 10, says authority

- Prone to natural disasters, Pakistan consistently ranks among countries most affected by impacts of climate change

PESHAWAR: The death toll from rain-related incidents in Pakistan’s northwestern Khyber Pakhtunkhwa (KP) province since Apr. 10 has surged to 92 while the number of injured has increased to 116, a spokesperson of the Provincial Disaster Management Authority (PDMA) confirmed on Tuesday.

The rains which began on Apr. 10 have destroyed 4,200 houses and damaged 5,900 others, PDMA spokesperson Anwar Shehzad shared. At least 17 people have been killed and 23 injured in rain-related incidents over the past three days, as per data from the PDMA’s latest report on Tuesday.

The report said the 17 dead included nine men, three women and five children while the 23 injured included nine men, three women and 11 children. Deaths and financial losses due to heavy rains were reported in Bajaur, Swat, Mansehra, Battagram, Dir Lower, Malakand, Lakki Marwat, Shangla, Mohmand and South Waziristan districts, the PDMA report added.

“At least 92 persons have died including women, children, and elderly people while 116 others were wounded since Apr. 10 in incidents involving roof collapse and lightning in parts of the province,” Shehzad told Arab News.

The PDMA’s report said the authority, district administrations and relief teams are engaged in relief activities in the affected districts. “The PDMA has also directed district administrations of the affected districts to provide immediate financial support to the victims,” it added.

Pakistan has received heavy rains this month that have triggered landslides and flash floods in several parts of the country.

The eastern province of Punjab has reported 21 lighting- and roof collapse-related deaths, while Balochistan, in the country’s southwest, reported at least 15 deaths this month from torrential rains.

In 2022, unprecedented rains swelled Pakistan’s rivers and at one point flooded a third of the country, killing 1,739 people. The floods also caused over $30 billion in damages, from which Pakistan is still trying to rebuild.

Pakistan has been prone to natural disasters and consistently ranks among the most severely affected countries in the world due to the effects of climate change.

Pakistani PM says IMF approval of $1.1 billion funding to bring economic stability

- Funding is last tranche of a $3 billion standby arrangement with the IMF secured last year

- Islamabad is seeking a new, larger long-term Extended Fund Facility agreement with the IMF

ISLAMABAD: Prime Minister Shehbaz Sharif said on Tuesday the International Monetary Fund’s approval of $1.1 billion in funding for Pakistan would bring economic stability, amid discussions for a new bailout loan.

The funding is the second and last tranche of a $3 billion standby arrangement with the IMF, which Islamabad secured last summer to help avert a sovereign default.

The approval came a day after Sharif discussed a new loan program with IMF Managing Director Kristalina Georgieva on the sidelines of the World Economic Forum in Riyadh.

“Sharif expressed his satisfaction over the release of the last financial tranche of the IMF today,” the Prime Minister’s Office (PMO) said in a statement. “Receiving the last tranche of 1.1 billion dollars from the IMF will bring more economic stability in Pakistan.”

This is the second Stand-by Arrangement (SBA) for short-term financial assistance that Pakistan has completed, the last one being in 2016 during the government of three-time PM Nawaz Sharif, who is Sharif’s elder brother.

“Bitter and difficult decisions were taken for the economic security of Pakistan, but their fruits are coming in the form of economic stability,” Sharif added about reforms under the IMF program.

The $350 billion economy faces a chronic balance of payments crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year — three-time more than its central bank’s foreign currency reserves.

Islamabad is seeking a new, larger long-term Extended Fund Facility (EFF) agreement with the fund after the current standby arrangement expires this month, and continuing with necessary policy reforms to rein in deficits, build up reserves and manage soaring debt servicing.

Aramco acquires 40% stake in GO, marking first entry into Pakistani fuel retail market

- Saudi oil giant Aramco inked agreement to buy 40 percent stake in Gas and Oil Pakistan Ltd. in December 2023

- Acquisition to bring much-needed foreign direct investment in Pakistan’s energy sector, says competition commission

KARACHI: The Competition Commission of Pakistan (CCP) this week approved Saudi oil giant Aramco’s decision to acquire a 40 percent stake in local company Gas & Oil Pakistan Ltd, officially marking the Saudi company’s entry into Pakistan’s fuels retail market.

Aramco and Gas signed the agreement to acquire 40 percent stake in Gas and Oil Pakistan Ltd., a licensed oil marketing company, in December 2023. Gas and Oil Pakistan Ltd. is involved in the procurement, storage, sale, and marketing of petroleum products and lubricants. It is also one of Pakistan’s largest retail and storage companies.

Aramco is a global integrated energy and chemicals company that produces approximately one in every eight barrels of the world’s oil supply and develops cutting-edge energy technologies. Aramco Asia Singapore Pte. Ltd., a Singaporean company wholly owned by Saudi Aramco, filed the pre-merger application with the CCP. It specializes in sales, marketing, procurement, logistics, and related services, with a focus on prospecting, exploring, drilling, extracting, processing, manufacturing, refining, and marketing hydrocarbon substances.

