NEW YORK: The US government took emergency steps Sunday in an attempt to prevent more instability among banks after the historic failure of Silicon Valley Bank, and assured clients of the failed financial institution that they would be able to recover all of their money quickly.

The announcement came amid fears that the factors that caused the Santa Clara, California-based bank could spread, and only hours before trading began in Asia. Regulators had worked all weekend to try and come up with a buyer for the bank or broker another intervention, and as another bank, Signature Bank, was shuttered. The Treasury Department, Federal Reserve and FDIC said Sunday that all Silicon Valley Bank clients will be protected and have access to their funds and announced steps designed to protect the bank’s customers and prevent more bank runs. “This step will ensure that the US banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth,” the agencies said in a joint statement.

Regulators had to rush to close Silicon Valley Bank, a financial institution with more than $200 billion in assets, on Friday when it experienced a traditional run on the bank where depositors rushed to withdraw their funds all at once. It is the second-largest bank failure in US history, behind only the 2008 failure of Washington Mutual.

Some prominent Silicon Valley executives feared that if Washington didn’t rescue the failed bank, customers would make runs on other financial institutions in the coming days. Stock prices plunged over the last few days at other banks that cater to technology companies, including First Republic Bank and PacWest Bank.

Among the bank’s customers are a range of companies from California’s wine industry, where many wineries rely on Silicon Valley Bank for loans, and technology startups devoted to combating climate change.

Sunrun, which sells and leases solar energy systems, had less than $80 million of cash deposits with Silicon Valley Bank as of Friday and expects to have more information on expected recovery in the coming week, the company said in a statement.

Stitchfix, the popular clothing retail website, disclosed in a recent quarterly report that it had a credit line of up to $100 million with Silicon Valley Bank and other lenders.

The Federal Deposit Insurance Corporation insures deposits up to $250,000, but many of the companies and wealthy people who used the bank — known for its relationships with technology startups and venture capital — had more than that amount in their account. There are fears that some workers across the country won’t receive their paychecks.

No plan had been announced on Sunday afternoon with hours to go until Asian markets opened. There were widespread hopes that Silicon Valley Bank would be acquired, but it was unclear if a buyer would emerge.

Federal officials set a deadline of 2 p.m. for potential buyers to submit bids in a government auction for the bank, according to a person who familiar with the matter. The person requested anonymity to talk about private conversations. Bloomberg was first to report the auction.

Yellen, in her Sunday morning interview with CBS’ “Face the Nation,” provided few details on the government’s next steps. But she emphasized that the situation was much different from the financial crisis almost 15 years ago, which led to bank bailouts to protect the industry.

“We’re not going to do that again,” she said. “But we are concerned about depositors, and we’re focused on trying to meet their needs.”

With Wall Street rattled, Yellen tried to reassure Americans that there will be no domino effect after the collapse of Silicon Valley Bank.

“The American banking system is really safe and well capitalized,” she said. “It’s resilient.”

Silicon Valley Bank, based in Santa Clara, California, is the nation’s 16th-largest bank. It was the second biggest bank failure in US history after the collapse of Washington Mutual in 2008. The bank served mostly technology workers and venture capital-backed companies, including some of the industry’s best-known brands.

Silicon Valley Bank began its slide into insolvency when its customers, largely technology companies that needed cash as they struggled to get financing, started withdrawing their deposits. The bank had to sell bonds at a loss to cover the withdrawals, leading to the largest failure of a US financial institution since the height of the financial crisis.

Yellen described rising interest rates, which have been increased by the Federal Reserve to combat inflation, as the core problem for Silicon Valley Bank. Many of its assets, such as bonds or mortgage-backed securities, lost market value as rates climbed.

“The problems with the tech sector aren’t at the heart of the problems at this bank,” she said.

Yellen said she expected regulators to consider “a wide range of available options,” including the acquisition of Silicon Valley Bank by another institution. No buyer has been announced.

Sheila Bair, who was the FDIC chair during the 2008 financial crisis, recalled that with almost all the bank failures during that time, “we sold a failed bank to a healthy bank. And usually, the healthy acquirer would also cover the uninsured because they wanted the franchise value of those large depositors so optimally, that’s the best outcome.” But with Silicon Valley Bank, she told NBC’s “Meet the Press,” “this was a liquidity failure, it was a bank run, so they didn’t have time to prepare to market the bank. So they’re having to do that now, and playing catch-up.”

