RIYADH: Saudi Arabia’s micro, small and medium enterprises continue to grow in 2022 on the back of strong consumer demand, as is evident from the steady increase in MSME lending by the country’s banks and financial companies.

Last month alone, investment deals worth $13.8 billion were signed at the Global Entrepreneurship Congress held in Riyadh, which also saw global firms announce expansion plans into Saudi Arabia.

Read More: Kafalah Fund signs 10 agreements, MoUs worth $1.67bn to finance SMEs

The lending boom this year follows a similar trend last year.

Saudi Arabia is ranked second in MENA in startup funding activities, providing SR2 billion ($533 million) to entrepreneurs in 2021, Abdulaziz Al-Nashwan, general manager of equity at Monsha’at, told Arab News last month on the sidelines of the Global Entrepreneurship Congress.

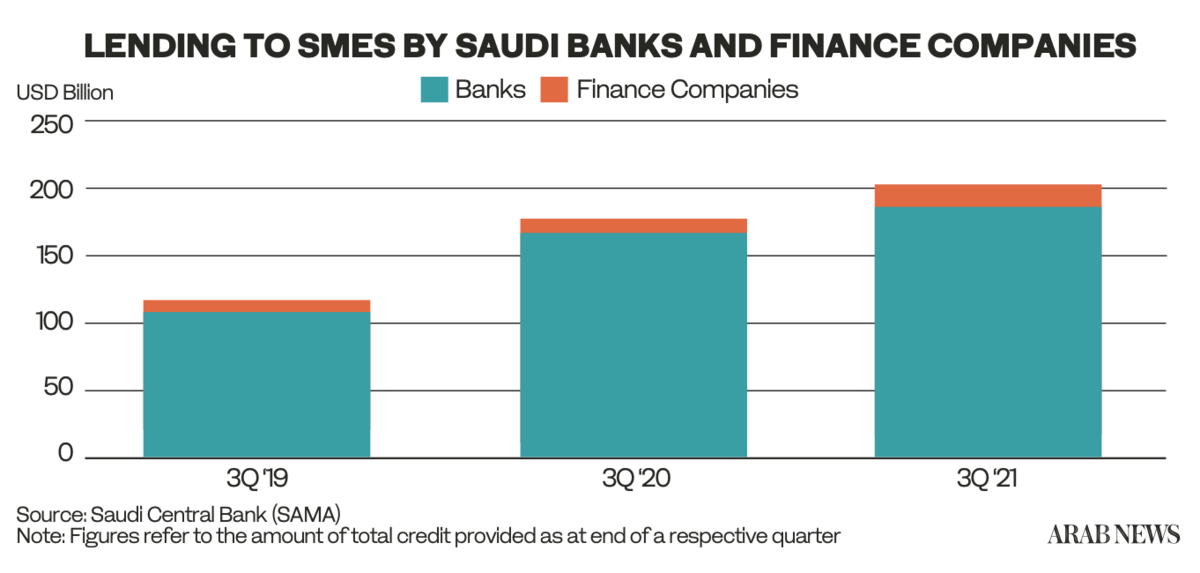

Saudi banks and finance companies have been on a lending spree over the last few years, with both collectively extending loans worth SR200.3 billion ($53.4 billion) to the MSME sector in the third quarter of 2021, up from SR175.7 billion in the third quarter of 2020, the latest Saudi Central Bank, or SAMA, data revealed. This is a 14-percent increase on a year-on-year basis.

This included SR14.2 billion credit provided by financial companies to MSMEs in the third quarter of 2021. This came as an increase from around SR10.75 billion in the third quarter of 2020, recording 31-percent growth on a year-on-year basis. This amounts to almost 22 percent of finance companies’ total credit facilities.

Recent surges in MSME credit indicate that the country’s business environment is improving despite COVID-infused challenges as the financial sector sees a strong capital liquidity value in lending to the Kingdom’s MSME sector.

SAMA statistics indicated credit facilities provided by local commercial banks to MSMEs also grew to SR186.2 billion in the third quarter of 2021 from SR165 billion in the same period the previous year, recording a 12.9-percent increase. This value equates to roughly 7.9 percent of the banks’ total credit facilities. It comes on the back of credit facilities by banks to MSMEs spanning over three years from 2018 through 2020 increasing by a noticeable 69 percent.

Read More: Saudi Arabia doles out $533m on startups in 2021, says Monsha’at official

This indicates a steady expansion of monetary loans to MSMEs, providing a promising future to the sector, with loans from finance companies increasing by 53.2 percent over the same duration.

With consumer spending continuing to increase in Saudi Arabia, this is creating a pent-up demand for goods and services provided by the country’s MSME sector. This, in turn, is pushing companies to go for further lending to meet the growing demand in the market.

This steady growth in MSME lending has been witnessed despite the Saudi Central Bank recently increasing the interest rates to tackle inflation. This event could be seen as a positive indicator of how the Kingdom’s financial sector can look for promising short-term revenues. This, in return, could aggrandize loans to MSME in the future as the economy and money market stabilize.