MOSCOW: Despite the ongoing conflict, Russian gas transit via Ukraine to the EU remained largely unaffected — just 6 percent off the 2021 levels.

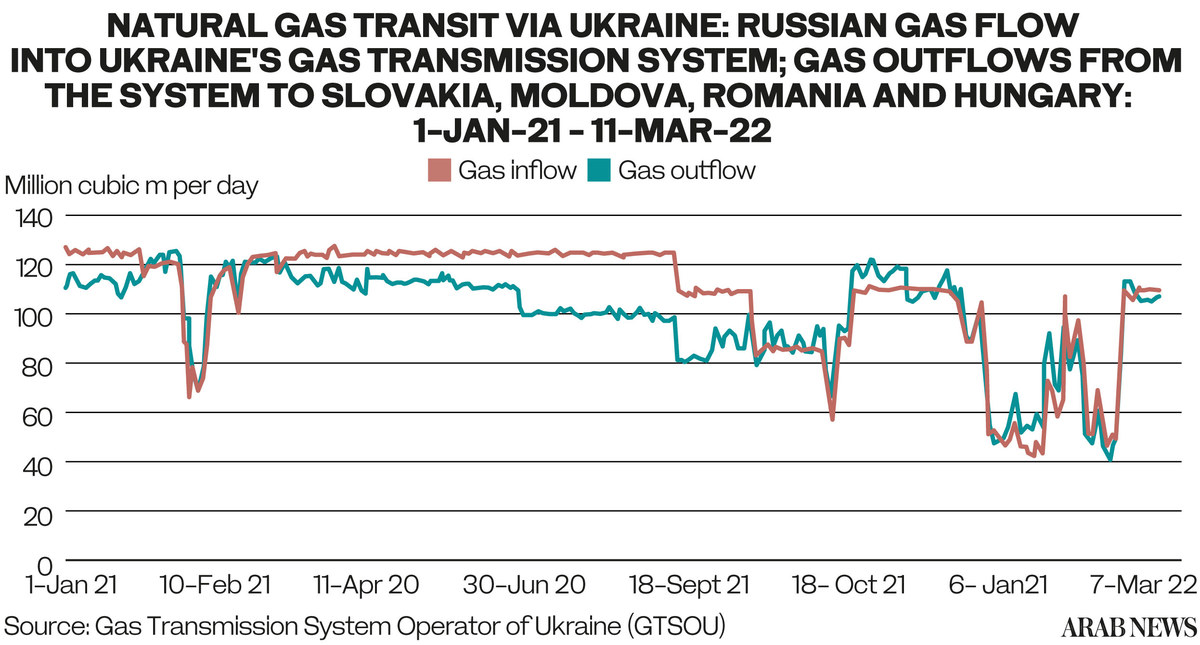

The Russian natural gas flows into Ukraine’s gas transmission system remained steady at a daily average 107.4 million cubic meter from Feb. 24 through March 11, data posted on the website of Ukraine’s Gas Transmission System Operator, also known as GTSOU, showed.

Since Feb. 24, when fighting between the Russian and Ukrainian forces began, the average daily inflows of Russian gas jumped 80 percent.

It is interesting to note that the supply of Russian gas into Ukraine’s gas system during the first two months of 2022 had fallen to 59.7 million cm, or 48 percent below the average flows in 2021.

In 2021, the average daily flows of Russian gas to Ukraine’s gas system were 114.1 million cm.

As for Russian gas transit figures, from Feb. 24 through March 11, average daily outflows from Ukraine’s gas transmission into EU and Moldova totaled 106.2 million cm, 177 percent more as compared to the period between Jan.1 and Feb. 23, 2022.

HIGHLIGHTS

Slovakia — via a cross-border point at Uzhgorod — 81.0 million cm

Moldova 18.4 million cm

Romania 4.9 million cm

Hungary 1.85 million cm

The pipeline capacity booked for transit of Russian gas for the next two days — March 12 and March 13 — are little changed from the past few days, GTSOU data showed.

Russia’s Gazprom ships part of its gas supplies to Europe via Ukraine based on a “ship-or-pay” transit deal that provides for Gazprom’s obligation to ship 40 billion cm of natural gas per annum via Ukraine.