“The Competition Commission of Pakistan (CCP) approved a 40 percent equity stake acquisition in Gas & Oil Pakistan Ltd. (GO) by Aramco, a global leader in integrated energy and chemicals,” the CCP said in a statement on Monday. “This transaction marks Aramco’s first entry into Pakistan’s fuels retail market, underscoring its confidence in the country’s economic potential and its commitment to its growth.”

The CCP said it had authorized the merger after determining that the acquisition would not result in the acquirers’ “dominance” in the relevant market post-transaction.

“Aramco’s acquisition indicates a significant milestone in Pakistan’s energy sector, bringing advanced expertise and technology to the fuels retail market,” it said. “This development is expected to boost competition, elevate service standards, and provide consumers with a broader range of high-quality products.”

The CCP said the acquisition would help bring much-needed foreign direct investment in Pakistan’s energy sector, contributing to economic growth and development of the country.

In February 2019, Pakistan and Saudi Arabia inked investment deals totaling $21 billion during the visit of Saudi Crown Prince Mohammed Bin Salman to Islamabad. The agreements included about $10 billion for an Aramco oil refinery and $1 billion for a petrochemical complex at the strategic Gwadar Port in Balochistan.

Pakistan’s Prime Minister Shehbaz Sharif, who is in Saudi Arabia for a special meeting of the World Economic Forum, held meetings this week with Saudi Arabia’s ministers of energy, economy and planning, and environment, according to his office.

In a meeting with Saudi Energy Minister Prince Abdulaziz bin Salman on Monday evening, Sharif highlighted initiatives undertaken by Pakistan to facilitate investment in the energy sector. The Saudi side showed keen interest in Pakistan’s energy projects highlighted by Sharif, the Prime Minister’s Office (PMO) said.

The proposed projects included building new and improving existing energy infrastructure, increasing focus on renewable energy, and bringing efficiency across entire energy ecosystem in Pakistan, according to the statement.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both countries have been closely working to increase bilateral trade and investment deals, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion.

Abu Dhabi International Book Fair kicks off with Pakistani writers participating for first time

- Two panels on Pakistani literature and drama will speak at the international fair

- This year’s fair welcomes 145 new exhibitors and publishers from around the world

ISLAMABAD: The Abu Dhabi International Book Fair, considered one of the world’s most important cultural platforms, kicked off this week in the UAE capital with participation from Pakistani writers for the first time ever.

The book fair is an annual event that brings different writers together with the goal of promoting reading, diverse cultures and knowledge locally, regionally, and globally. Organizers of the fair say their aim is also to promote cultural exchange and dialogue between several nations.

It also brings together leaders from the publishing and creative industries every year, providing promising opportunities for those involved in this sector to form new partnerships, learn about the latest trends and developments and discuss its fundamental priorities.

“Pakistan is being represented at the Abu Dhabi Internationally Book Fair at @Adnec from April 29 to May 5,” the Pakistan Consulate General Dubai wrote on social media platform X on Monday.

Two sessions at the fair will feature participation from Pakistani writers. On May 1, a session titled: “The Pakistani Drama: Capturing Diverse Realities, Dreaming Many Dreams” will be moderated by journalist Mehwish Ajaz. It will feature panelists Amna Mufti, a renowned Urdu playwright and novelist, and Shazia Ali Khan, a UAE-based Urdu film screenplay writer.

The second session is scheduled to be held on May 3 and is titled: “Pakistani Fiction’s Connection with Past, Present & Future.” This session will be moderated by Mufti and will feature participation from Urdu novelist Tahira Iqbal and Osama Siddique, an English and Urdu novelist.

This year’s fair welcomes 145 new exhibitors and publishers this year along with 12 countries joining for the first time, namely Greece, Sri Lanka, Malaysia, Pakistan, Cyprus, Bulgaria, Mozambique, Uzbekistan, Tajikistan, Turkmenistan, Kyrgyzstan, and Indonesia.

PM Sharif thanks Saudi crown prince for ‘comprehensive’ Pakistan investment program

- Pakistani PM meets Saudi Crown Prince Mohammed bin Salman during visit to Riyadh for World Economic Forum meeting

- Kingdom’s foreign minister visited Pakistan this month to push forward previously agreed investment deals, strengthen cooperation

