The total value of point-of-sale transactions fell by SR980 million ( $260 million) to SR39.9 billion ($10 billion) in September, after it recorded an all-time high of SR41 billion ($10.9 billion) in August.

However, the number of transactions increased to 468.9 million in September from 465.8 million in August.

Mobile phone led transactions grew for the fifth consecutive month to SR175.7 million ($46.8 million) in September compared to SR116.9 million (31.14 million) in April 2021, posting a month-on-month growth of three percent.

The number of card transactions eased slightly by less than 1 percent from August when SR273 million ($72 million) transactions, the highest on record since January 2019, were posted.

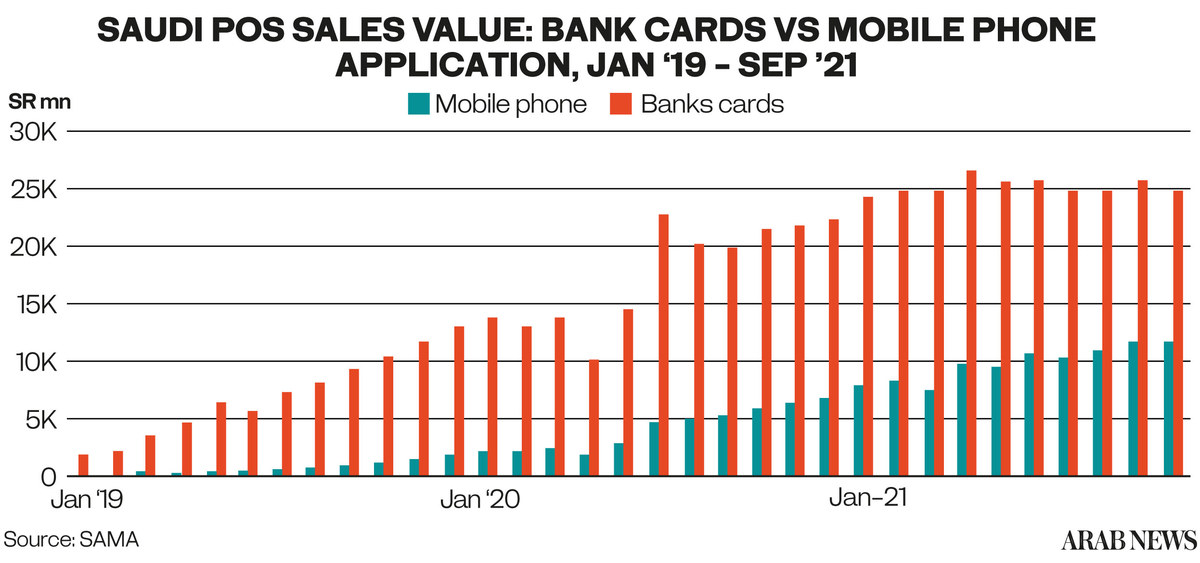

In terms of year-to-date changes, mobile-phone transactions grew by 67 percent compared to 19 percent for card transactions.

In value terms, mobile-phone transactions recorded a year-to-date growth of 40 percent to SR11.8 billion($3.1 billion) compared to 3 percent growth for card transactions SR25 billion ($ 6.6 billion ) over the same period.

E-Commerce transactions using Mada cards have evidenced the highest numbers on record in terms of transactions count and value, having reached SR31.7 million ($ 8.4 million ) and SR7 billion($ 1.8 billion), respectively.