LONDON: The Organization of the Petroleum-Exporting Countries has warned a lack of investment in new oil and gas supplies could lead to tighter supplies and price rises which could derail the fledgling post-pandemic global recovery.

The warning, published in the World Oil Outlook 2021 report released this afternoon, comes amid a sharp rebound in global demand for energy that has already led to a supply crunch and a surge in prices.

The report said the shift toward cleaner fuels and the impact of the COVID-19 pandemic has seen oil and gas investment fall around 30 percent last year.

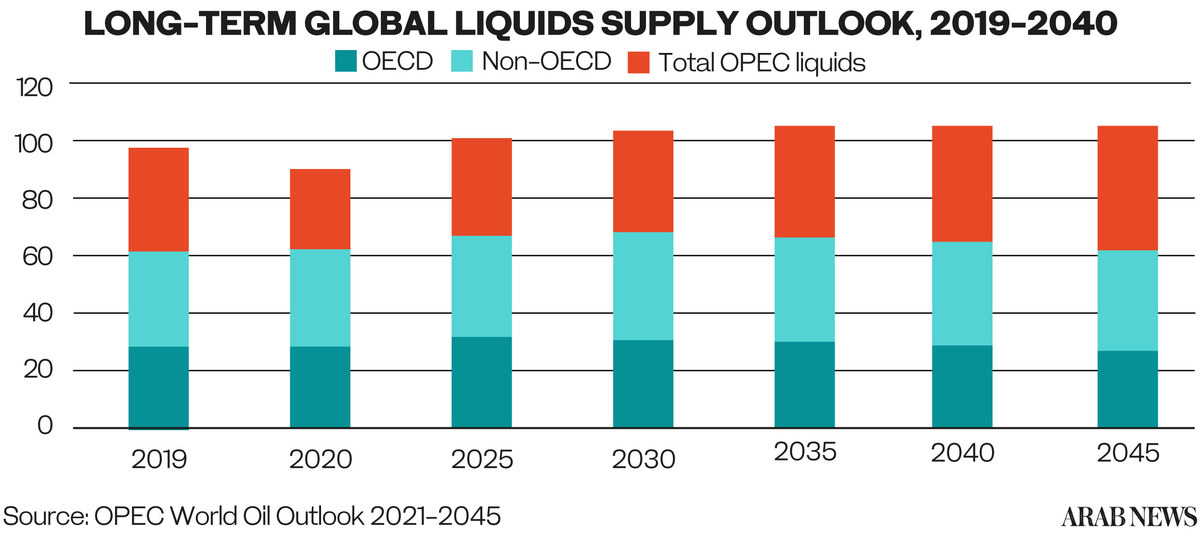

"Cumulative investment requirements in the oil sector amount to $11.8 trillion in 2021–2045. Of this, 80% or $9.2 trillion, is directed towards the upstream, the bulk of which is in North America, as US tight oil, in particular, drives medium-term non-OPEC supply growth," OPEC said.

OPEC warned that without necessary investment the potential for further volatility and a future energy shortfall would hang over the global recovery.

Gas prices in Europe and Asia are at or near record highs, while those in the United States are at seven-year peaks. Coal prices are at record levels and Brent breached $80 per barrel, its highest level in three years.

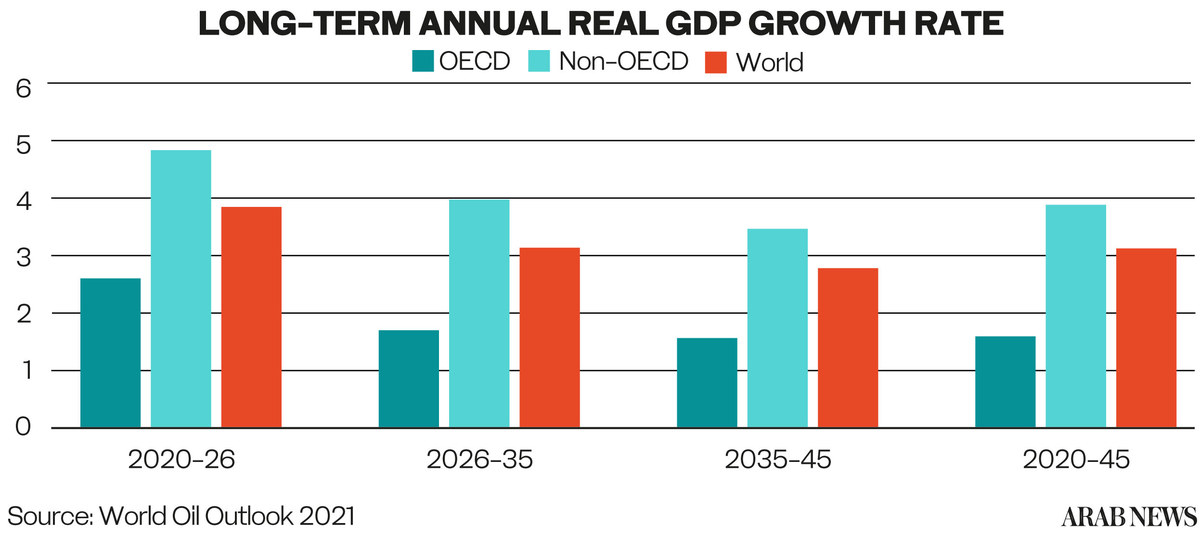

While the report was relatively bullish about the wider post pandemic economic recovery, it warned the risk for oil demand over the medium-term is “skewed to the downside”, and added “worries persist about the pace and trajectory of this recovery”.

The report cited concerns about the spread of COVID-19 variants, inflationary pressures, and the ability of central banks to unwind the massive quantitative easing programmes that continue to underpin the current rebound.

OPEC forecast world oil demand will rise to reach a level similar to before the pandemic at 104.4 mb/d by 2026.

However, it added that almost 80% of this incremental demand will materialize within the first three years (2021–2023), primarily as part of the recovery process from the COVID-19 crisis.

OECD oil demand is expected to rise by almost 4 mb/d in the period to 2026, but OPEC added that this increase will not be sufficient to return to pre-COVID-19 demand levels.

Non-OECD demand, driven by increasing populations and growing economies in Asia, Africa and the Middle East, is expected to rise by almost 10 mb/d over the medium-term.

China and Japan and the wider Asia-Pacific region, which is largely supplied by the Middle East, will see an increase in imports from around 23.5 mb/d in 2019 prior to the pandemic, to almost 30 mb/d by 2045.

Middle East exports to the region are forecast to increase to above 19.5 mb/d by 2045, around 4.8 mb/d higher than levels in 2019.

Overall, OPEC forecast world energy demand will increase by 28% between 2020 and 2045, driven by an expected doubling in size of the global economy and population expansion.

The report said all energies would see growth except for coal.

Renewables is forecast to enjoy the largest growth, followed by gas, but oil is expected to retain its number one position in the energy mix.

On the eve of COP26, which takes place in Glasgow in the United Kingdom four weeks, OPEC warned that tackling climate change should not increase energy poverty in developing countries.

The report said that amid the wider greening of the global economy, the UN’s Sustainable Development Goals have committed to ensuring access to affordable, reliable, sustainable and modern energy for everyone - a clear reference to the continuing role of oil and gas in the transition to cleaner energy.

The International Energy Agency (IEA) has called on investors to stop funding new fossil fuel projects to reach net zero emissions by mid-century. However, even the IEA’s sustainable development scenario states that oil and gas will account for 46% of the global energy mix in 2040.