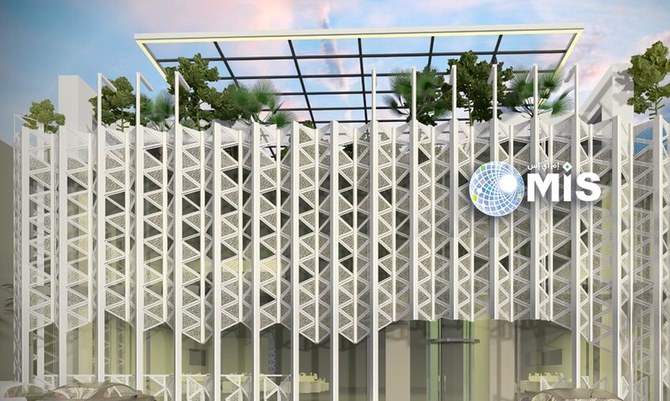

DUBAI: Al Moammar Information Systems Co. (MIS) expects the development of its recently announced data fund to start within six months, vice chairman Ibrahim Al-Moammar told Argaam.

MIS and Saudi Fransi Capital (SFC) are planning to study the possibility of offering the fund to the public at a later stage, if it is value-accretive to shareholders, after obtaining the necessary approvals, the financial news website reported.

The fund is part of a broader push by the Kingdom to become a regional hub of global data centers, cloud computing services providers, application services providers, and electronic games firms, Al-Moammar said.

Al-Moammar expects the company to record strong returns from the management and operations of these centers underpinning its profitability.

MIS expects to start Saudi data center fund development in six months, possible IPO later: Argaam

https://arab.news/nxb9f

MIS expects to start Saudi data center fund development in six months, possible IPO later: Argaam

- Al-Moammar expects the company to record strong returns from the management and operations of these centers underpinning its profitability

Closing Bell: Saudi main index rises to close at 11,251

RIYADH: Saudi Arabia’s Tadawul All Share Index rose on Thursday, gaining 84.27 points, or 0.75 percent, to close at 11,251.81.

The total trading turnover of the benchmark index was SR5.38 billion ($1.43 billion), as 188 of the stocks advanced and 67 retreated.

Similarly, the Kingdom’s parallel market Nomu gained 157.22 points, or 0.67 percent, to close at 23,643.74. This comes as 44 of the stocks advanced while 32 retreated.

The MSCI Tadawul Index gained 10.88 points, or 0.72 percent, to close at 1,517.43.

The best-performing stock of the day was Saudi Kayan Petrochemical Co., whose share price surged 9.96 percent to SR5.30.

Other top performers included Ataa Educational Co., whose share price rose 9.94 percent to SR57.50, as well as Rabigh Refining and Petrochemical Co., whose share price surged 5.74 percent to SR7.55.

Saudia Dairy and Foodstuff Co. recorded the most significant drop, falling 5.93 percent to SR220.50.

Abdullah Saad Mohammed Abo Moati for Bookstores Co. also saw its stock prices fall 2.77 percent to SR43.56.

Zahrat Al Waha for Trading Co. also saw its stock prices decline 2.30 percent to SR2.55.

On the announcement front, Multi Business Group Co. reported its annual financial results for the year ended Dec. 31. According to a Tadawul statement, the firm recorded a net profit of SR352,172 during the year, down 98 percent from the previous year.

The company attributed the decline primarily to a 2 percent drop in building contracting revenues and a 73 percent decrease in gross profit.

Multi Business Group Co. ended the session at SR9.90, down 1 percent.

Hamad Mohammed Bin Saedan Real Estate Co. announced the signing of a memorandum of understanding with Saudi Awwal Bank to enhance collaboration in financing solutions, advance real estate development projects, and expand access to customer financing programs.

Hamad Mohammed Bin Saedan Real Estate Co. ended the session at SR6.67, up 1.21 percent.