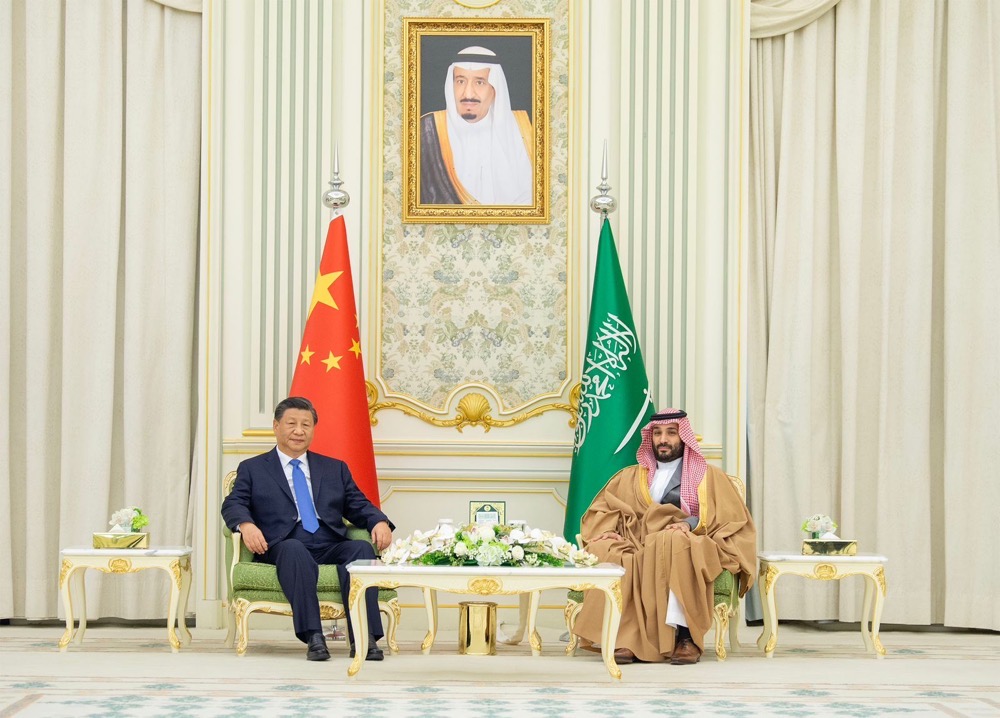

RIYADH: Decisions made over the past decade since Xi Jinping became president have placed China on a firm footing to become Asia’s — if not the world’s — pre-eminent economic power. The country’s many achievements are in the limelight as Xi pays a state visit to Saudi Arabia in response to an invitation from King Salman.

Thanks to sweeping reforms, diplomatic engagement, and massive infrastructure development, China has emerged today as the Arab region’s largest trade partner, reclaiming its historic mantle as an export powerhouse.

What makes China such a resilient exporter is the diversity of products it manufactures — having shifted away from agriculture, clothing and textiles into electronics, machinery and computers — making it less vulnerable to market volatility.

The rise of China did not happen overnight of course. In the early 1970s, the country’s share of global trade stood at less than 1 percent. Then, after a series of reforms designed to open up the economy, demand for exports boomed, growing from $2.31 billion in 1970 to $7.69 billion in 1975.

The country’s many achievements are in the limelight as Xi pays a state visit to Saudi Arabia. (SPA)

By 1985, Chinese exports had reached a value of $25.77 billion, growing throughout the decade until 1993 when exports almost doubled in value in just one year from $53.36 billion to $104.61 billion in 1994.

Further growth followed China’s induction into the World Trade Organization in December 2001, stimulating a surge in value worth $520.24 billion over a period of just five years.

In 1990, China was ranked 14th among the top world exporters, representing just 1.8 percent of global exports. By 2000, it had risen to seventh place, making up 3.9 percent, just behind the UK and Canada.

In 2004, China overtook Japan as the world’s third-largest exporter, accounting for 6.5 percent of global exports. Then, in 2007, the value of Chinese exports broke the $1 trillion threshold for the first time, reaching $1.26 trillion.

Although the 2008 global financial crisis briefly slowed Chinese export growth, it quickly rebounded. By 2009, China had overtaken Germany as the world’s largest exporting nation, making up 9.6 percent of global exports.

Unbowed by the COVID-19 pandemic, which originated in the Chinese city of Wuhan in late 2019, resulting in lockdowns, travel bans and a global economic slowdown, China’s exports have continued to grow, reaching an estimated $3.55 trillion in 2021.

