PARIS: Vision 2030, Saudi Arabia’s social and economic reform agenda, has created tremendous opportunities for foreign direct investment from France and other major economies, Mohamed Ben Laden, president of the Saudi-French Business Council, told Arab News ahead of Crown Prince Mohammed bin Salman’s visit to France.

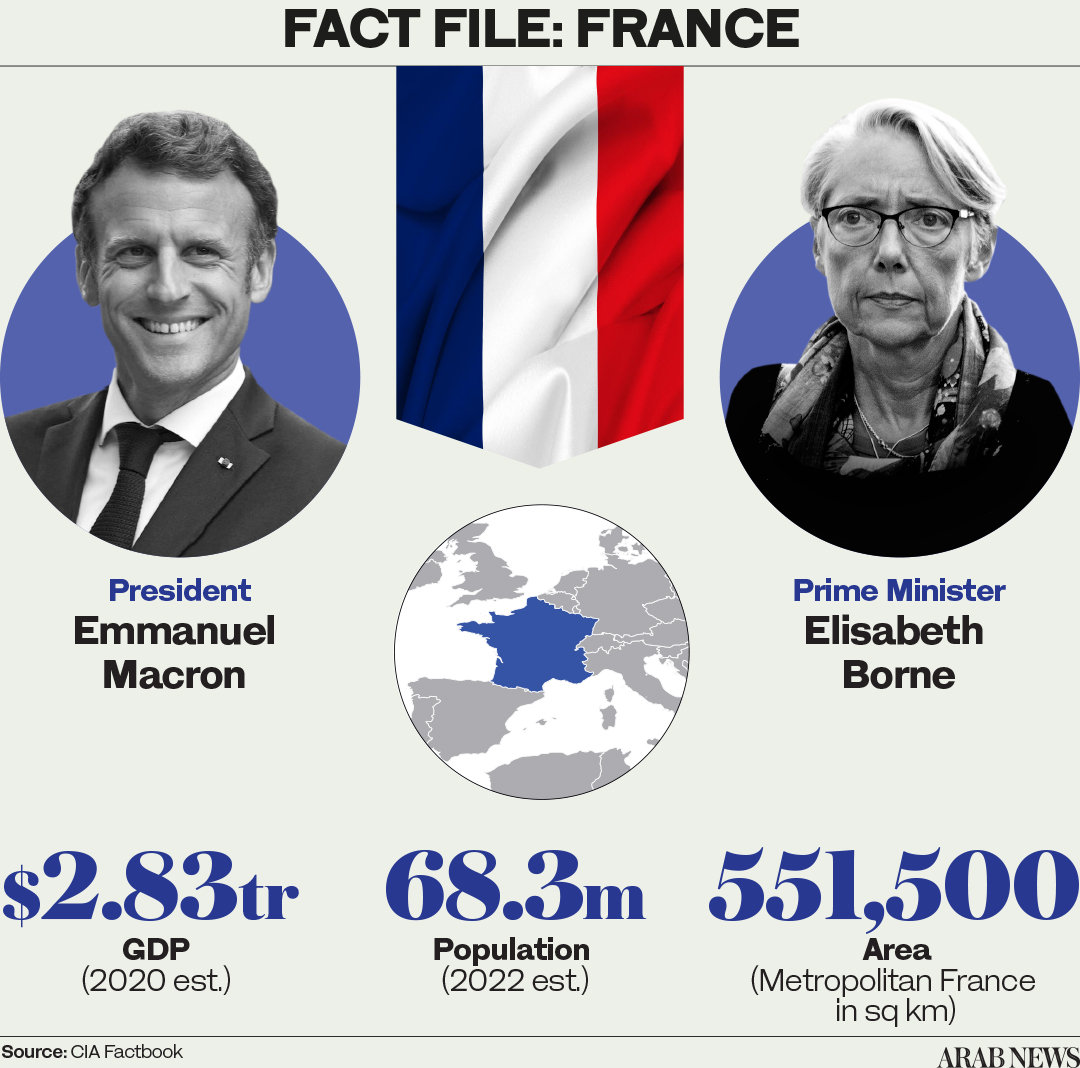

After spending Tuesday and Wednesday in the Greek capital Athens holding talks, the crown prince was scheduled to arrve in Paris on Thursday to meet with French President Emmanuel Macron and representatives of the country’s business community.

