RIYADH: China’s business links with Saudi Arabia have been significantly boosted thanks to the signing of 35 investment agreements involving organizations from the two countries.

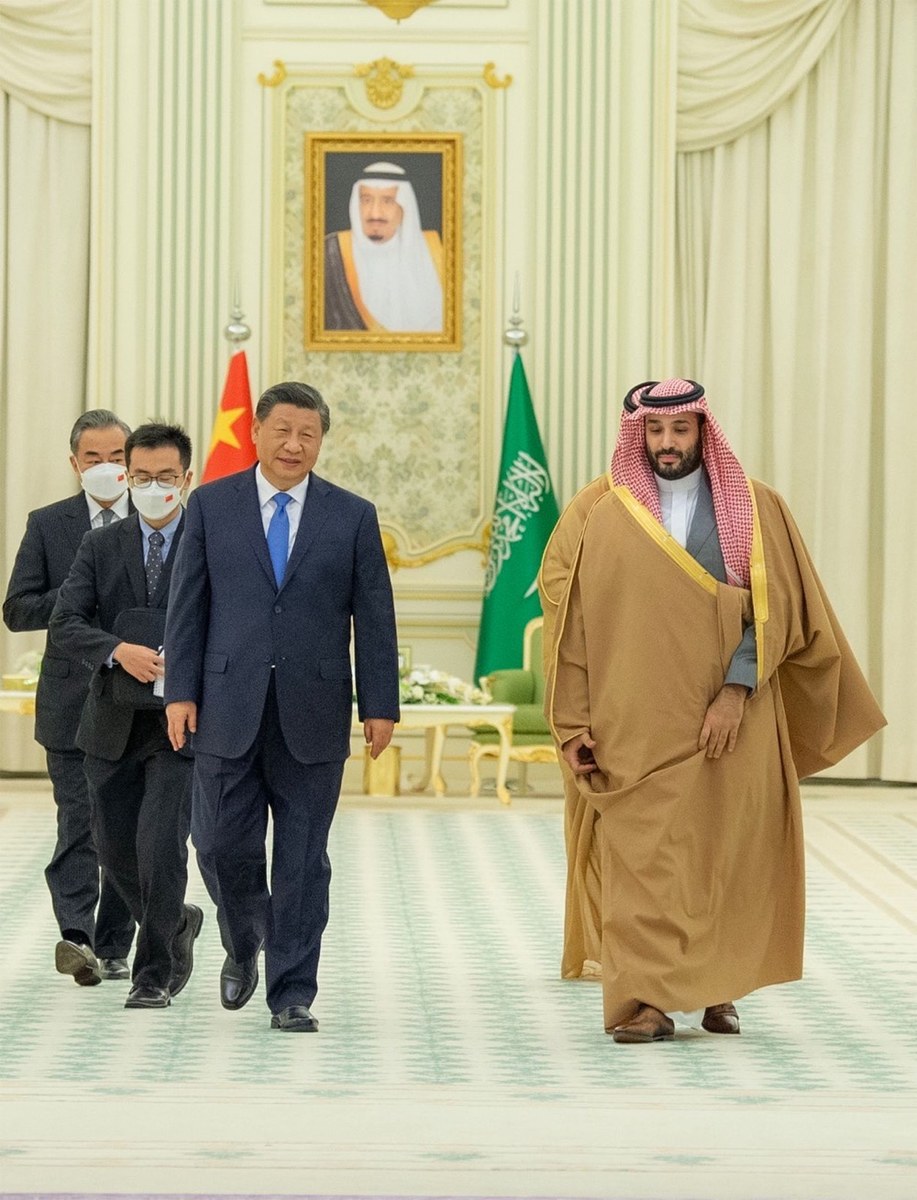

The raft of deals came during the visit of Chinese President Xi Jinping to the Kingdom. They cover a range of sectors, including green energy, technology and cloud services.

Transportation, logistics, medical industries, construction and manufacturing are also covered by the deals, as is a petrochemicals project, housing developments and the teaching of the Chinese language.

