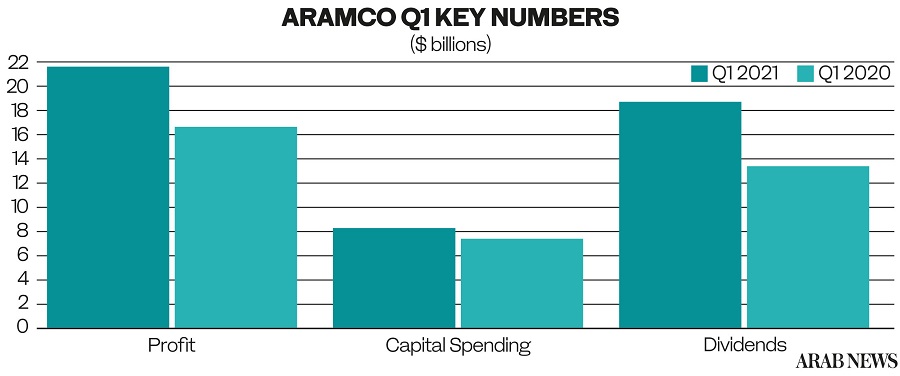

DUBAI: Saudi Aramco, the world’s biggest oil company, beat experts’ expectations with a profit of $21.7 billion in the first quarter of 2021 as the global energy outlook improved.

Net income in the first three months was 30 percent higher than last year, when the pandemic had just begin to impact world oil demand. The big jump in Aramco profits was also because of higher refining and chemicals margins.

Amin Nasser, president and chief executive of Aramco, said: “The momentum provided by the global economic recovery has strengthened energy markets, and Aramco’s operational flexibility, financial agility and the resilience of our employees have contributed to a strong first quarter performance.”

Aramco has again stuck to the pledge it made at the time of its record-breaking initial public offering in late 2019 by paying a big dividend — some $18.8 billion — for the quarter. “For our customers we remain a supplier of choice, and for our shareholders we continue to deliver an exceptional quarterly dividend,” Nasser added.

The dividend payment is nearly covered by free cash flow of $18.3 billion in the quarter, while Aramco’s gearing ratio — a measure of its indebtedness compared to its assets — was unchanged at 23 percent.

Capital expenditure, which most oil companies have cut back dramatically during the pandemic recession, came to $8.2 billion in the first three months of the year.

Nasser was positive on the outlook for global oil demand as the world economy recovers from the ravages of the pandemic recession.

“Given the positive signs for energy demand in 2021, there are more reasons to be optimistic that better days are coming. And while some headwinds still remain, we are well-positioned to meet the world’s growing energy needs as economies start to recover,” Nasser said.

The oil price has risen by more than a third since the start of the year, giving an immediate boost to Aramco revenues in the quarter, but this has to some extent been offset by big OPEC+ output cuts, backed up by additional voluntary reductions by Saudi Arabia.

Brent crude, the global benchmark for oil, had another good day on international markets, rising above the $68-a-barrel level.

There are more reasons to be optimistic that better days are coming. And while some headwinds still remain, we are well-positioned to meet the world’s growing energy needs as economies start to recover.

Amin Nasser, Aramco CEO

The company also took a big step toward the diversification of its revenue stream with a multibillion-dollar deal with international investors to securitize revenue from its pipeline operations, and Nasser hinted that there would be further such deals in the future. “We made further progress toward our strategic objectives during the quarter and our portfolio optimization program continues to identify value-creation opportunities, such as the recent announcement of our landmark $12.4 billion pipeline infrastructure deal,” he said.

He also sees opportunities for growth in the new Shareek initiative in the Kingdom, which seeks to encourage private-sector partnerships and investments.

Aramco shares — quoted on the Tadawul stock exchange — closed near the top end of their recent range at SR35.65 ($9.51). Some analysts had been expecting first quarter net income of about $19 billion. Oil expert Robin Mills, chief executive of Qamar Energy consultancy, told Arab News: “These are quite solid results, which beat estimates and with no big surprises. The free cash flow is almost covering the dividend and is likely to do so in the second quarter as volumes recover.”

Average total hydrocarbon production came to 11.5 million barrels per day of oil equivalent in the first quarter, including 8.6 million barrels per day of crude oil.

Aramco also announced that it had planted 500,000 trees in the first quarter, to hit its target of planting one million trees in an initiative to mitigate desertification, sequester carbon and enhance native biodiversity, along international environmental guidelines.