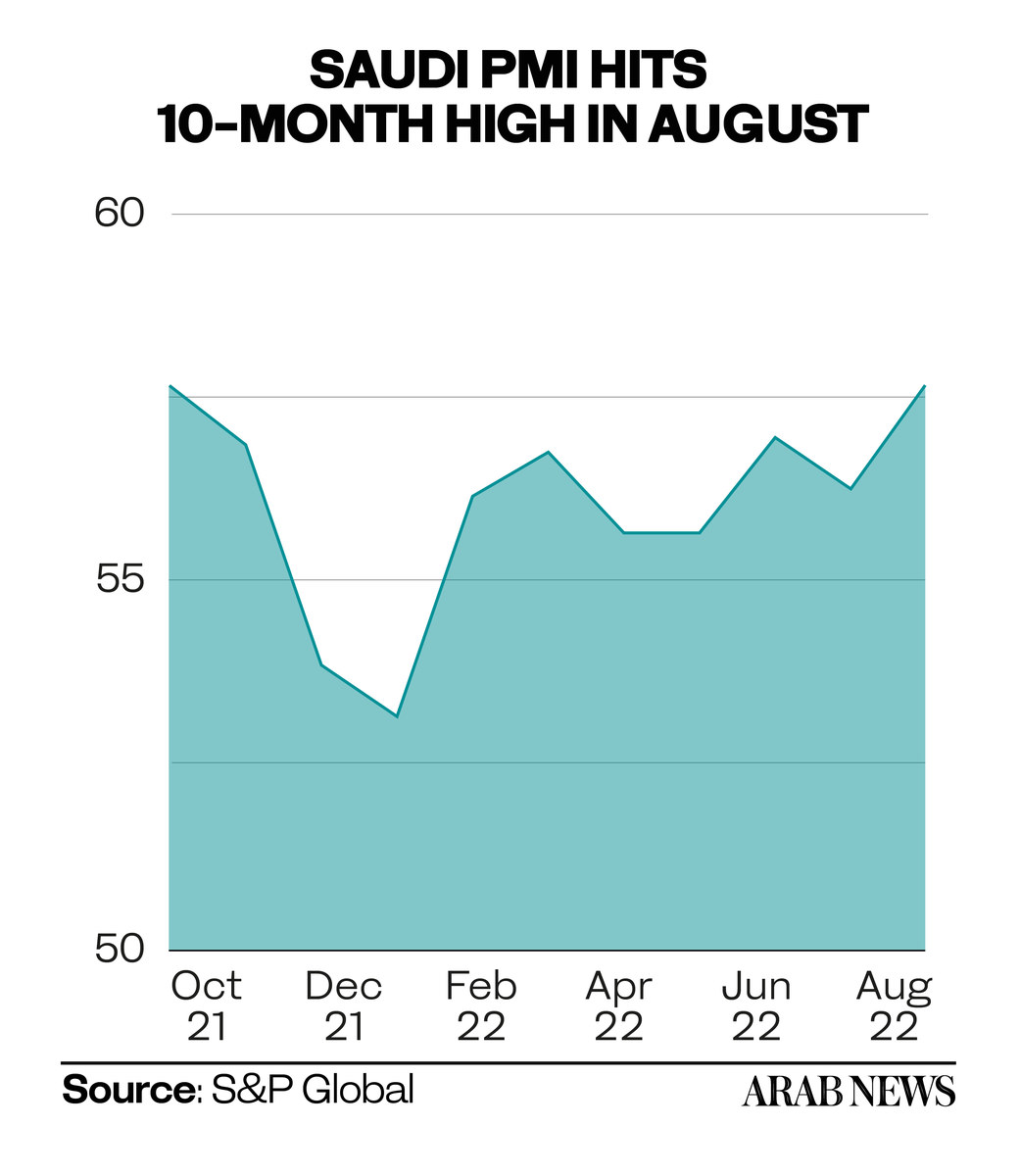

RIYADH: Saudi Arabia’s non-oil economic growth hit a 10-month high in August as the Kingdom steadily progresses in its effort to diversify its economy, according to the latest Purchasing Managers Index data from S&P Global.

The Kingdom’s PMI stood at 57.7 in August, up from 56.3 in July and the highest since October 2021.

“The Saudi Arabia PMI pointed to added resilience in the non-oil economy during August, as business activity and sales continued to rise sharply despite reports of mounting global economic distress,” said David Owen, economist at S&P Global Market Intelligence.

He added: “Total new orders rose at the quickest pace since October last year, driven by improving client demand, higher exports, and a broad recovery in economic conditions since the pandemic.”

The increase in new export orders was only slightly softer than last month, with July setting an eight-month record high, according to the data.

The release further noted that the improvement in non-oil activities led companies to expand their purchasing of inputs in August.

“The rate of purchasing growth accelerated to the sharpest in exactly seven years, as businesses looked to fulfill current demand and build extra stocks in anticipation of further sales growth,” the S&P release added.

Firms recorded a boost in the average lead times of vendors in August despite the additional pressures of the increased demand for inputs.

The release pointed out that employment levels in the Kingdom rose for the fifth successive month in August, as businesses made additional efforts to build staffing capacity.

S&P Global, however, added that the rate of job creation in August was marginal and it was fractionally slower than in July.

The release showed a reasonable drop in input costs and output prices as the global price level of goods and services moderately leveled, and a rise in staff wages for the sixth consecutive month in August.

Saudi Arabia’s fuel costs, on the other hand, did not convey any improvement this month, showed the PMI data.

“The fall in charge inflation was particularly strong in August, as the latest data signaled one of the most marked month-on-month slowdowns in the series history” added the S&P Global report.

Both the manufacturing and retail sectors saw a fall in charges last month, whereas the overall increase in selling charges was the mildest since February of this year.

The Kingdom’s business confidence in the coming year stood strong, showing a trust in potential new order growth despite the current shortcomings in the global economy.

“Whilst slipping to a three-month low, the degree of optimism was one of the strongest seen over the last one-and-a-half years,” according to the S&P Global report.