RIYADH: Lowering its growth forecast for 2023, Saudi Arabia expects to post a budget deficit this year rather than an earlier projected surplus, mainly due to “expansionary” spending policies and “conservative revenue estimates.”

Saudi Arabia will continue its fiscal and structural reforms as the Kingdom is steadily embarking on its economic diversification journey in line with the goals outlined in Vision 2030, said Finance Minister Mohammed Al-Jadaan.

He said that continuous implementation of the ambitious plan is necessary for the Kingdom to catalyze its economic growth and maintain fiscal sustainability.

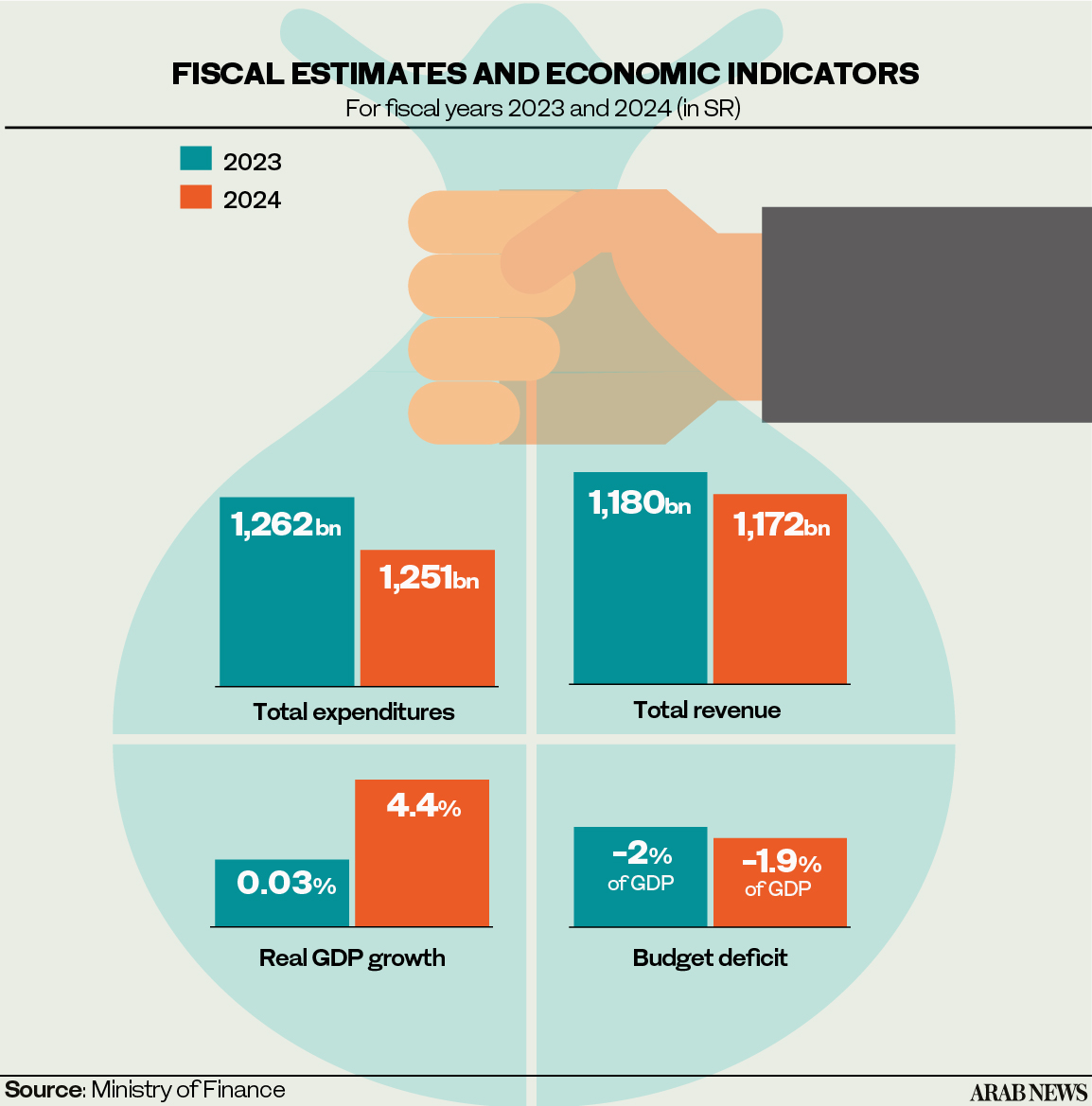

A preliminary budget statement issued on Saturday showed that the largest Arab economy expects real gross domestic product to grow by 0.03 percent this year compared with a previous forecast for growth of 3.1 percent.

The document also projected the government would post a budget deficit of 1.9 percent of the gross domestic project in 2024, 1.6 percent of GDP in 2025, and 2.3 percent of GDP in 2026. It said “limited budget deficits” would continue in the medium term.

Meanwhile, total expenditure is seen rising to SR1.262 billion in 2023, from an earlier estimate of SR1.114 billion, before slowing down marginally to SR1.251 billion in 2024.

However, the Kingdom’s debt-to-GDP ratio is expected to remain below 27 percent due to a gradual decrease in the deficit over the coming years, Mazen Al-Sudairi, head of research at Al Rajhi Capital told Arab News.

“The (budget) deficit is expected to decrease gradually over the coming years, keeping the debt-to-GDP ratio below 27 percent, well below the government’s target of 30 percent,” the analyst said.

Borrowing plan

Al-Sudairi said most of the deficit would be funded through borrowing, demonstrating prudent fiscal management.

According to the ministry, the government is now expecting an SR82 billion ($21.8 billion) deficit for 2023 instead of an SR16 billion surplus projected earlier.

For 2024, the government expects total revenues at SR1.172 trillion and total spending of SR1.251 trillion.

Commenting on the budget statement, Al-Jadaan said the government program will help Saudi Arabia develop promising economic sectors, enhance investment attractions, stimulate industrial growth, raise the percentage of local content, and promote non-oil exports.

The ministry currently expects budget deficits to last through 2026, the statement said.

Saudi Arabia is working to prepare an annual borrowing plan in accordance with a medium-term debt strategy and “access global debt markets to enhance the Kingdom’s position in international markets,” the Finance Ministry said.

Non-oil GDP

The budget statement touted growth in non-oil sectors, whose revenue jumped by 11 percent in the first half of the year.

Commenting on the non-oil sector, Al-Sudairi stressed the importance of focusing on the non-oil GDP, which is expected to grow by 5.9 percent in 2023 and over 4 percent in the following year.

“This growth above 4 percent is very healthy and will help diversify the non-oil economy, creating new sectors and segments inside the economy.”

The expert also highlighted the significance of cities and service-based industries in the Saudi economy.

He stated: “The Vision 2030 concentrates on cities. With the global economy becoming more service-based, cities become much more important as service industries thrive.”