RIYADH: Saudi Arabia’s merchandise imports dropped 4.9 percent to SR186.4 billion ($49 billion) in the first quarter of 2023, compared to SR196 billion recorded in the previous quarter, the latest data from the Kingdom’s General Authority for Statistics showed.

However, when compared with the SR157.9 billion worth of imports recorded in the first quarter of 2022, the Kingdom’s merchandise imports surged 18.1 percent in the first three months of this year.

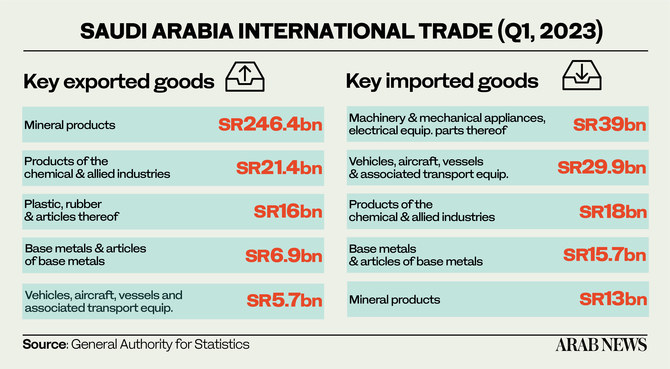

It was driven by machinery and mechanical appliances, electrical equipment, and parts which collectively accounted for 20.9 percent of the total merchandise imports. The imports of transport equipment and parts accounted for 16.1 percent of the total value.

China remains Saudi Arabia’s top origin for imports with SR40 billion worth of merchandise, representing 21.5 percent of the Kingdom’s total imports during the period.

Jeddah Islamic Port facilitated SR54.6 billion worth of imports in the first quarter of 2023, reflecting 29.3 percent of the total value during the period.

Among the other major ports of entry were King Abdulaziz Port in Dammam and King Khalid International Airport in Riyadh, which accounted for 19.3 percent and 12.2 percent of the total value of imports, respectively, in the first quarter of 2023.

Meanwhile, King Abdulaziz International Airport accounted for 6.5 percent of the total value of imports while King Fahad International Airport in Dammam accounted for 6 percent.

Together, those five ports accounted for 73.3 percent of the total merchandise imports of the Kingdom in the first quarter of this year.

On the other hand, overall merchandise exports decreased by 14.6 percent in the first three months of 2023 when compared to the same period of last year.

The value of exports amounted to SR313.5 billion in the same period, down from SR367.1 billion in the corresponding period a year ago.

The drop in exports is mainly attributed to the decrease in oil exports which fell by 14.9 percent to SR245.4 billion in the first quarter of 2023, compared to SR288.5 billion recorded during the same period last year.

The GASTAT report further disclosed that exports to China amounted to SR51.5 billion, reflecting 16.4 percent of total exports, as the East Asian country remains the Kingdom’s main destination for exports.

However, Saudi Arabia’s exports are likely to grow at nearly 5 percent annually to hit $418 billion by 2030, a new report by Standard Chartered predicted.

It attributed this to Saudi Arabia’s strategic location which the Kingdom is looking to leverage on to drive trade and export.

“The Kingdom aspires to become the next global logistics hub and has pledged to make its economy more sustainable and innovative,” Mazen Al-Bunyan, CEO of Standard Chartered in Saudi Arabia, said.

Leveraging its strategic location at the center of Asia, Africa and Europe, he said Saudi Arabia is enhancing its shipping networks to connect these regions and is continuously liberalizing international trade of goods and services.

With various initiatives across the logistics, sustainability and innovation fronts, Al-Bunyan said, “Saudi Arabia is poised to lead the Gulf and wider Middle East into a new era of trade and economic prosperity.”