The agreements are worth about $30 billion, and come as China seeks to shore up its COVID-19-hit economy and the Kingdom continues to diversify its economic and political alliances in line with Vision 2030.

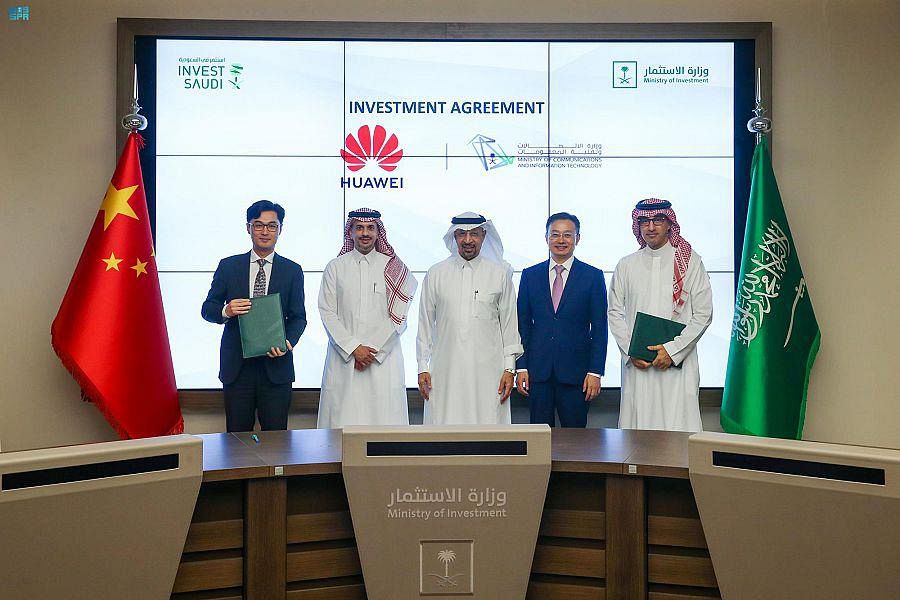

One of the deals involved a memorandum of understanding with China’s Huawei Technologies on cloud computing and building high-tech complexes in Saudi cities. (Supplied)

