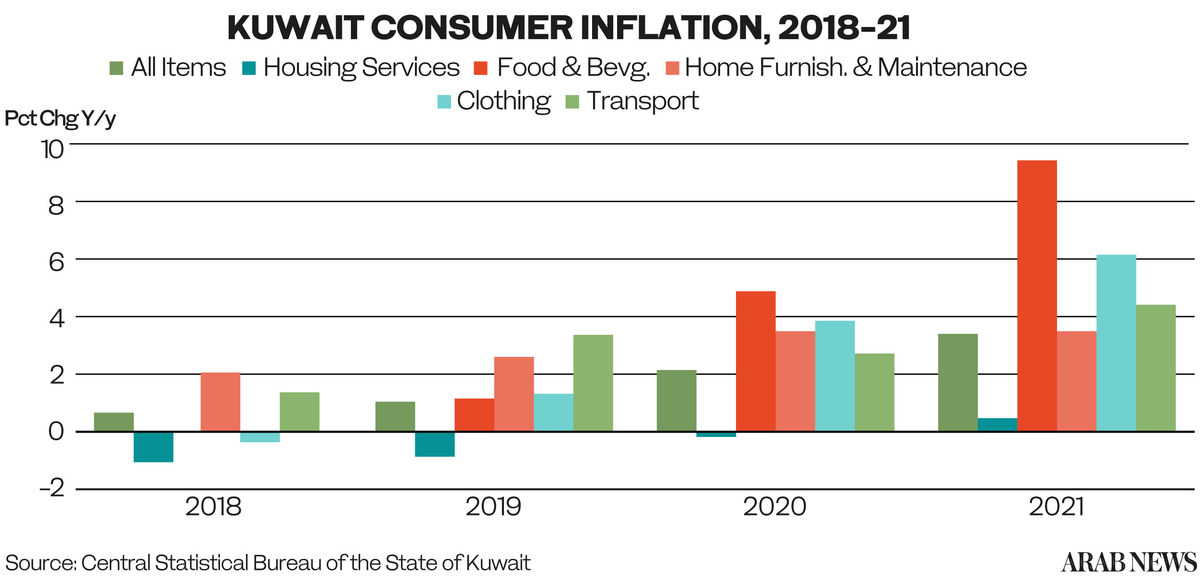

Food and beverage price rises helped increase Kuwait’s consumer inflation to 3.43 percent in 2021, according to official statistics.

The figure stood at 2.1 percent in 2020, the latest monthly report from the country’s Central Statistical Bureau showed.

Food and beverage prices rose from 4.9 percent in 2020 to 9.5 percent in 2021, while growth in prices for housing services turned to 0.5 percent from minus 0.2 percent over the same period.

Housing services have the highest weighting in the general index — 33 percent.

Another two groups of consumer consumption also contributed to the rise in the headline figure. Growth in clothing prices accelerated to 6.1 percent year-on-year in 2021 from 3.8 percent in 2020, while transport costs quickened to 4.4 percent from 2.8 percent.

Consumer inflation rose in December 2021 to 4.3 percent year-on year from 3.9 percent in November driven by a much faster growth in prices for housing services, which jumped to 2.4 percent from 0.8 percent in November.

Growth in food and beverages also quickened to 7.2 percent from 7 percent, respectively.

The National Bank of Kuwait is expecting consumer inflation in 2022 to remain mostly unchanged.

“Consumers in Kuwait are much more shielded than in many other countries due to price caps and controls in key areas such as fuel and energy,” the Bank said in a research note issued Feb. 21.

However, it pointed out that “one potential inflationary impulse could be housing rents.”

Any increase in this group of consumer consumption “could offset the expected deceleration in food price inflation leaving the average headline rate broadly unchanged from 2021 levels at 3.5 percent,” NBK analysts said in the note.