RIYADH: Travel restrictions related to the Covid-19 pandemic saw tourism’s direct contribution to Saudi Arabia's GDP decline by 61 percent from 3.8 percent in 2019 compared to 1.7 percent in 2020, according to the General Authority for Statistics.

The sector's direct contribution to the Kingdom's gross domestic product fell to SR44.4 billion ($11.84 billion) in 2020 from SR114.2 billion in 2019.

The "direct contribution to GDP" indicator refers to the sum of the portion of the gross value added generated by all industries at basic prices in response to domestic tourism consumption plus the amount of net taxes on products and imports included in the value of this spending at purchase prices", according to a methodology note from GASTAT.

The direct gross value added, also known as GVA, generated by tourism activities such as visitor accommodation, food and beverages catering, passenger transport, travel agencies and the like fell to SR27.8 billion in 2020 from SR57.2 billion in 2019.

The GVA generated by other tourism-related activities fell to SR14 billion from SR53.2 billion.

The value of net taxes also declined to SR2.62 billion from SR3.73 billion in 2019.

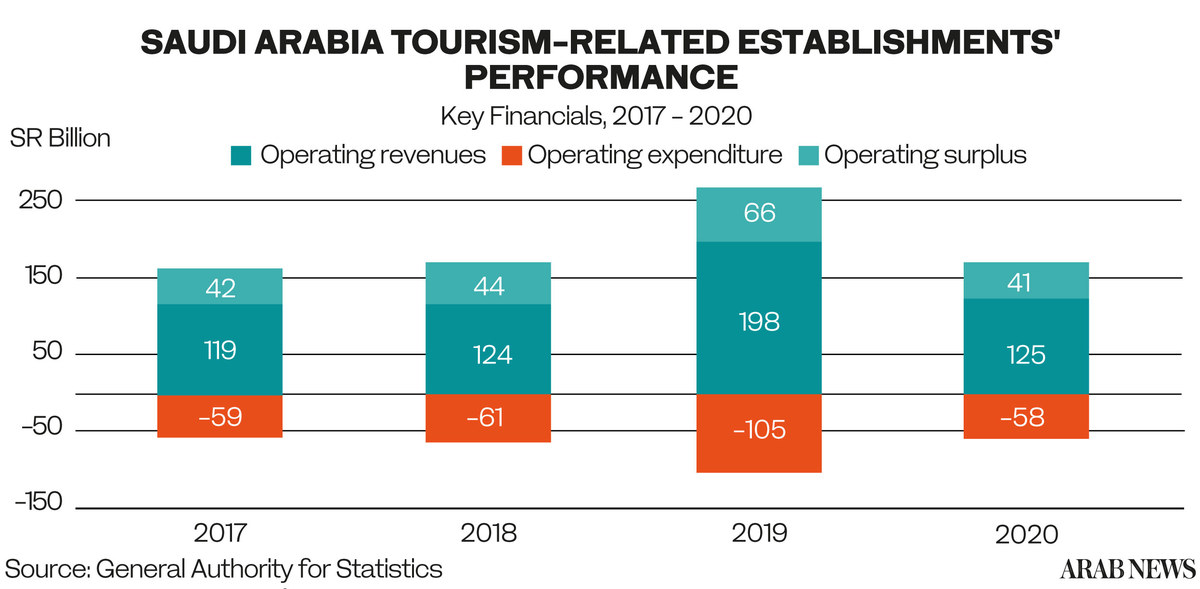

Over the same period, the total operating revenues of tourism-related establishments at a basic price fell 37 percent to SR124.9 billion.

Operating revenues in the services related to passenger air transportation declined almost 60 percent, and those for visitor accommodation fell 51 percent.

The food and beverage catering activities were hit relatively less hard — a decline of 20.4 percent compared to 2019.

It's worth mentioning 2019 saw a surge in total operating revenues of the tourism-related establishments which grew to SR197.9 billion from SR124.1 billion in 2018, according to previous GASTAT reports.