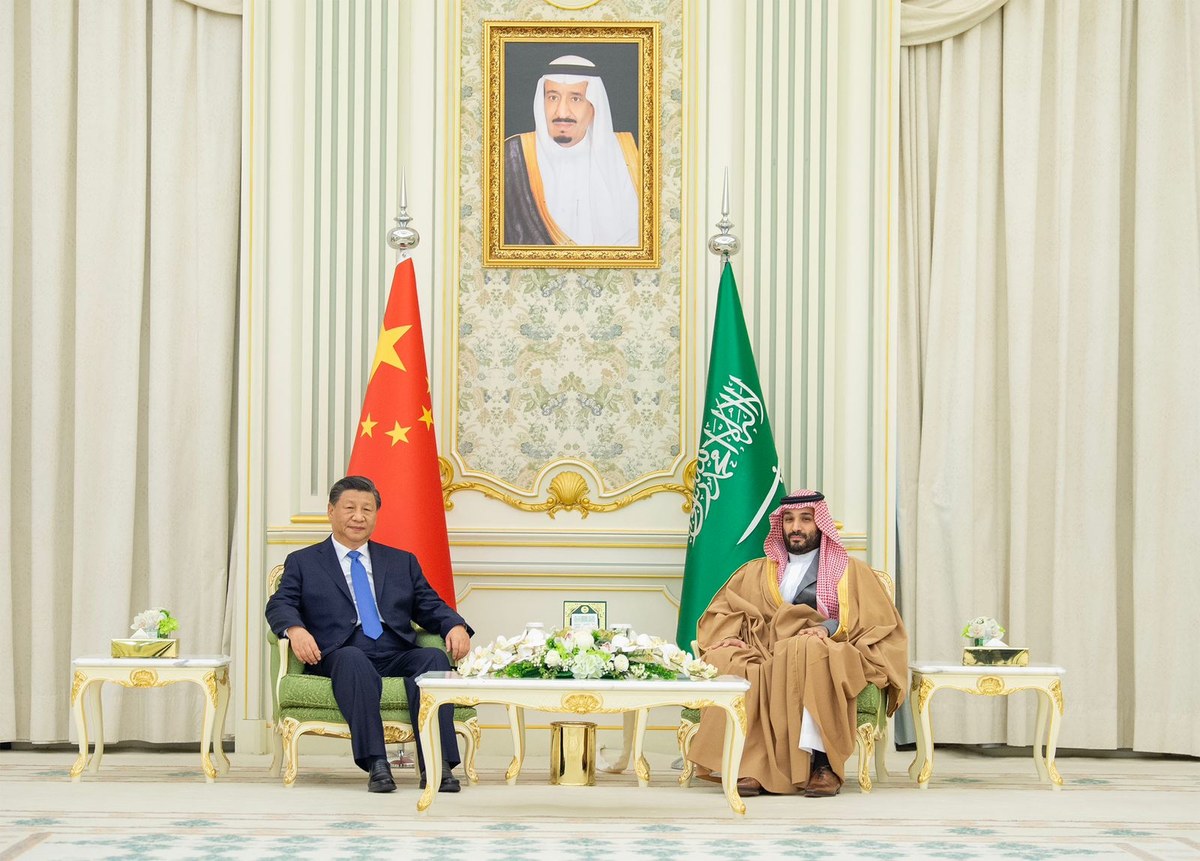

The signing of the agreements was overseen by Saudi Crown Prince Mohammed bin Salman and President Xi, with the first an alignment plan between the Kingdom’s Vision 2030 and China’s Belt and Road Initiative.

Another deal saw a memorandum of understanding in the field of hydrogen energy signed by Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, and He Lifeng, chairman of the Chinese National Development and Reform Commission.

Walid bin Mohammed Al-Samaani, the Kingdom’s justice minister, and Wang Yi, China’s state councilor and minister of foreign affairs, inked an agreement for cooperation and judicial assistance in civil, commercial and personal status cases.

A memorandum of cooperation to teach the Chinese language was signed by Yousef bin Abdullah Al-Benyan, Saudi Arabia’s education minister, and China’s Wang Yi.

Direct investment is to be encouraged through an MoU penned by Khalid bin Abdulaziz Al-Falih, the Kingdom’s investment minister, and Wang Wentao, China’s minister of commerce.

An action plan to activate the provisions of the housing memorandum of cooperation was also agreed, and signed by Majid Al-Hogail, Saudi Arabia’s minister of municipal, rural affairs and housing, and China’s Wang Wentao.

The signing of these MoUs and agreements was followed by a ceremony during which the Chinese president received an honorary doctorate degree in administration from King Saud University.

The Saudi crown prince also held an official lunch in honor of the Chinese president. (SPA)

The Saudi crown prince also held an official lunch in honor of the Chinese president.

Saudi investment minister Khalid Al-Falih said that this week’s visit “will contribute to raising the pace of economic and investment cooperation between the two countries,” offering Chinese companies and investors “rewarding returns.”

One of the deals involved a memorandum of understanding with China’s Huawei Technologies on cloud computing and building high-tech complexes in Saudi cities, the government communication office said in a statement.

Saudi firm AJEX Logistics Services is one of the companies looking to benefit from the growing ties between the Kingdom and China.

The firm marked the visit of the Chinese leader by announcing the launch of two new services as part of its expansion strategy into China and the Middle East.

Customers will soon be able to send single-piece and multi-piece shipments from China to Saudi Arabia, the UAE and Bahrain in four to seven days.

Another deal, signed between the Saudi Investment Ministry and Shandong Innovation Group, involves the construction of an aluminum plant.

Chinese chemical company Kingfa, Shanghai-based wind turbines and energy management software firm Envision, and Beijing-headquartered CITIC Construction also penned MoUs.

