ISLAMABAD: Pakistan's government is targeting a fiscal deficit of 6.54% of GDP for the 2023-24 fiscal year, the finance minister said in his budget speech on Friday, much wider than the current year's original estimate of 4.9%.

The budget needs to satisfy the IMF to secure the release of stuck bailout money for the crisis-struck country, which is due to hold a general election by November.

The government was targeting primary surplus at 0.4% of GDP, the finance minister said.

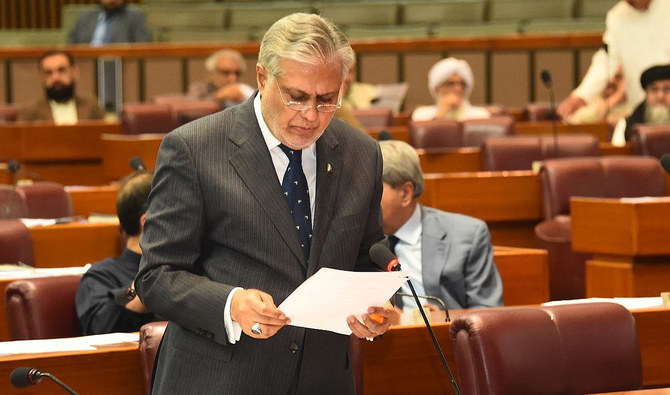

"This is not an election budget. This budget is for the success of the country, it has no political elements in it," Ishaq Dar said on the floor of the house.

For the next year, GDP growth had been budgeted at 3.5 per cent, Dar said, calling it a “modest target.”

The country’s economy has suffered record high inflation and an economic slowdown compounded by devastating floods last year and a failure so far to unlock crucial finances from the International Monetary Fund. The IMF had demanded a number of prior actions from Pakistan, including reversing subsidies, a hike in energy and fuel prices, jacking up its key policy rate, a market-based exchange rate, arranging for external financing and raising over 170 billion rupees ($613 million) in new taxation.

“Owing to the depreciating value of the rupee and the rapid increase in interest rates, the economic woes of the country increased but the government adopted the policy of saving the state instead of saving political interests,” Dar said in his budget speech.

Pakistan's Prime Minister Shehbaz Sharif in a televised address to his cabinet on Friday reiterated that he was hopeful that the agreement with the IMF would go to its board for approval this month.

He added that the United Arab Emirates, Saudi Arabia and China had been "very helpful" in recent months in providing funding to Pakistan.

The IMF said earlier this week that it was discussing the budget with Pakistan's government. Sharif's government is hoping to persuade the IMF to unlock at least some of the $2.5 billion left in a $6.5 billion programme that Pakistan entered in 2019 and which expires at the end of this month.