MOSCOW: The global natural gas market is tightening with demand recovering this year as many countries led by China are seeing their economic life rebound following the pandemic.

The global liquefied natural gas (LNG) demand growth this year has been driven primarily by China, Francisco Blanch, commodity and derivatives strategist at the Bank of America Securities said in a note issued on Aug. 12.

China’s economic recovery led to an 18 percent year-on-year jump in thermal generation through the first half of 2021, which in turn, resulted in LNG year-to-date imports volumes rising nearly 30 percent year-on-year to 8.6 million tons. China is on pace in 2021 to overtake Japan as the world’s largest importer, Blanch said.

Another important factor driving gas prices up in both Europe and Asia in recent weeks is an increasingly low level of gas inventories in Europe, which fell to 16 billion cubic meters (bcm) or 20 percent below the five-year average. This is partly because “Russia has declined to export additional volumes to Europe as it hopes to push Nord Stream 2 over the finish line,” according to Blanch.

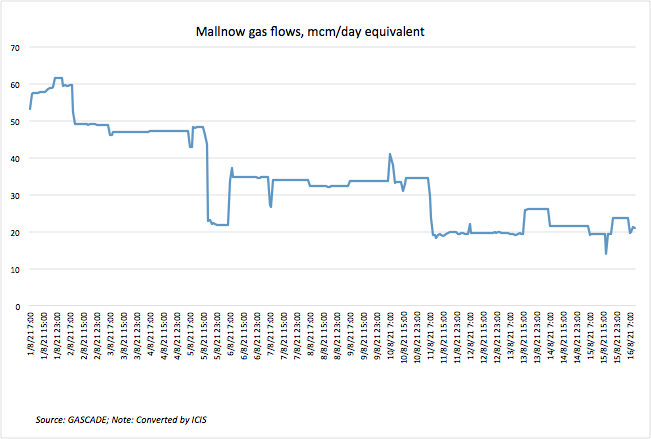

Gas flows via the Mallnow compressor station at the German border which handles predominantly Russian gas for transport to the west of the country remained low on Aug. 16, at around 20 million cubic meters per day, much reduced from the start of the month, Alex Froley, a LNG analyst at a London-based energy market information provider ICIS said in a comment posted on LinkedIn on Aug. 16.

Concerns over Russian gas availability increased recently after a fire at a production plant in Russia’s Yamal peninsula. Russian gas is transported to western Europe via several pipeline routes, including the Yamal-Europe line through Poland and into Germany’s GASCADE network at Mallnow. Flows at Mallnow, in particular, seem to have reduced over August, Froley said.

Data from German grid operator GASCADE shows flows of Russian gas into Germany at the Mallnow border point have dropped from 60 million cubic meters a day at the start of August to around 20 million cubic meters a day as of mid-August.