ISLAMABAD: The Pakistan government has shared a proposal with the International Monetary Fund (IMF) seeking approval for domestic customers to be able to pay electricity bills in installments, a senior official of the finance ministry told Arab News on Thursday, as protests continued for a second week against electricity bills.

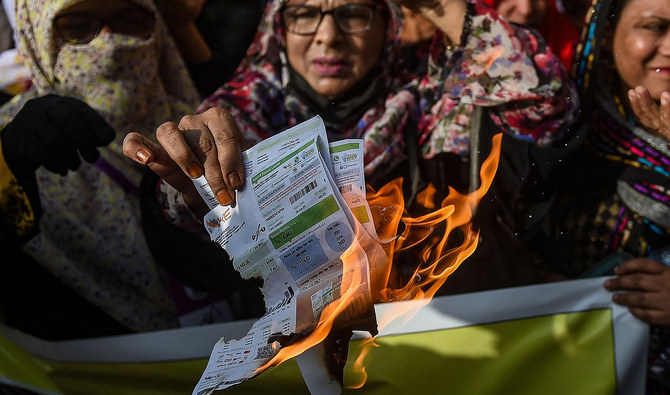

An electricity price hike was agreed with the IMF earlier this year when the international lender approved a short-term $3 billion bailout package for Pakistan. Protests against steep bills began in Karachi on August 17 and have since spread across the country.

A Rs7 increase in basic tariff was approved last month to be levied from September, while last week the National Electric Power Regulatory Authority approved a further hike of Rs4.96 per unit, whose notification has been delayed due to ongoing protests.

“We have shared a detailed plan with the IMF seeking approval for relief to electricity consumers of up to 400 units and that the increase of Rs7 per unit be applied in phases,” the official, who declined to be named, said.

It could take a “day or two” to get approval from the IMF, after which the measures would be made public:

“If the IMF grants the approval, the ministry will allow collection of August and September electricity bills in installments.”

The government also planned to collect at least Rs250 billion by curbing electricity theft, the official said.

To a question about multiple taxes added in bills, he said the government could not reduce or abolish taxes in bills as long as Pakistan was part of an IMF program.

IMF resident representative Esther Perez Ruiz did not respond to questions seeking comment for the story. Director General Media for the finance ministry, Biraj Lal Dosani, declined to comment on the issue.

The previous government of former Prime Minister Shehbaz Sharif had agreed with the IMF to raise taxes and power prices to secure a bailout deal that helped the nation avert a sovereign debt default.

The official said the Sharif government had agreed with the IMF to keep power sector circular debt below Rs2.3 trillion and thus Pakistan was not in a position to extend any relief to the public without prior approval of the fund.

Samiullah Tariq, Director Research at Pakistan Kuwait Investment Company, said the government did not have the fiscal space to extend relief to electricity consumers as power prices and the formula were predetermined.

“The government can allow the consumers to deposit their bills in instalments, but this was also not the solution as the electricity would cost the public more next month,” he told Arab News.

Tariq said the government would have to pass on the burden to consumers with a change in currency parity as the rupee was rapidly depreciating on a daily basis against the US dollar.

“The authorities are caught in a vicious cycle now,” Tariq said, “where we can all only pray for the better.”