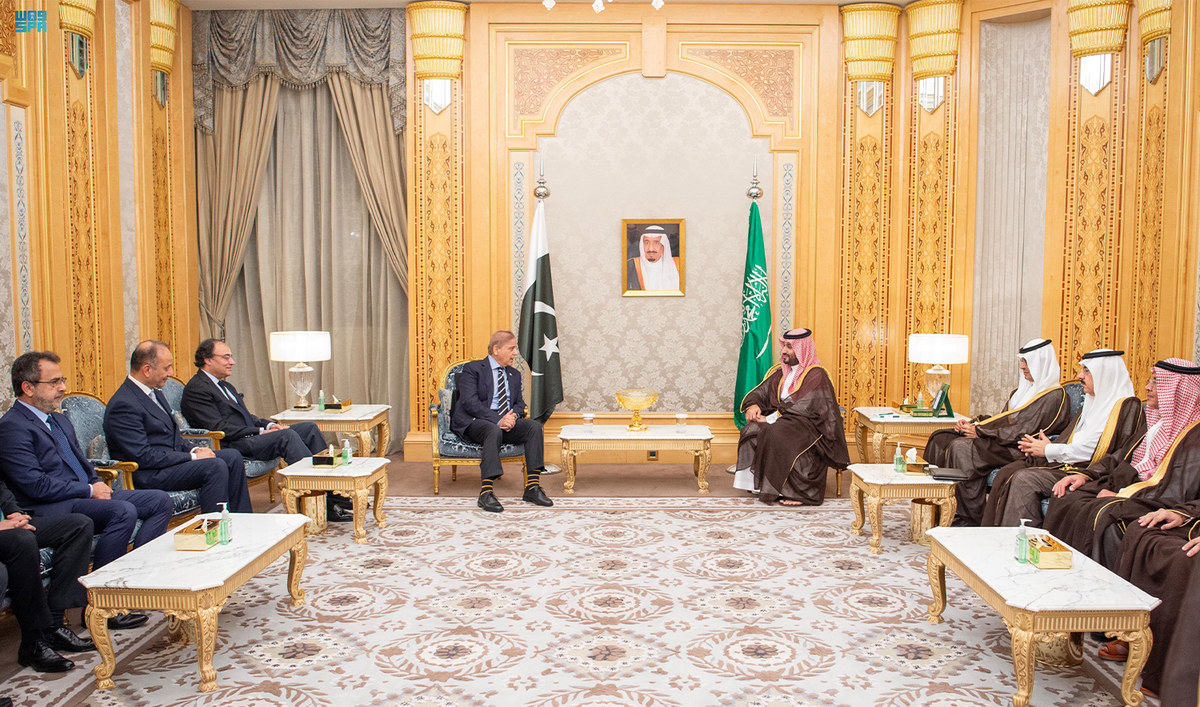

ISLAMABAD: Prime Minister Shehbaz Sharif met Saudi Crown Prince Mohammed bin Salman on Monday to discuss matters of mutual interest and regional developments, thanking him for a “comprehensive” program presented by Saudi ministers regarding investment in Pakistan, Sharif’s office said on Monday.

Sharif has held meetings with Saudi officials and ministers since he arrived in Riyadh on Saturday to attend a two-day World Economic Forum (WEF) special meeting on energy, collaboration, and health. His visit to the Kingdom follows Saudi Foreign Minister Prince Faisal bin Farhan’s trip to Pakistan in mid-April with a high-level delegation. The Saudi foreign minister’s visit was aimed at strengthening bilateral economic cooperation and pushing forward previously agreed investment deals. Pakistan has said it pitched investment projects worth $30 billion to Riyadh during Prince Faisal’s visit.

In videos and pictures shared by Sharif’s office, the two leaders can be seen interacting with each other in the presence of their teams. Sharif thanked the Saudi crown prince for sending the high-level delegation to Pakistan and issuing directions for more Saudi delegations to visit the country “to promote investment,” the Prime Minister’s Office (PMO) said.

“The Prime Minister expressed gratitude to the Crown Prince for the hospitality during his visit to Saudi Arabia and for a comprehensive program presented by Saudi Ministers regarding investment in Pakistan,” the PMO said.

The statement added that both leaders agreed to further promote cooperation in different sectors as they discussed areas of mutual interest and expressed satisfaction over their meeting in Makkah earlier this month.

“The situation in Gaza was also discussed in the meeting,” the PMO said. “The Prime Minister reiterated the invitation to the Saudi Crown Prince to visit Pakistan.”

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both Pakistan and Saudi Arabia have been closely working to increase bilateral trade and investment deals, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion.

Pakistan set up the Special Investment Facilitation Council (SIFC), a hybrid civil-military body, in June 2023 to attract international investments mainly from Gulf countries. The SIFC has identified mining, agriculture, energy and information technology as some of the key sectors where it hopes to attract foreign funding.

Cash-strapped Pakistan desperately needs to shore up its foreign reserves and signal to the International Monetary Fund (IMF) that it can continue to meet requirements for foreign financing that has been a key demand in previous bailout packages.

Saudi Arabia has often come to Pakistan’s aid in the past, regularly providing it oil on deferred payments and offering direct financial support to help stabilize its economy and shore up its forex reserves.