PARIS: They were little known before the pandemic, but startups in the flourishing digital payment industry are now worth a fortune as COVID-19 has forced people to increasingly embrace e-commerce.

Online shopping, contactless card readers and mobile payments are nothing new, but lockdowns and fears of contagion changed consumer behavior during the coronavirus crisis.

“2020 considerably accelerated the shift in consumer preferences to electronic payments and online shopping,” said Marc-Henri Desportes, deputy CEO of Worldline, a French payment and transactions processing firm.

A trio of startups — Stripe, SumUp and Pledg — have benefited from the shift.

Founded by two Irish brothers in 2011, Stripe catapulted to the forefront of the industry after its valuation soared to $95 billion in the past week, nearly tripling since last year.

However, it still has a long way to catch up to the likes of Mastercard, valued above $300 billion.

The California-based payments processing firm reached its new valuation after raising $600 million in funding from investors last weekend.

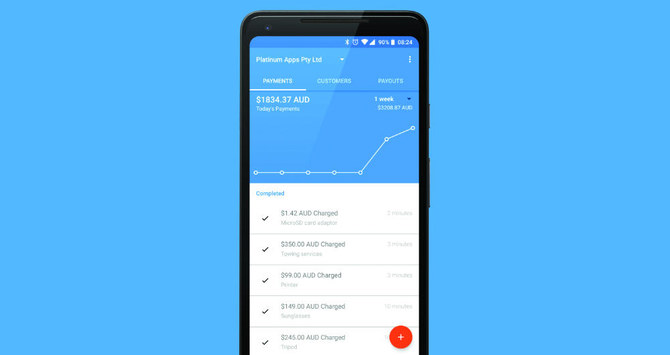

On Tuesday, the British startup SumUp, which provides card payment terminals and online services, raised €750 million in funding.

On the same day, the Paris-based startup Pledg, which specializes in installment payment services, raised €80 million.

“We’ve done in one year a transformation which would in normal times take three or five years,” said Desportes.

FASTFACTS

● The biggest names in the sector include US firms PayPal, Apple Pay and Visa, and China’s WeChat Pay and Alipay.

● Others on the rise include US firm Square and Dutch-based Adyen.

According a study by the consulting firm Accenture published last year, global payments revenue may rise by $500 billion over the coming years to hit $2 trillion in 2025.

The biggest names in the sector include US firms PayPal, Apple Pay and Visa, and China’s WeChat Pay and Alipay.

Others on the rise include US firm Square and Dutch-based Adyen.

Stripe’s “recent valuation is maybe a signal that the accelerating forces of COVID are going to actually make it a lot easier for fintechs to sort of become more successful with greater market share,” said Matt Palframan, director of financial services research at survey and data firm YouGov.

“The really interesting thing ... is to what extent do consumers go back to how they were living before COVID as we emerge from the crisis and to what extent some of this behavioral change is permanent,” he added.

That question is crucial for fintechs (finance technology companies) like Stripe, which helps online retailers with payments processing, said Palframan.