JEDDAH: The Red Sea Fund will support 26 Saudi films in a list of 90 carefully selected projects from the Arab World and Africa.

Following over 650 submissions, the fund on Tuesday announced its final selection of the much-anticipated projects, aiming to create a game-changing generation of filmmakers.

The grants will be given to 37 films in development, 33 live projects, and 28 films in post-production.

Of the projects to receive funding, 11 hail from Africa, 60 from the Arab region, and 26 from Saudi Arabia.

The exciting and unique selection includes 59 feature fictions, 18 feature documentaries, 10 short fictions, five feature animations, three episodic series, and two short animations.

The fund will also back 28 talented Saudi film directors, 54 percent of whom are female.

The Red Sea Film Festival Foundation established the fund in June to back 100 feature films, short projects, and episodics by directors from the Arab world and Africa.

The fund was supported earlier this year by the Saudi Film Commission to help a larger pool of talented filmmakers from the Kingdom and the Arab region bring their work from script to screen.

Three committees of industry professionals were formed for each section of the funding: Development, production, and post-production support.

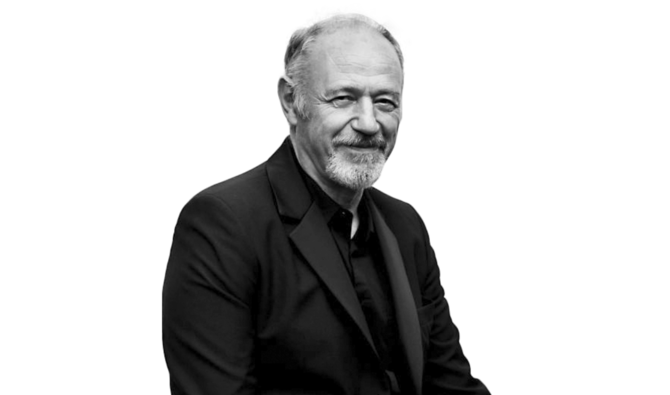

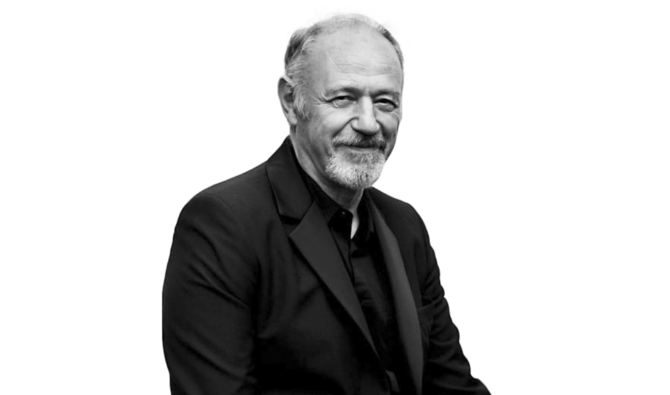

Edouard Waintrop, artistic director of the Red Sea International Film Festival and head of the committee awarding funds for post-production, said: “There is a wealth of undiscovered talent in Saudi Arabia and across the Arab world. As pioneers and believers in the importance of cinema and film in driving inspiration, creativity, and innovation, we are very proud to enable these brilliant artists to showcase their work by investing in their talents and empowering them to realize their dreams through the Red Sea Fund.

“These exceptional cinematic works will challenge people’s perceptions of traditional cinema and revive the film industry in KSA and the region.”

He continued: “We truly cannot wait to see these selections come to fruition and find their way to the big screen.”

Red Sea Fund announces support for 26 Saudi films

https://arab.news/vkrj9

Red Sea Fund announces support for 26 Saudi films

- In its first cycle, the fund carefully selected 90 ‘game-changing’ films from over 650 submissions

‘Stability can’t be bought’: Saudi ministers extol benefits of long-term reform in a fragmented world

- They outline during discussion at the World Economic Forum in Davos the ways in which the Kingdom is capitalizing on stability as a competitive advantage

- They highlight in particular the use of predictable policymaking, disciplined public finances, and long-term planning under Saudi Vision 2030

DAVOS: Stability is the crucial ingredient for long-term economic growth, especially in an increasingly fragmented global economy, Saudi ministers said on Thursday at the World Economic Forum in Davos.

