RIYADH: Tabby, Saudi Arabia’s “buy now, pay later” platform, has become the first fintech firm in the Middle East and North Africa to have achieved “unicorn” status after securing $200 million in a series D funding round.

A unicorn rating is achieved when a business reaches a valuation of $1 billion without the need for a stock market listing.

In a press release, the company shared that its valuation has reached $1.5 billion, ahead of its anticipated initial public offering in the Kingdom.

The latest funding has bolstered Tabby’s financial standing, enabling it to cater to the demand for its flagship BNPL solution, which oversees over $6 billion in annualized transaction volume.

“Tabby set out with a purpose to reshape financial services — one that’s fair and responsible — and with this investment, we can advance our mission across Saudi Arabia and the UAE,” noted Hosam Arab, CEO and co-founder of the company.

Initially established in the UAE, Tabby recently shifted its headquarters to the Kingdom in line with its IPO plans.

Moving to Saudi Arabia was a strategic step for Tabby, as 80 percent of its users were from the Kingdom.

The financing was led by Wellington Management, one of the world’s leading independent investment management firms, besides existing investors like STV, Mubadala Investment Capital, PayPal Ventures and Arbor Ventures.

The company boasts 10 million users and collaborates with over 30,000 brands, encompassing 10 of MENA’s top retail groups.

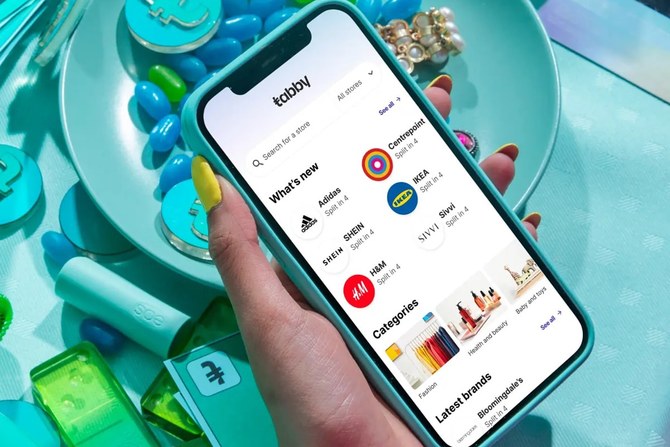

It recently introduced Tabby Shop, featuring over 500,000 items from brands, aiding consumers in locating and monitoring prime products and deals.

Tabby’s adoption in brick-and-mortar stores via the Tabby Card is growing and now accounts for over 20 percent of total volumes, the company claimed.

“Tabby created a new industry and is transforming the way people consume and pay across MENA. Hosam and team built an iconic enterprise that is a reference model in terms of discipline and disruption, two things that are hard to crack in tandem,” Abdulrahman Tarabzouni, founder and CEO of STV, said.

“We are excited to see Tabby become an integral part of Saudi’s fintech landscape, nurturing growth and empowering the broader economy,” Tarabzouni added.