Regulators seized the bank’s assets on Friday. Deposits that are insured by the federal government are supposed to be available by Monday morning.

“I’ve been working all weekend with our banking regulators to design appropriate policies to address this situation,” Yellen said. “I can’t really provide further details at this time.”

House Speaker Kevin McCarthy, R-Calif., told Fox News Channel’s “Sunday Morning Futures” that he hoped the administration would announce the next steps as soon as Sunday.

“They do have the tools to handle the current situation, they do know the seriousness of this and they are working to try to come forward with some announcement before the markets open,” he said.

McCarthy also expressed hope that Silicon Valley Bank would be purchased.

“I think that would be the best outcome to move forward and cool the markets and let people understand that we can move forward in the right manner,” he said.

Democratic Rep. Ro Khanna, whose district includes the city where the bank has its headquarters, said it was imperative that the government guarantee all depositors and that they “have full access to their accounts Monday morning.”

“Time is ticking,” he told CBS.

Sen. Mark Warner, D-Virginia, said in an interview with ABC News’ “This Week” that he was concerned that the bank’s collapse could prompt nervous people to transfer money from other regional banks to larger institutions.

“We don’t want further consolidation,” he said.

Warner suggested there would be a “moral hazard” in reimbursing depositors in excess of the $250,000 limit and said an acquisition would be the best next step.

“I’m more optimistic this morning than I was yesterday afternoon at this time,” he said. “But, again, we will see how this plays out during the rest of the day.”

He added: “What we’ve got to focus on right now is how do we make sure there’s not contagion.”

President Joe Biden and Gov. Gavin Newsom spoke about “efforts to address the situation” on Saturday, although the White House did not provide additional details on next steps.

Newsom said the goal was to “stabilize the situation as quickly as possible, to protect jobs, people’s livelihoods, and the entire innovation ecosystem that has served as a tent pole for our economy.”

US government: Silicon Valley Bank clients will get funds

https://arab.news/4kcwq

US government: Silicon Valley Bank clients will get funds

- Regulators closed the bank on Friday when depositors rushed to withdraw their funds all at once

- Execs feared that if the failed bank is not rescued, customers would make runs on other financial institutions in the coming days

Saudi Arabia, China discuss collaboration in urban development during Beijing meeting

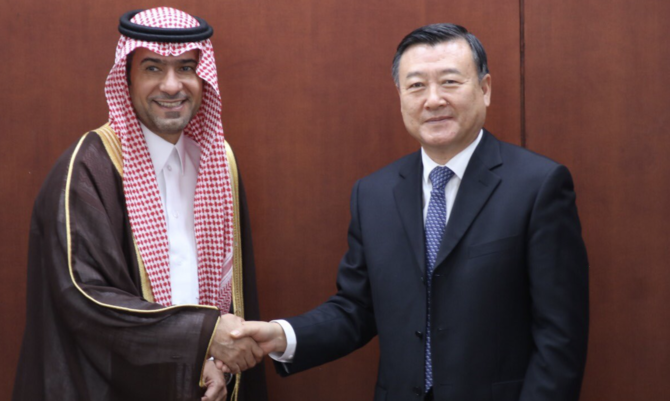

RIYADH: Saudi Arabia and China stand to gain by sharing expertise in city planning, sustainable urban development, and construction technology as officials from both sides met in Beijing.

Saudi Minister of Municipal and Rural Affairs and Housing Majid Al-Hogail and Chinese Minister of Housing and Urban-Rural Development Ni Hong held discussions to explore cooperation opportunities in developing housing policies and programs for residential communities.

This move extends from the Chinese President’s visit to the Kingdom in December 2022 and the agreements signed between the two nations during that time.

Following the meeting in Beijing, Al-Hogail stated in a post on X: “Our leaders have completed an agreement on the importance of strengthening the partnership and aligning Saudi Vision 2030 with the Belt and Road Initiative, which will reflect positively on the aspirations and economic standing of Saudi Arabia and China globally.”