China and the Arab world have a trade relationship stretching back 1,500 years to the time of the Silk Road, when Chinese fabrics came overland to the Arabian Peninsula and Arab incense, frankincense and pearls were carried to East Asia.

The name “Silk Road” was first coined by German geographer Ferdinand von Richthofen in 1877 to describe the ancient trade routes between East Asia and Europe. The concept of a great unifying belt continues to inspire trade relations to this day.

Today, China is Saudi Arabia’s largest trading partner. According to Reuters news agency, bilateral trade between the two countries reached $87.3 billion in 2021, with Chinese exports to the Kingdom reaching $30.3 billion and China’s imports from Saudi Arabia totaling $57 billion.

China’s main exports to Saudi Arabia are textiles, electronics and machinery, while China mainly imports crude oil and primary plastics from the Kingdom. In the first 10 months of 2022, China’s Saudi oil imports reached 1.77 million barrels per day, valued at $55.5 billion, according to Chinese customs data.

China’s global exports

• 1970: $2.31bn

• 1985: $25.77bn

• 2000: $253.1bn

• 2005: $773.34bn

• 2010: $1.65 trillion

• 2020: $2.72 trillion

• 2021: $3.55 trillion

Bilateral trade between Saudi Arabia and China grew steadily after the signing of a memorandum of understanding in November 1988, growing to $5.1 billion in 2002, of which China’s exports were worth $1.67 billion and imports $3.43 billion.

In October 1999, China’s then-President Jiang Zemin became the first Chinese leader to visit Saudi Arabia, where he signed a strategic oil deal with the Kingdom to help fuel China’s booming manufacturing sector.

In 2000, crude oil exports to China alone were valued at $1.5 billion. By 2010, they were worth well over $25 billion. In 2022, Saudi Aramco invested in a $10 billion refining and petrochemicals complex in China — the largest Saudi investment in China.

In September 2013, Xi announced the launch of the Belt and Road Initiative — formerly known as One Belt One Road, and often referred to as the new Silk Road — during an official visit to Kazakhstan.

The initiative sets out to connect the markets and manufactories of East Asia to those of Europe via a vast logistical and digital network running through Central Asia, the Middle East and North Africa in a modern-day reimagining of the ancient Silk Road.

China’s exports have continued to grow, reaching an estimated $3.55 trillion in 2021. (AFP)

Considered the centerpiece of Xi’s foreign policy agenda, the Belt and Road Initiative is a global infrastructure development strategy, investing in 149 countries and international organizations, and which has been likened to the US Marshall Plan of the late 1940s.

The initiative, which was incorporated into the Chinese constitution in 2018, has a target completion date of 2049, intended to coincide with the 100th anniversary of the founding of the People’s Republic of China.

China’s Belt and Road Initiative shares the same goal of boosting interconnectivity through cooperation in energy, trade, investment and technology as Saudi Arabia’s Vision 2030 social reform and economic diversification agenda, launched in 2016 by Crown Prince Mohammed bin Salman.

Beyond energy, technology and sustainable development, another emerging area of cooperation between the two nations is logistics. The Kingdom’s courier, express and parcel services market is forecast to grow over the next five years, offering the Belt and Road Initiative a valuable source of haulage infrastructure.

Saudi-based companies like AJEX and its international e-commerce express service are looking at ways to improve trade between China, Saudi Arabia, the UAE, Bahrain and the wider Middle East to keep up with the demand for cross-border commerce.

By working together, diplomats and business leaders say Saudi Arabia and China are well-placed to expand their cooperation in the circular carbon economy, hydrogen power, renewable energy, and a host of other sustainable and high-tech industries.

In 2019, Chen Weiqing, China’s ambassador to Saudi Arabia, said his country’s Belt and Road Initiative is wholly consistent with the Kingdom’s Vision 2030 agenda, highlighting both governments’ common interests and readiness to collaborate.

“China and the Kingdom are among the leading forces of dialogue among civilizations,” Chen said at the time in an opinion article for Arab News. “Cooperation between China and the Kingdom enjoys the characteristics of strategy, harmony, and mutual benefit.”

During the Chinese-Arab Friendship Association meeting in 2021, Mohammed Al-Ajlan, chairman of the Saudi-Chinese Business Council, said more than a dozen Chinese investors had expressed an interest in various Saudi infrastructure projects.

“The economic and financial cooperation between the Arab countries and China witnessed a clear development in the process of consolidating trade and investment relations,” Al-Ajlan said in a statement at the time.

“(We are) looking forward to more efforts to support trade exchange and joint investments by taking advantage of the opportunities available in all countries.”