It is not something that can be purchased or improvised, said Faisal Alibrahim, the minister of economy and planning, it must be developed patiently.

“You have to build it, accumulate it over time, for it to be the right kind of stability,” he said. “We treat it as a discipline,”

Speaking during a panel discussion on the Saudi economy, Alibrahim and Finance Minister Mohammed Al-Jadaan outlined the ways in which the Kingdom has sought to capitalize on stability as a competitive advantage.

They highlighted in particular the use of predictable policymaking, disciplined public finances, and long-term planning under the Kingdom’s Vision 2030 plan for national development and diversification.

Al-Jadaan said governments and businesses alike are operating in a world where uncertainty has become the norm, which places a greater burden on policymakers to reduce ambiguity wherever possible.

“Businesses can price tariffs, they can price taxes,” he said. “What they find very difficult to price is ambiguity. We are trying to ensure that we build that resilience within our economy and give the private sector that predictability that they need.”

This focus on predictability, he added, has been central to Saudi Arabia’s economic transformation, by helping the private sector to plan for the long term while the government undertakes deep structural reform.

Alibrahim noted that trust has become a big factor in global trade and investment, particularly as geopolitical tensions and economic fragmentation intensify.

In a fragmenting world, one of the rarest things now is the idea that a “commitment made today will be honored tomorrow,” he said. Yet trust shapes how the world trades and how markets remain active, because it means participants can predict what will happen, he added. Stability therefore becomes a “rare currency, and even a competitive edge.”

He also said that reform on paper was not enough; it must be coupled with streamlined regulation and continuous engagement, so that businesses can develop long-term thinking and navigate uncertainty with more confidence.

Al-Jadaan framed Saudi Vision 2030 as a multiphase journey that began with structural reforms, followed by an execution-heavy phase, and is now entering a third stage focused on the maximization of impact.

He said the Kingdom was in a phase of “learning, reprioritizing and staying the course,” would make bold decisions, and had the “courage to continue through difficulties.” A key anchor of all this, he added, was discipline in relation to public finance.

“You cannot compromise public finance for the sake of growth,” Al-Jadaan said. “If you spend without restraint, you lose your anchor while the economy is still diversifying.”

This discipline underpins what he described as Saudi Arabia’s “deficit by design” — in other words, borrowing strategically to fund capital expenditure that supports long-term growth, rather than consumption.

“If you borrow to spend on growth-enhancing investment, you are safe,” he said. “If you borrow to consume today, you are leaving the burden to your children.”

Alibrahim said the focus in the next phase of Vision 2030 will be on the optimal deployment of capital, ensuring the momentum continues while costs are tightly managed.

Looking ahead, both ministers emphasized the importance of long-term planning, which can be a challenge for some countries constrained by short election cycles.

“If you cannot take a long-term view in a turbulent world, it becomes very difficult,” Al-Jadaan said.

“Success stories like Singapore, South Korea and China were built on decades-long plans, pursued through good times and bad.”

The ministers’ discussion points were echoed by international participants. Noubar Afeyan, founder and CEO of life sciences venture capital firm Flagship Pioneering, said that by utilizing technology, including artificial intelligence, alongside a strategic vision in the form of Vision 2030, the Kingdom had been able to turn vulnerabilities into strengths, becoming not only self-sufficient but a potential exporter of innovation and intellectual property.

“Uncertainty opens up opportunities for countries that might otherwise be overlooked,” he added.

“Saudi Arabia, with Vision 2030, is positioning itself to not only address its own challenges but also become a net exporter of innovation and expertise.”

Ajay Banga, the president of the World Bank, said Vision 2030 had helped create “physical and human infrastructure” that allows Saudi Arabia to capitalize on its demographic dividend.

Jennifer Johnson, CEO of investment management firm Franklin Templeton, said Saudi policymakers stood out for their openness and curiosity.

“I have spoken to Saudi ministers and they ask what they need to do — that doesn’t happen often,” she said.