MOSCOW: Rising energy prices pose significant risks of inflation in many emerging markets and developing countries, World Bank warned on Monday.

In its semi-annual report “Commodity Markets Outlook,” the bank said the ongoing energy crunch is likely to weigh on the growth of energy-importing countries in 2022.

Energy prices are expected to increase more than 2 percent in 2022 after jumping more than 80 percent in 2021, supported by continued robust demand and gradual production gains.

The bank has raised its forecast for average oil prices to $74/bbl in 2022 from $70/bbl in 2021 projected previously in April. Natural gas and coal prices are expected to decline only slightly in 2022 to $4/mmbtu and $3.9/mmbtu from $4.1/mmbtu in 2021, as demand growth eases and production and exports increase, driven by the US.

Prices of non-energy commodities like metals and wheat are also projected to remain at elevated levels. After rising more than 48 percent this year, metal prices are projected to decline 5 percent in 2022. Prices for US hard red wheat are projected to decrease to $250 per metric ton and $245 per metric ton in 2022 and 2023 respectively from $255/mt in 2021.

The rally in energy prices has sharply increased agricultural input costs. This includes fertilizers, which have risen more than 55 percent since January this year, with several fertilizer manufacturers halting or reducing production capacity. Elevated food prices combined with the recent spike in energy costs is pushing food price inflation up in several low-income countries such as Ethiopia, Zambia, and Zimbabwe as well as higher-income economies including Argentina and Turkey, the report pointed out.

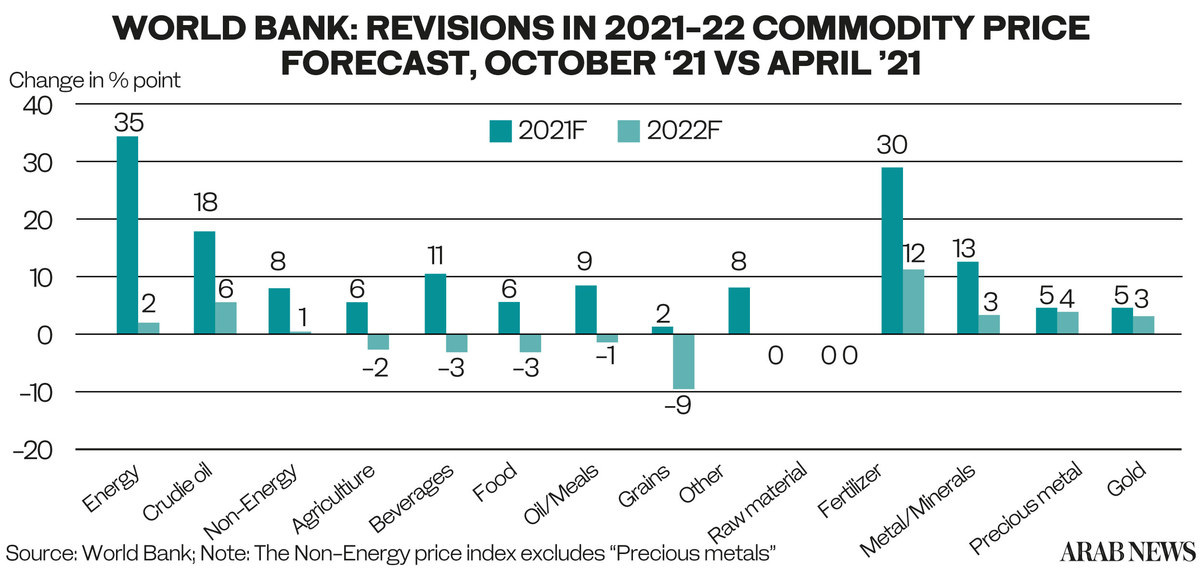

The report provided its 2022 price forecast for energy and non-energy commodity groups revised from its previous estimate published in April this year. The most notable revisions include fertilizers (+11.8 percentage points), precious metals (+4.1 ppts), metals and minerals (+3.4 ppts), grains (-9.2 ppts), beverages (-2.7 ppts).