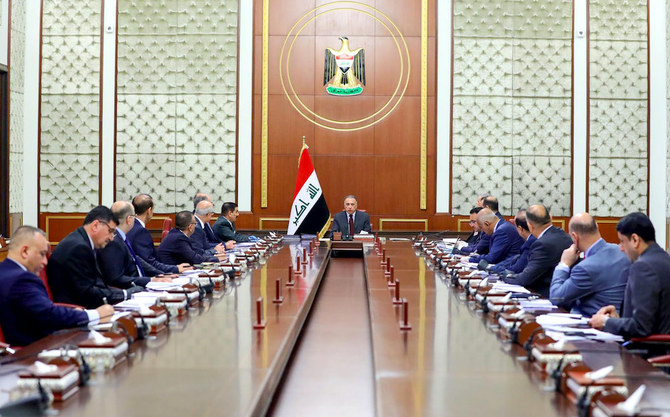

BAGHDAD: Iraq’s cabinet on Monday approved a 2021 draft budget of 150 trillion Iraqi dinars ($103 billion) as the country wrestles with an economic and financial crisis due to low crude prices.

The budget deficit would be estimated at 63 trillion dinars ($43 billion), two government sources said.

The draft 2021 budget is based on a world oil price of $42 a barrel and expected oil exports of 3.25 million barrels per day (bpd), including 250,000 bpd from the Kurdish region, the officials said.

But despite approval of the budget, which should be referred to parliament for final approval, disputes between the central government and semi-autonomous Kurdish region are still unresolved, a government senior economic adviser said.

“Differences between Baghdad and Kurdish delegates are still persisting over Kurdish oil exports and the region’s debts. It’s too complicated for now to reach an agreement,” said a senior government adviser.

Hit by squeezed revenues, Iraq’s central bank on Saturday increased the sale price of US dollars to banks and currency exchanges to 1,460 dinars, from 1,182 dinars, seeking to close the gap of widened 2021 budget inflation after a collapse in global oil prices, a major source of Iraq’s financial resources.

The finance ministry supplies the central bank with dollars based on a price of 1,450 dinars against the dollar, Central Bank chief Mustafa Ghalib said in a statement.

Iraq has the world’s fourth-largest oil reserves and depends on oil revenues to fund 95 percent of its national budget.

($1 = 1.45 Iraqi dinars)

Iraq’s cabinet approves 2021 draft $103 billion budget

https://arab.news/9erxu

Iraq’s cabinet approves 2021 draft $103 billion budget

- The budget deficit would be estimated at $43 billion

- The draft 2021 budget is based on a world oil price of $42 a barrel

US envoy calls for ceasefire deal in northeastern Syria to be maintained

- Tom Barrack, ambassador to Turkiye and special envoy for Syria, reiterates Washington’s support for Jan. 18 integration agreement between Syria’s government and Syrian Democratic Forces

LONDON: Tom Barrack, the US ambassador to Turkiye and special envoy for Syria, on Monday reiterated Washington’s desire to ensure the ceasefire agreement in northeastern Syria between Syria’s government and the Syrian Democratic Forces continues.

In a message posted on social media platform X, he wrote: “Productive phone call this evening with his excellency Masoud Barzani to discuss the situation in Syria and the importance of maintaining the ceasefire and ensuring humanitarian assistance to those in need, especially in Kobani.”

Barzani has been the leader of the Kurdistan Democratic Party since 1979, and served as president of Kurdistan region between 2005 and 2017.

The current present, Nechirvan Barzani, previously welcomed a recent decree by the Syrian president, Ahmad Al-Sharaa, officially recognizing the Kurdish population as an integral part of the country.

Barrack reiterated Washington’s support for efforts to advance the Jan. 18 agreement between Syria’s government and the SDF to integrate the latter into state institutions. The SDF is a Kurdish-led faction led by Mazloum Abdi that operates in northeastern Syria and recently clashed with government forces.

On Saturday, the Syrian Arab News Agency reported that the Syrian Ministry of Defense had announced a 15-day extension of the ceasefire deal.