MIAMI: Tensions between the US and China may be the “defining issue of our time” for business, a senior American CEO has said as the Future Investment Finance conference opened in Miami.

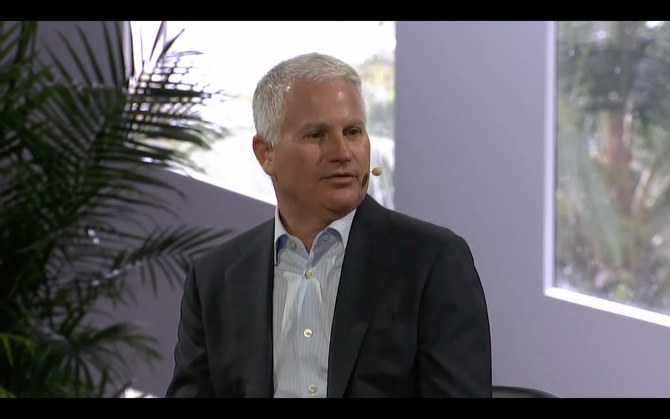

Chip Kaye, of private equity company Warburg Pincus, was discussing the dangers of increasingly fractured geopolitics with other business executives on a panel titled “Business in the new world order.”

He said that everything from climate change to “very local issues… rely on some dimension of state capacity and some dimension of political discourse” to be solved.

“And that’s in short supply in an environment where two sides don’t understand each other at all. (The) US-China divide may be the defining issue of our time.”

Kaye said geopolitical frictions and cultural wars, not only between the US and China, were having far-reaching effects on economic stability.

“I think economic activity is all stronger than we think and the reality is, inflation is a little stickier than we think, and that we may live in a more elevated inflation environment for a longer stretch of time,” he said. “We’re at the very beginning of this adjustment, as opposed to the end.”

Speakers on the panel discussed the consequences of these adjustments on the global economy, and argued that despite the many obstacles it would not lead to the end of globalization.

“I don’t think globalization is dead,” said Jenny Johnson, CEO of investment company Franklin Templeton.

“It’s slowing down and there’s probably some themes that can inform some investments.”

Johnson pointed out how this shift could offer opportunities for investors, particularly for countries like Saudi Arabia that focus on “entrepreneurship, entrepreneurism, on education, where the government is supporting business.”

Speakers also said investors needed to focus more on micro-level problem-solving rather than trying to predict macro-level trends.

“I think macro should have humbled us all at this point,” said She Nyatta, founder of Bicycle Capital, a US-based growth equity investment firm.

“Trying to make big macro predictions over the last four years has been a complete fool’s errand.”

One way investors can support micro-level problem-solving was by investing in developing markets, which Nyatta said were fertile ground for innovation and problem-solving due to their lack of infrastructure and advanced technology.

“I think we need to look where problems are, and find ways to solve those problems at a micro level and those will turn into good businesses because a problem is being solved,” Nyatta said.

But “take risks. In an uncertain time don’t sit on your hands. Don’t wonder what’s going to happen. Take risks.”