He added: “We are working to enhance fruitful cooperation between the two countries in various fields including developing urban areas and attracting the best Chinese construction companies to benefit from their expertise in enhancing housing units in various regions of the Kingdom, with the aim of achieving the goals of the housing program — one of the programs of the Kingdom’s Vision 2030 — by providing various housing and financing options for citizens.”

Furthermore, the two countries reviewed successful experiences in providing housing solutions and options, along with enhancing opportunities for citizens to own homes. They also discussed ways to facilitate the exchange of experiences in urban management and the application of best practices in this regard.

The meeting was part of an official visit by Al-Hogail to the Chinese capital. During his visit, he is scheduled to meet with senior officials in the Chinese government, heads of construction companies, and banks to strengthen the partnership in the construction sector. The trip also aims to attract top international companies in real estate development.

Aramco acquires 40% stake in GO, marking first entry into Pakistani fuel retail market

- Saudi oil giant Aramco inked agreement to buy 40 percent stake in Gas and Oil Pakistan Ltd. in December 2023

- Acquisition to bring much-needed foreign direct investment in Pakistan’s energy sector, says competition commission

KARACHI: The Competition Commission of Pakistan this week approved Saudi oil giant Aramco’s decision to acquire a 40 percent stake in local company Gas & Oil Pakistan Ltd, officially marking the Saudi company’s entry into Pakistan’s fuels retail market.

Aramco and Gas signed the agreement to acquire 40 percent stake in Gas and Oil Pakistan Ltd., a licensed oil marketing company, in December 2023.

Gas and Oil Pakistan Ltd. is involved in the procurement, storage, sale, and marketing of petroleum products and lubricants. It is also one of Pakistan’s largest retail and storage companies.

Aramco is a global integrated energy and chemicals company that produces approximately one in every eight barrels of the world’s oil supply and develops cutting-edge energy technologies.

Aramco Asia Singapore Pte. Ltd., a Singaporean company wholly owned by Saudi Aramco, filed the pre-merger application with the CCP. It specializes in sales, marketing, procurement, logistics, and related services, with a focus on prospecting, exploring, drilling, extracting, processing, manufacturing, refining, and marketing hydrocarbon substances.

“The Competition Commission of Pakistan approved a 40 percent equity stake acquisition in Gas & Oil Pakistan Ltd. by Aramco, a global leader in integrated energy and chemicals,” the CCP said in a statement on Monday. “This transaction marks Aramco’s first entry into Pakistan’s fuels retail market, underscoring its confidence in the country’s economic potential and its commitment to its growth.”

The CCP said it had authorized the merger after determining that the acquisition would not result in the acquirers’ “dominance” in the relevant market post-transaction.

“Aramco’s acquisition indicates a significant milestone in Pakistan’s energy sector, bringing advanced expertise and technology to the fuels retail market,” it said. “This development is expected to boost competition, elevate service standards, and provide consumers with a broader range of high-quality products.”

The CCP said the acquisition would help bring much-needed foreign direct investment in Pakistan’s energy sector, contributing to economic growth and development of the country.

In February 2019, Pakistan and Saudi Arabia inked investment deals totaling $21 billion during the visit of Saudi Crown Prince Mohammed Bin Salman to Islamabad. The agreements included about $10 billion for an Aramco oil refinery and $1 billion for a petrochemical complex at the strategic Gwadar Port in Balochistan.

Pakistan’s Prime Minister Shehbaz Sharif, who is in Saudi Arabia for a special meeting of the World Economic Forum, held meetings this week with Saudi Arabia’s ministers of energy, economy and planning, and environment, according to his office.

In a meeting with Saudi Energy Minister Prince Abdulaziz bin Salman on Monday evening, Sharif highlighted initiatives undertaken by Pakistan to facilitate investment in the energy sector. The Saudi side showed keen interest in Pakistan’s energy projects highlighted by Sharif, the Prime Minister’s Office said.

The proposed projects included building new and improving existing energy infrastructure, increasing focus on renewable energy, and bringing efficiency across entire energy ecosystem in Pakistan, according to the statement.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both countries have been closely working to increase bilateral trade and investment deals, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion.

IHG’s luxury brand Hotel Indigo set to debut in Alkhobar, expanding Saudi footprint

RIYADH: The Saudi hospitality landscape is poised to welcome a new luxury hotel brand following a management agreement between UK-based IHG Hotels & Resorts and REFAD Real Estate Co.

