DAVOS: Aramco, the Saudi Arabian oil giant, could swallow BP and Shell and buy both of them, CEO and Founder of Brand Finance David Haigh said at the World Economic Forum’s annual meeting.

“In the last few years, Aramco has really been ramping up its marketing globally. You see it everywhere, sponsorship, advertising, all sorts of government relations,” Haigh told Arab News at the HCL Pavilion on Davos’s promenade. “So Aramco has awareness and (its) reputation is growing very fast.”

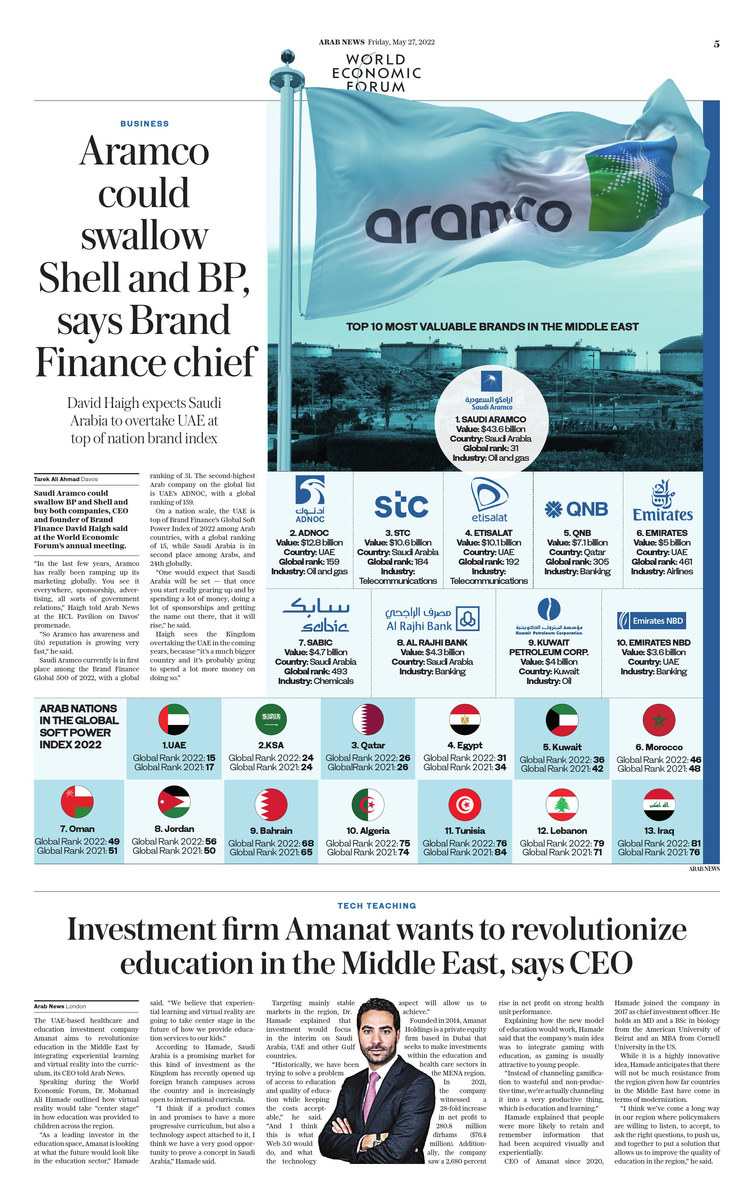

Saudi Aramco currently is in first place among the Brand Finance Global 500 of 2022, with a global ranking of 31. The second-highest Arab company on the global list is UAE’s ADNOC, at a global ranking of 159.

On a nation scale, the UAE is top of Brand Finance’s Global Soft Power Index of 2022 among Arab countries, with a global ranking of 15, while Saudi Arabia is in second place among Arabs, and 24th globally.

“One would expect that Saudi Arabia will be set that once you start really gearing up and by spending a lot of money, doing a lot of sponsorships and getting the name out there, that it will rise,” he said.

Haigh sees the Kingdom overtaking the UAE in the coming years, because “it’s a much bigger country and it’s probably going to spend a lot more money on doing so.”