RIYADH: Saudi Arabia will lead increases in oil and gas production globally through 2030 as international energy majors remain wary of fluctuating demand and focus on short-term profit, according to Fitch Ratings.

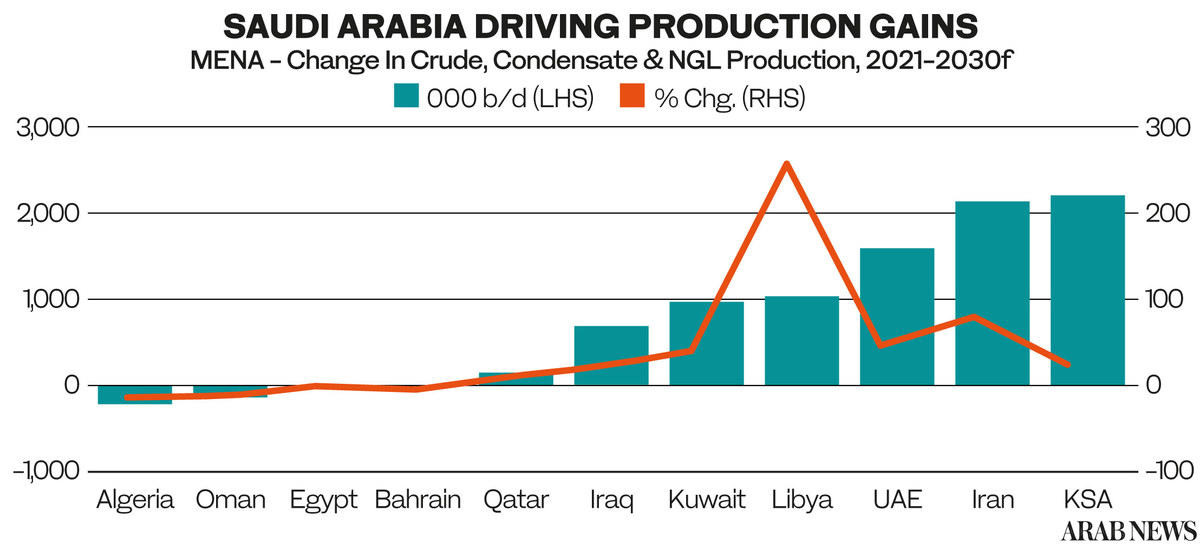

The Kingdom will increase production of crude oil, condensate and natural gas liquids by 2.24 million barrels a day between 2021 and 2030, ahead of Iran’s 2.17 million barrels the UAE’s 1.61 million, Libya’s 1.04 million and Kuwait’s 966,000 barrels, Fitch wrote in its Oil & Gas Global Capex Outlook.

Iraq is also expected to see a considerable gain, of 691,000 barrels, while Qatar’s will be more modest, at 127,000 barrels. Bahrain and Oman will both see a contraction in output.

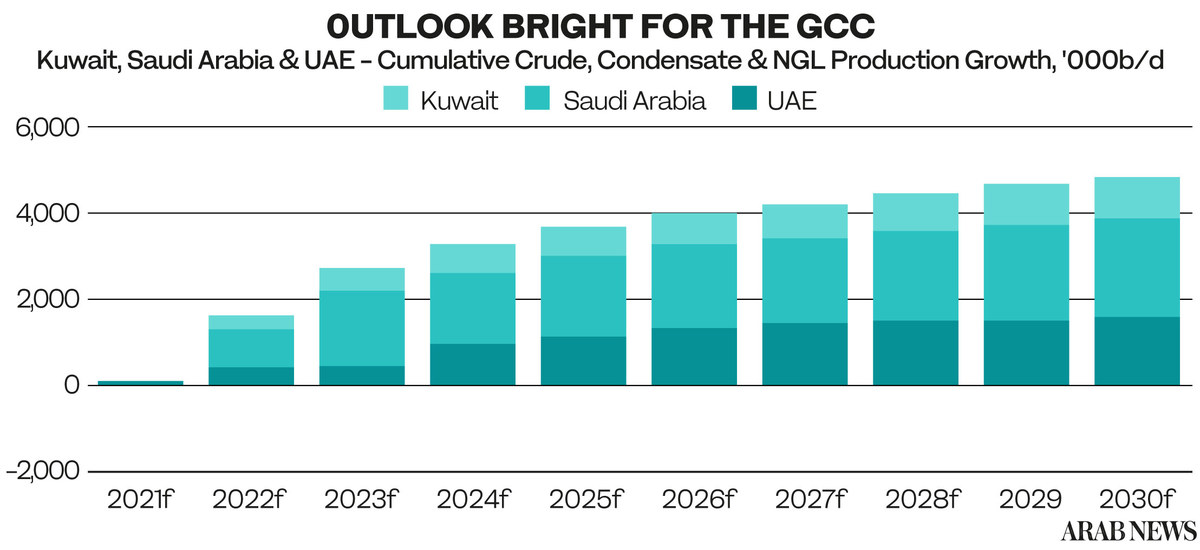

The bulk of Libya, Iran and Iraq’s output gains are “due to the recovery of barrels temporarily shut-in due to domestic instability (Libya) or international sanctions (Iran), or as a result of the unwinding of the OPEC+ production cut agreement (Iraq),” Fitch analysts wrote in the report. “The only markets in which we forecast substantial gains above pre-pandemic levels are Saudi Arabia, the UAE and Kuwait.”

Such was the size of last year’s oil market crash when global oil and gas capex slumped 25.9 percent to $423 billion, investment will not return to 2019 levels until 2025, Fitch said. This year will see 12.8 percent growth to $477 billion, followed by a similar-sized increase in 2022, to $505 billion.

Investment by international oil companies will contract 3.6 percent this year, to $79.35 billion before rebounding 12.6 percent in 2022 to $89.34 billion, Fitch predicts.

“Middle Eastern NOCs, at least those in the GCC, are very well placed to exploit current market conditions,” Emma Richards, a senior oil and gas analyst at Fitch told Arab News. “Because of the nature of the resource base, they can compete on the basis of both cost and carbon intensity and they’re not coming under the same regulatory pressures as companies in Europe and North America.”

“As we see greater restrictions on supply coming into force in those markets, there will be a sizeable gap for the Middle East to fill,” Richards said.

The report also looked at the energy transition with a focus on the emerging hydrogen-production industry.

While low-carbon investment by the Middle East’s national oil companies is likely to take only a negligible share of capex for the coming years, Saudi Arabia and the UAE have the opportunity to gain a first-mover advantage in the markets for clean hydrogen and ammonia, Fitch said.

Saudi Arabia ranks 8th and the UAE 7th in Fitch’s blue hydrogen index, which assesses the suitability of a given market for the development of a blue hydrogen industry.

Blue hydrogen is created from natural gas through traditional methods but the carbon is captured, while green hydrogen is produced through electrolysis of water. Hydrogen is converted to ammonia for long-distance transport before being turned back into hydrogen.

“We expect hydrogen to be a big growth market in the GCC,” Richards said. “They have a strong resource endowment, so are well-placed to 1ompete with others once the market matures.”

Saudi Arabia has been a first mover in the hydrogen and ammonia markets. Saudi Aramco partnered with SABIC on the world’s first shipment of blue ammonia to Japan in September last year.

“Over the longer run, green hydrogen is likely to dominate, but I don’t think the near-term cost advantages of blue hydrogen should be underplayed,” said Richards. It depends on the market, but where natural gas is cheap and abundant, blue hydrogen makes a lot of sense.”