ISLAMABAD: When Kashaf Alvi became the first deaf Pakistani to receive Microsoft’s certified associate badge last year, it was just the beginning of the teenager’s rise to fame.

The 18-year-old has since published a book — likely becoming the youngest deaf person to do so — and last week received the Pride of Pakistan award, an accolade from the country’s powerful military that recognizes outstanding individuals.

But despite the recognition at home, Alvi, whose dream is to become a computer game developer, will have to study abroad as Pakistani universities are not equipped to accommodate courses in sign language.

“I want to study computer sciences and information technology which is not possible in Pakistan,” Alvi said in an interview with Arab News, communicating with the help of his father, Nadim Salim. “Special education institutions offer very limited courses in science and were not offering mathematics as a subject, as they didn’t have mathematics in sign language.”

Kashaf Alvi at the “Pride of Pakistan” awards ceremony in Islamabad, Pakistan, on March 23, 2022. (Photo courtesy: Nadim Salim)

Alvi is now preparing for his English language exam and will then apply to study in Sweden.

The National Special Education Center for Hearing Impaired Children in Islamabad, where Alvi lives, offers science courses.

“We are affiliated with Punjab University, Lahore, and if there are substantial students in any subject then the university permits us to offer that subject,” the center’s director, Khalid Ranjha, told Arab News.

But he added that there were no teaching materials for specialized science subjects — and the problem was not just in offering them.

According to Zaigham Rizvi, chairman of the Sir Syed Deaf Association, the main obstacle in facilitating deaf students was a lack of scientific terminology in Pakistan Sign Language.

“We are trying to get it from Gallaudet University in the USA,” he added. “They have prepared all these signs in medicine, mathematics, and other sciences.”

Even when sign language — used by approximately 10 million hearing impaired Pakistani citizens — is finally supplemented with scientific terms, a lack of trained instructors would be the next obstacle.

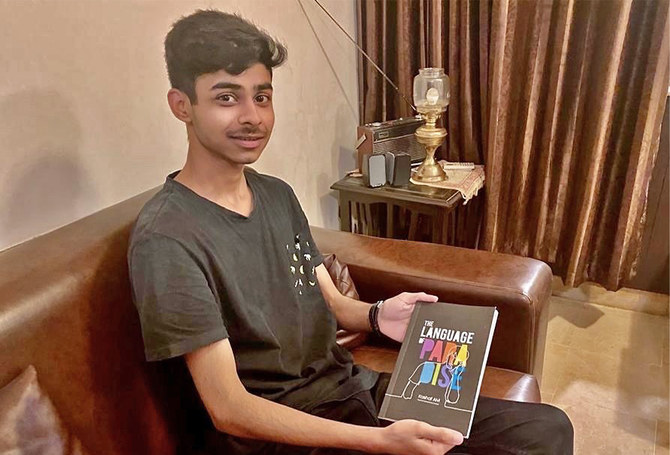

Alvi has written about the challenges he has faced as a deaf person in his book, “The Language of Paradise,” which was published by Liberty Books and launched by the wife of the Pakistani president, Samina Alvi, last December.

“The major problem faced by hearing impaired people is a lack of awareness about sign language,” he said. “Even instructors in special education institutions did not have command of it.”

“The book contained my experiences about life, achievements, challenges, and feelings. I wanted to share it with the world to motivate other people like me to come forward and work hard to achieve their goals.”

Kashaf Alvi presents his book to Samina Alvi, the wife of Pakistani President Arif Alvi, in Islamabad, Pakistan, on December 19, 2021. (Photo courtesy: Nadim Salim)

Alvi’s current goals, besides higher education, are to support the deaf community.

“I am working to develop a mobile application for hearing and speech impaired people to contact emergency services as there is no such thing,” he said. “I am also making a video to interpret the constitution of Pakistan into sign language to help my community. First, I will convert sections related to persons with disabilities.”