The range of deals prompted the CEO of the Saudi Export Development Authority, Abdulrahman Al-Thukair, to hail the strong economic relations between Saudi Arabia and China.

Al-Thukair praised the growth and development of the volume of trade exchange between the two countries, noting that China is one of the Kingdom’s main trade partners, as total non-oil exports from the Kingdom to China reached SR36 billion ($9.57 billion) in 2021, mainly petrochemicals, which amounted to SR31.7 billion, and minerals, which amounted to SR2 billion.

Thursday’s developments prompted Hussain Al-Shammari, the Ministry of Media’s director of international media, to claim that Saudi Arabia is now a “hub” for Chinese industry.

Speaking to Arab News, he said: “Today they will open a regional center for all factories of China in Saudi Arabia that makes Saudi Arabia a hub for the industry for China. The Silk Road of China will be served with the Saudi Vision. Both countries are interested in strengthening these relations and we will benefit, both China and Saudi Arabia, from these visits.”

He added: “This second visit of the Chinese president is very important. We are signing a SR110 billion contract. We are signing more than 20 agreements — it is the deal of the decade for both countries.”

Al-Shammari highlighted the importance of the Chinese president’s visit to the Kingdom and the aligned goals of Saudi Vision 2030 and China’s Belt and Road Initiative.

“These important agreements will serve both purposes of Saudi Vision 2030 and will also serve the purposes of China,” Al-Shammari said, adding: “China needs the continuity of energy and oil going to their economy. We are important to China and China is also important to us.

