RIYADH: Saudi Arabia’s real gross domestic product grew by 12.2 percent in the second quarter of 2022, over the same period last year, recording the highest growth since the third quarter of 2011, revealed the latest data from the General Authority for Statistics.

According to the GASTAT report, the real GDP grew by 2.2 percent when compared with the second quarter of 2022.

The report noted that the surge in real GDP was due to an increase in oil activities which went up 22.9 percent year-on-year, and 4.4 percent quarter-on-quarter.

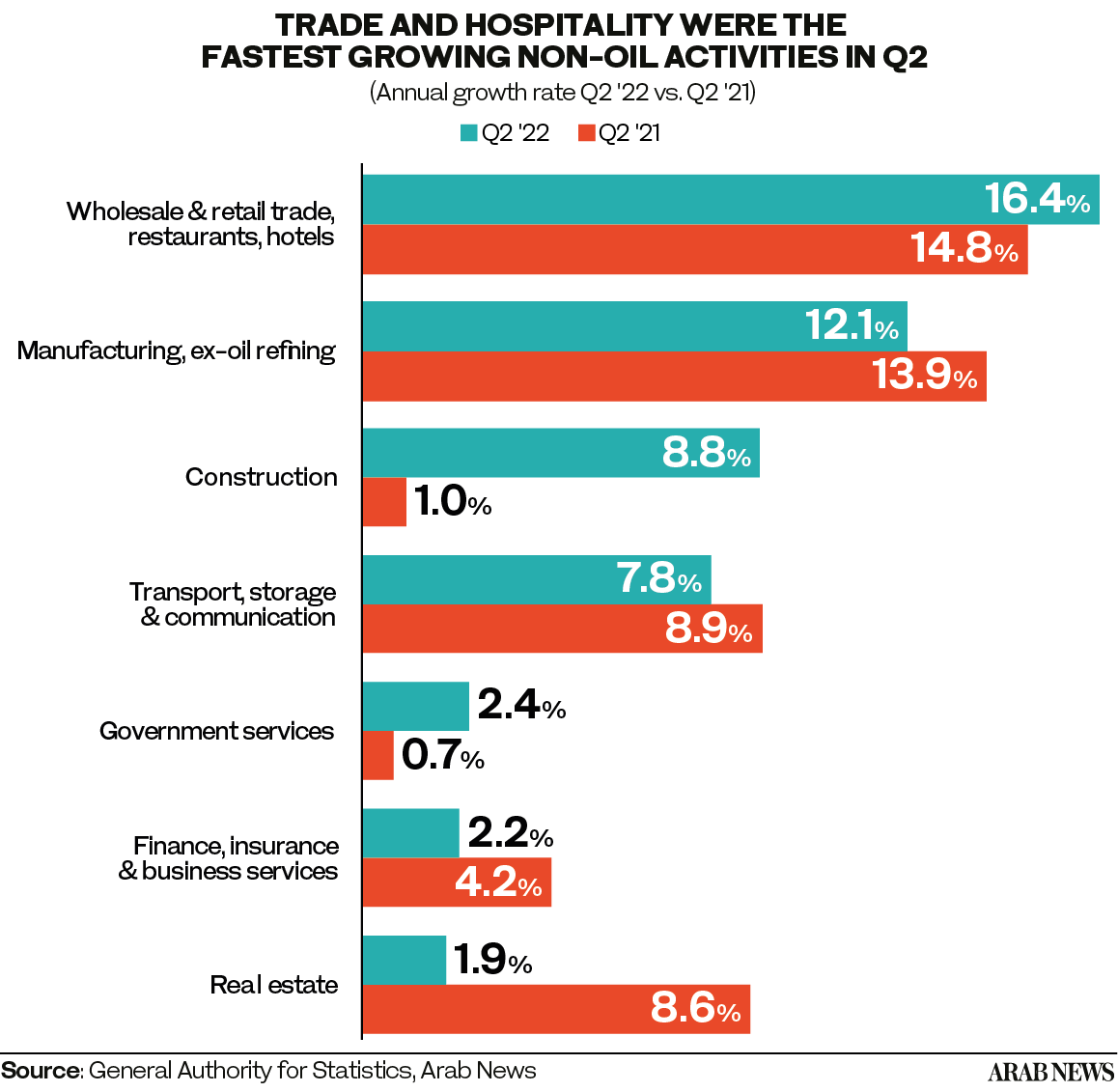

The non-oil activities in the Kingdom during the second quarter increased 8.2 percent year-on-year, the highest increase since the second quarter of 2021.

The country’s seasonally adjusted non-oil activities rose by 4.5 percent quarter-on-quarter, recording the highest jump in three years, showed the data.

The GASTAT report showed that crude petroleum and natural gas grew by 23.5 percent year-on-year, dominating Saudi Arabia’s rise in GDP.

Petroleum refining came in second, recording a yearly growth of 16.6 percent. However, growth in this sector slowed down by 0.8 percentage points when compared to the previous quarter.

Restaurants, hotels, wholesale and retail trade closely followed where it increased by 16.4 percent compared to the same period a year ago, according to GASTAT.

The expenditure on real GDP at constant prices witnessed an increase in all components in the second quarter compared to a year earlier.

Expenditure from gross fixed capital formation rose by 28.8 percent, exports rose by 25.2 percent, and imports rose 18.3 percent year-on-year.

Furthermore, government final consumption expenditure, as well as private final consumption, also rose by 9 percent and 5.5 percent respectively in the second quarter.

The Kingdom’s GDP at current prices totaled SR1.1 trillion ($293 billion) in the second quarter of 2022.

The non-oil sector's shares in GDP fell across the board because of the massive expansion of the oil GDP.

Petroleum and natural gas rose to 38.7 percent of GDP at the current price from 25 percent a year earlier, showing the largest contribution as of the second quarter of 2022.

Government services came second holding 13.9 percent of GDP, down from 19.4 percent a year before.

Manufacturing, excluding petroleum refining, followed suit, holding 7.5 percent of the total GDP in the second quarter down from 8.6 percent in the second quarter of 2021.

Wholesale and retail trade and restaurants and hotels were the fourth largest contributor to GDP at 7 percent down from 8.1 percent, while petroleum refining followed at 6.1 percent, showed data.

As for Saudi Arabia’s GDP per capita, it amounted to SR29,819 in the second quarter of 2022, according to the report.

The per capita GDP grew by 44.6 percent in the second quarter compared to SR26,961 in the first quarter of 2022.

The year-on-year growth of GDP per capita reached 10.6 percent in the second quarter, compared to SR20,617 in the same period of 2021.