Saudi Arabia and France enjoy robust economic ties. In 2021, France imported $3.8 billion worth of Saudi goods, while it exported $3.23 billion to the Kingdom, according to the UN’s Comtrade international trade database.

Mohamed Ben Laden, president of the Saudi-French Business Council, says French companies know investing in the Kingdom can be sometimes complex but never risky. (Supplied)

Furthermore, France is Saudi Arabia’s largest European investor, and the third largest in the world, representing nearly 10 percent of its foreign direct investments. “This number is likely to grow in the coming years since Vision 2030 offers so many opportunities,” Ben Laden told Arab News.

“French groups know that investing in the Kingdom is sometimes complex but never risky. They look forward to the opportunities and future privatizations that are perceived as growth drivers. Significant projects exist in tourism, transport, circular economy and oil, but it is not up to me to unveil ongoing negotiations.”

Ben Laden said Vision 2030 has been a game changer for foreign investment — something the Saudi-French Business Council, or CAFS, known in French as the Conseil d’Affaires Franco-Saoudien, has been eager to promote.

“Vision 2030 offers growing opportunities for French companies with the intention of developing in Saudi Arabia,” he said. “The evolution in trade and investment laws simplify the arrival of new foreign companies.

“France is already Saudi Arabia’s main European partner, ranking third after the UAE and USA. Industrial investments continue to grow as can be seen with the projects recently announced by Electricite de France’s EDF, Total and others.”

In addition, efforts to attract and streamline investment in Saudi Arabia under the Vision 2030 reform agenda have made the Kingdom a far more attractive destination for smaller French enterprises.

“We often think of the large groups that have been present in the Kingdom for some time now, namely Total, Engie, EDF, RATPDev, AirLiquide,” said Ben Laden. “However, Vision 2030 offers a myriad of opportunities to smaller French companies.”

One added benefit of this new investment is job creation. According to Ben Laden, several hundred Saudis now work for French companies and in partnerships across the Kingdom. And this number is growing, keeping pace with the process of Saudization facilitated by the presence of a quality workforce.

“Saudi youth are hardworking and buy into the values of Vision 2030,” he said.

As one of the first business councils founded by the Saudi Chamber of Commerce in 2003, CAFS has hosted dozens of sessions addressing bilateral trade and investments in both countries and played a major role in developing economic ties.

Ben Laden said CAFS’ aim is to develop, promote and support economic relations between the Kingdom and France. Therefore, regular visits to both countries are organized several times a year to discover new industrial sectors or regions and assess potential cooperation opportunities.

Efforts to streamline foreign investments under Vision 2030 have made Saudi Arabia an attractive destination for even smaller French enterprises. (FILE/AFP)

“Our primary role is to help the companies by supporting them and helping them discover the multiple existing opportunities. In parallel, we highlight the legal and competitive framework which holds many advantages,” he said.

“Similarly, if need be, we serve as an interface with the authorities to bypass small administrative difficulties and in rare cases, fortunately, to absorb tensions between companies in both countries.”

Ben Laden emphasized that CAFS is a body for facilitation and exchange. Rather than coaxing companies to come to Saudi Arabia, its role is to guide them in their choice of partners and targets.

“Our administrations — Saudi and French — are similar in their complexity, and being counseled helps to avoid costly errors, so with the help of our friends, the foreign trade advisers, we are here to share our experiences,” he said. “The council is an open structure which will gladly welcome new members in its ranks.”

Trust is at the heart of the development of trade relations between any two sides, said Ben Laden. Therefore CAFS helps companies from both countries to get acquainted and establish relationships. It also helps firms to obtain funding for projects so they can settle in either of the two countries.

Ben Laden believes the development of tourism in AlUla and on the Red Sea coast, as well as recent growth in the entertainment sector, are precious opportunities for French companies wishing to operate in the Kingdom.

“We are only at the beginning of an investment cycle of tens of billions of euros.”