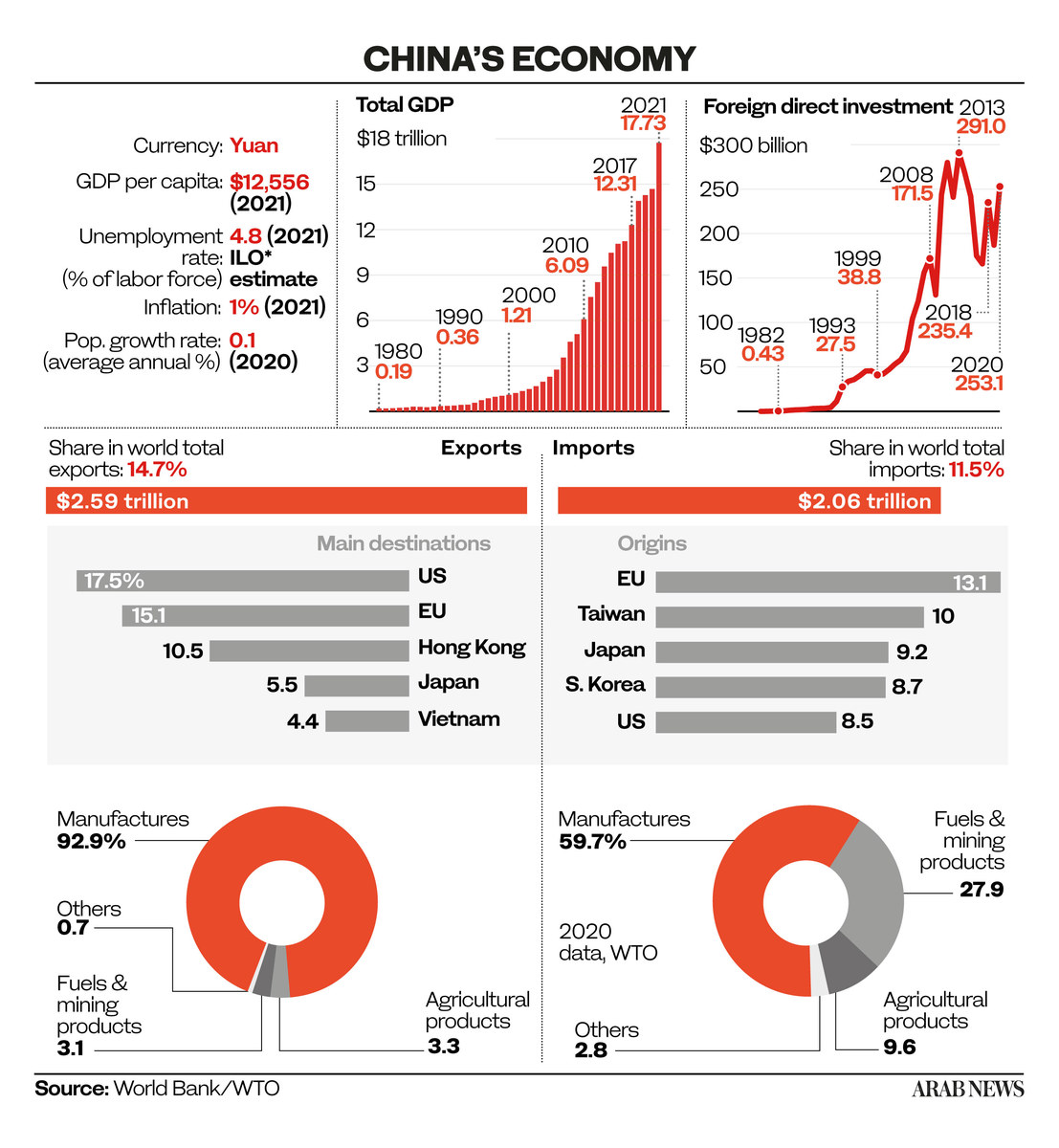

China is the largest commercial partner of Saudi Arabia with a $67 billion interaction annually between the two countries. (Supplied)

“The Saudi-Chinese bilateral relations are very strong, China is the largest commercial partner of Saudi Arabia with a $67 billion interaction annually between the two countries, and both leaderships are looking forward to developing these relations even further.”

As China is the second largest economy in the world and Saudi Arabia is going through its Vision 2030 goals, a transfer of new technologies is required, said Al-Shammari.

“These summits come at an important time for both countries to further strengthen these bilateral relations,” he added.

As confirmed recently by Saudi Minister of Energy Prince Abdulaziz bin Salman, the Kingdom will host a regional center for Chinese factories owing to Saudi Arabia’s strategic location among the three continents of Asia, Africa and Europe.

The minister also reaffirmed collaboration with China’s Belt and Road Initiative, as well as investment in integrated refining and petrochemical complexes in both countries.

Cooperation between the two countries has witnessed remarkable growth during the past five years, Bandar bin Ibrahim Al-Khorayef, the minister of industry and mineral resources, told Arab News.

The raft of deals came during the visit of Chinese President Xi Jinping to the Kingdom. (SPA)

During the crown prince’s visit to China in February 2019, both countries concluded agreements to establish joint projects covering several sectors including manufacturing, petrochemicals, pharmaceuticals and others.

The countries already share a good history of cooperation, Al-Khorayef said, citing the example of seven Chinese factories operating in different fields in the Saudi Authority for Industrial Cities and Technology Zones.

In addition to this, there are 10 other factories at different stages of planning, construction and implementation.

Furthermore, there are about 12 projects for the Royal Commission for Jubail and Yanbu with Chinese companies at different stages, some of them in operation and others under procedure or design.

It is not just business groups that are benefiting from Saudi Arabia’s closer ties with China.

Saudi Arabian think tank King Abdullah Petroleum Studies and Research Center signed an MoU with China’s Economics and Technology Research Institute to exchange information around energy, economics and climate change.

Under the terms of the MoU, both entities will work hand in hand to allow for the exchange of research and the generation of actionable insights.

Some of the fields of common interest which will be prioritized as topics of research include energy, economics, climate change, sustainability, transition, productivity, hydrogen and carbon capture, among others.

The MoU falls in line with KAPSARC’s mission to utilize applied research and innovation to drive and propel the global energy sector, while the Chinese organization is affiliated with oil and gas firm China National Petroleum Corporation.