LONDON: Boeing said it forecasts $14.9 billion in opportunity for growth in Saudi Arabia’s military business over the next five years with a rise in strong demand for defense capabilities.

“We are committed to making the Kingdom’s Vision 2030 a success by contributing to its defense and security needs, creating jobs and growing Saudi Arabia’s aerospace and defense industry,” Rick Lemaster, vice president of Middle East, North Africa, and Turkey and international business development at Boeing Defense, Space and Security, told Arab News.

He said the US aerospace manufacturer sees strong demand for fighters, trainer aircraft, vertical lift and attack helicopters, surveillance capability, autonomous systems, and refueling aircraft – both on the platform side and support and services side.

The company, which has been partnering with the Kingdom for more than 70 years, has over 2,200 people employed by various Boeing entities and joint ventures with Saudis holding leadership positions and a strong Saudi employee base.

Lemaster shrugged off growing global supply chain issues, rising costs and the negative effects of COVID-19, and said: “Customers across the Middle East and here in Saudi Arabia have placed their trust in Boeing to help sustain and upgrade their fleets, support high operational readiness rates, expand parts availability, and maximize partnerships with local industry.”

He added that these goals are key elements of Boeing’s business and they are working with their customers to ensure the challenges are mitigated.

“We see tremendous opportunity for customers in the region to upgrade their existing fleets to the newest, most advanced configurations or acquire new capability. Boeing continues to invest based on our customer’s requirements in innovation, technology, defense and security; as well as in partnerships, and services.”

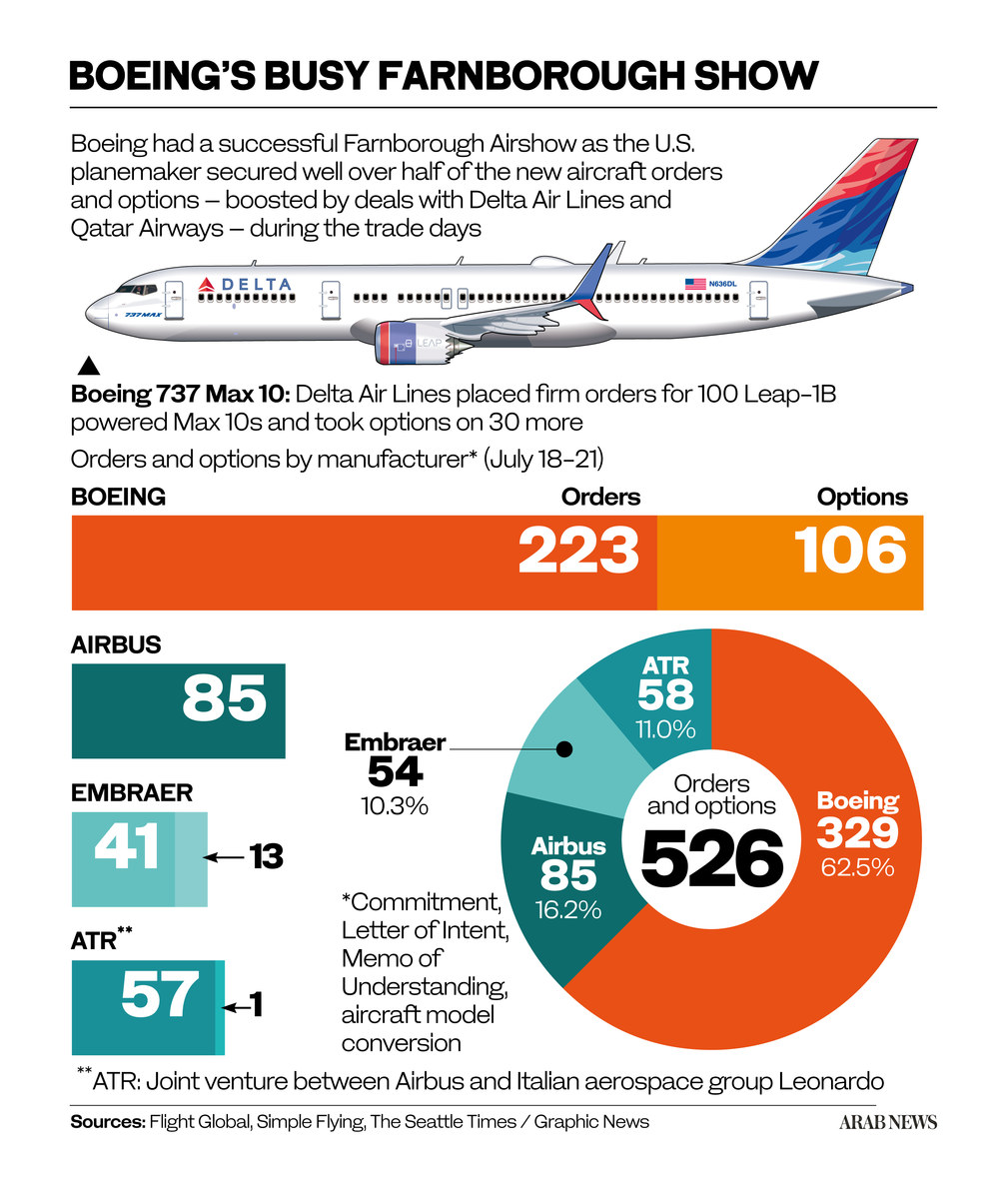

Boeing participated in the UK’s Farnborough Airshow — one of the biggest global aerospace and defense exhibitions — that ran from July 18-22, along with the Kingdom, which had a grand pavilion featuring some of the country’s key defense stakeholders.

Aside from highlighting its highly capable military helicopters and aircraft, and displaying some of its newest, most digitally-advanced programs, Boeing also held ongoing discussions with defense officials from the Gulf and Middle East regions on the sidelines of the event.

Lemaster said talks mainly focused on Boeing’s “fleet modernization efforts and enduring needs for fighters, trainers, cargo and attack helicopters, intelligence, surveillance and reconnaissance capabilities, tankers, unmanned systems, support and training.”

An agreement was also signed between Boeing and the Saudi Arabian Military Industries as a joint venture to further enable the Kingdom’s capabilities and help achieve the 50 percent localization target by 2030.

“The Middle East in particular is a region of very strategic importance to Boeing in terms of growth, partnerships, investments and presence, ” Lemaster said, adding: “We are proud that our customers in the region operate several of Boeing’s platforms.”

Boeing’s overall Middle East market outlook for defense and government services is $33.5 billion for the next five years with 98 campaigns, he informed.

Lemaster said Boeing was also “privileged” to be part of the Kingdom’s World Defense Show, which was held in March, and was impressed with how quickly the expo came together, adding that they “expect the next show will be even bigger and better.”

He said: “We hope to build on that experience in following shows, where we will continue to take the time to listen to our customers’ needs and emphasize the benefits of Boeing’s refreshed business strategy to them.”