Signed on the sidelines of the Future Hospitality Summit in Riyadh, the deal will bring the lifestyle brand Hotel Indigo & Residences, featuring 200 keys, to Alkhobar by September 2027.

Supported by the Kingdom’s Tourism Development Fund, the hotel will also include serviced apartments.

Speaking to Arab News, Haitham Mattar, managing director at IHG Hotels & Resorts in India, Middle East and Africa, said: “It’s on the corniche of Alkhobar. It brings authentic, cultural experiences into the hotel, and this is where we found this unique partnership with Refad. Their interest in the brand, also the brand positioning in Saudi Arabia.”

He revealed that the company has so far signed five Hotel Indigo hotels in Saudi Arabia.

The executive also noted that the luxury brand is expanding in the Middle East, following the success of an existing Hotel Indigo in Dubai.

Commenting on the agreement, Mattar said: “This strategic addition not only fuels our growth in Saudi but also reaffirms our commitment to providing exceptional hospitality experiences in key markets.”

He continued: “With the Kingdom having increased its 2030 visitor target from 100 to 150 million, there is a need to bring in lifestyle hotels offering compelling guest experiences that will only further strengthen its robust hospitality sector in line with the goals of Vision 2030.”

Mattar further elaborated on the significant investment and expansion plans for the hotel industry in Saudi Arabia over the next three to five years, including SR2.5 billion ($667 million) to renovate and upgrade existing facilities.

"His Excellency, Ahmed Al-Khateeb, the minister of tourism, has given us a very specific mandate to ensure that we uplift and elevate our hotel product,” he said.

This is to “to ensure that these hotels are well-positioned to receive international travelers, that the ministry and the government are seeking. We have a commitment from our owners to staff that are waiting, especially our Intercontinental brand,” Mattar added.

The managing director said the focus is on the Intercontinental brand, which currently has 10 to 11 hotels in Saudi Arabia and is part of a broader pipeline of 39 new hotels set to open across the region.

“We have a huge concentration of hotels coming up in the Makkah Medinah area, but also we are going into the secondary market. So, for example, Hotel Indigo is also going to Abha, in the Asir region, a very special location as well, in the mountains of Saudi Arabia, and we are also covering new opportunities in Riyadh, Jeddah, as well as Eastern Province,” Mattar explained.

As part of Saudi Arabia’s tourism strategy, which involves developing ten key destinations focusing on a mix of major cities and lesser-known regions, the list of destinations includes Madinah, Riyadh, and several secondary and tertiary markets like the Asir region, Qasim, and Al-Jouf, as well as Jazan, Abha, and Baha.

“This is where, you know, the natural assets of Saudi Arabia are. This is where the future of tourism is going to be. This is where the cultural and historical sites are also placed, and some of the places, as I see it,” Mattar emphasized.

He added that the Ministry of Tourism focuses on exploiting those assets and showcasing them to the world, emphasizing that it’s not just about city escapes in Riyadh and Jeddah, but also about the historical and spiritual offerings in Makkah and Madinah.

Hotel Indigo and Residence will provide guests with a range of dining options, including the Neighborhood Café and Lobby Lounge, as well as an Executive Lounge for a diverse culinary experience.

Business travelers will have access to facilities, including five meeting rooms and a ballroom spanning 290 sq. m., all equipped with the latest technology.

Closing Bell: Saudi main index gains 25 points to close at 12,395

RIYADH: Saudi Arabia’s Tadawul All Share Index continued its upward momentum for the second consecutive day, gaining 25 points to close at 12,394.91.

The total trading turnover of the benchmark index was SR7.47 billion ($1.99 billion) with 187 of the listed stocks advancing and 36 declining.

The Kingdom’s parallel market Nomu also edged up by 0.41 percent to 26,336.28.

However, the MSCI Tadawul Index shed 9.12 points to close at 1,560.69.

Makkah Construction and Development Co. was the best-performing stock of the day with its share price surging by 7.88 percent to SR106.80.

Other top performers on the main market were National Agricultural Development Co. and Saudi Reinsurance Co., whose share prices soared by 7.34 percent and 7.23 percent respectively.

The worst performer on the benchmark index was Saudi Electricity Co., as its share price slipped by 3.72 percent to SR18.62.

On the announcements front, ACWA Power said that shareholders approved the board of directors’ recommendation to distribute a cash dividend of SR0.45 per share for 2023.

Shareholders of the utility developer also green signaled the board’s recommendation to increase capital by SR14.62 million from retained earnings.

On Tuesday, Almunajem Foods Co. said that it signed a share purchase agreement with Balady Poultry Trading Co.

Under the deal, Almunajem Foods Co. will buy a 23 percent stake from Balady Poultry Trading Co.’s shareholders totalling SR181.33 million.

The company, in a Tadawul statement, revealed that the deal will be completed only after obtaining the necessary approvals from the relevant authorities, including the Kingdom\s General Authority for Competition.

Meanwhile, Yamama Cement Co. announced its financial results for the first quarter of this year.

In a Tadawul statement, the cement manufacturer said that its net profit increased by 2.34 percent in the first three months of 2024 to SR115.03 million, compared to the same period of the previous year.

The company attributed the rise in profit to lower cost of sales and higher revenues.

The National Co. for Glass Industries, also known as Zoujaj revealed that its net profit in the first quarter of this year surged by 166.27 percent to SR22.9 million, compared to the same quarter of the preceding year.

Sudan to pursue nuclear energy, exploit gold resources: Energy minister

- Energy, mining ministries combined, says official at WEF meeting

- Nuclear power will ‘accelerate’ industrial developmental progress

RIYADH: In a bid to boost the country’s development, Sudan has consolidated its energy and mining ministries, and is pursuing nuclear power as a source of electricity, a senior official said at the World Economic Forum here on Monday.

Speaking to Arab News, Minister of Energy and Petroleum Moheiddin Naeem Mohamed Saeed said the merging of the ministries is aimed at capitalizing on the nation’s gold resources. Pursuing nuclear energy would boost the war-torn country’s development, he added.

“Sudan’s significant gold production will be leveraged to drive development in other sectors,” the minister said.

Meanwhile, Saeed said that he found the discussions on nuclear energy during the WEF event beneficial, adding that his country has begun the process of developing its nuclear-power sector.

“Having completed the initial two steps, it is now high time to seriously consider nuclear energy, given it is safe. This action will accelerate Sudan’s industrial and developmental progress, potentially spearheading reforms in the energy sector, which is a key indicator of a country’s level of development,” Saeed said.

He said that discussions around energy were critical for all nations. “Energy is no longer a private matter; it is a concern that resonates worldwide. Access to energy is a fundamental right for people everywhere. With the evolving quality of life, energy has become indispensable. From household appliances to industrial machinery, our modern way of life relies heavily on energy,” he said.

Saeed added that the WEF special meeting provides a platform for participants to discuss different energy sources and strategies for investing in them optimally, while keeping costs as low as possible, and developing industry standards.

“This forum seeks to unite the global regulations and provide safe and available energy,” he said.

Saeed said Sudan was developing relations with other nations with regard to energy provision. “We have a power interconnection with Ethiopia, and we have a power interconnection with Egypt; they are our neighbors. We have a big goal to achieve in Africa, which is to pursue this interconnection. So, African countries exchange energy,” he said.

He emphasized that Africa, known for its economic challenges, requires collaborative efforts among its nations to address energy issues effectively. “Energy has become an indicator of whether a country is advanced or not, as I previously said. They strive to integrate electricity and energy in general.”

Saeed said that as an oil-producing country, Sudan had undertaken projects with China and Malaysia. “In early 2000, our oil production reached 500,000 bpd (barrels per day), after the country split into two with the establishment of South Sudan, where most of the oil projects were located.

“Our big challenge now is to cooperate with oil old players or the new ones everywhere, as we have no political issues with any country, and this is business. We have a substantial oil reserve in the north,” he said.

He said Sudan has only exploited 20 percent of its known oil reserves for energy, and the government was striving to maximize production due to high demand.

“We currently meet 40 percent of our energy requirements. Additionally, we have initiatives in solar, thermal and wind energy to generate electricity. Moreover, our river systems, supported by numerous dams, contribute to half of Sudan’s power supply, and we are making significant progress in this area.”

On gas, he said Sudan has potential fields in the Red Sea, and are transitioning electricity stations to utilize more of this source.