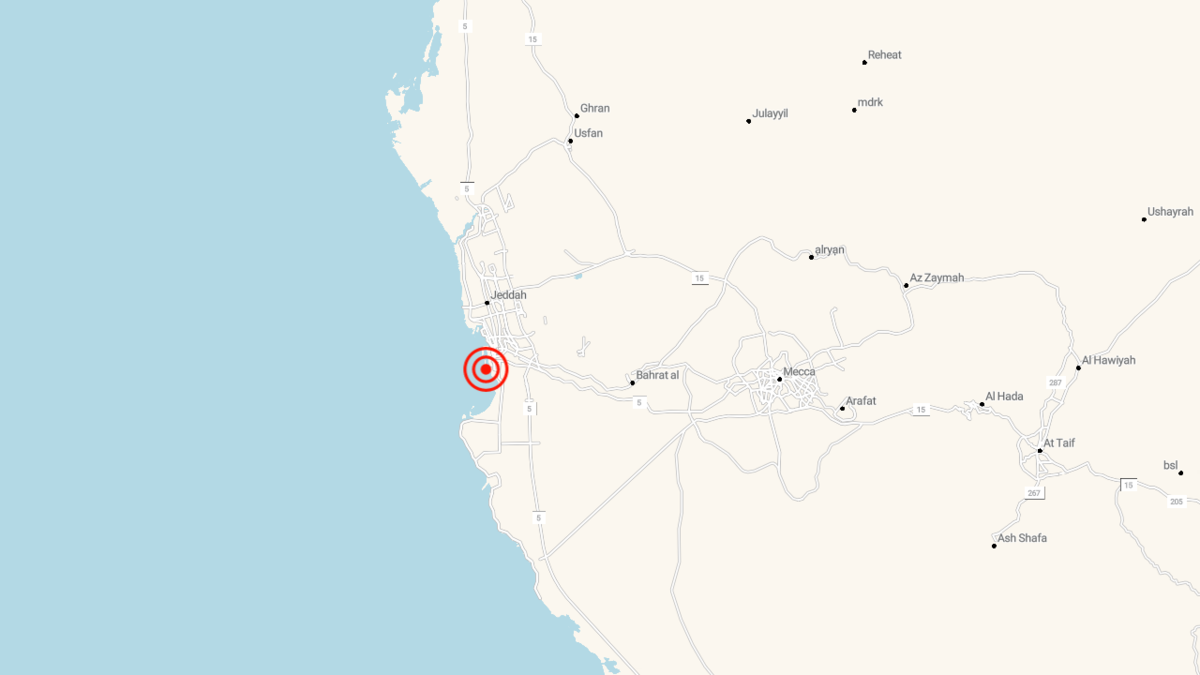

JEDDAH: Terrorists using a small boat laden with explosives attacked an oil tanker on Monday as it unloaded fuel at Jeddah port.

The attack caused an explosion and a fire on board the Singapore-flagged BW Rhine, which was carrying 60,000 tons of gasoline. The ship’s crew put out the fire and there were no casualties, but parts of the vessel’s hull were damaged.

“BW Rhine has been hit from an external source whilst discharging at Jeddah, Saudi Arabia at approximately 00:40 local time on 14 December 2020, causing an explosion and subsequent fire onboard,” a Hafnia statement said.

“It is possible that some oil has escaped from the vessel, but this has not been confirmed and instrumentation currently indicates that oil levels on board are at the same level as before the incident,” Hafnia said.

It was the fourth attack on Saudi energy infrastructure in the past month, all blamed on Iran-backed Houthi militias in Yemen. Explosive-laden boats targeted a floating platform in Jazan on Nov. 13, a Saudi Aramco distribution station in Jeddah was attacked on Nov. 23, and two days later an explosion damaged a tanker at the Shuqaiq terminal on the Red Sea just north of the Yemeni border.

“These acts of terrorism and vandalism, directed against vital installations, go beyond the Kingdom and its vital facilities, to the security and stability of energy supplies to the world and the global economy,” the Saudi Energy Ministry said on Monday.

The ministry urged the world to “stand together against such subversive terrorist acts, and take practical deterrent measures against the perpetrators and those who enable them.”

Col. Turki Al-Maliki, spokesman for the Saudi-led coalition in Yemen, said Monday’s explosion was a continuation of attacks on other oil facilities in the Kingdom, including Abqaiq and Khurais last year.

“Those attacks were initially claimed by the Houthis, although substantiated evidence proved the direct involvement of the Iranian regime using Iranian-made advanced conventional weapons, such as explosive-laden drones and cruise missiles,” he said.

Monday’s attack was also condemned by the secretary-general of the Organization of Islamic Cooperation, Dr. Yusuf bin Ahmed Al-Othaimeen. “These terrorist and criminal acts not only target the Kingdom, but also affect the security and stability of energy supplies in the world, as they threaten maritime traffic and the freedom of global trade, as well as coasts and regional waters with exposure to environmental disasters,” he said.

Before Monday’s explosion, the UN Security Council condemned the Houthi attacks on Saudi oil facilities in Jeddah last month, and restated their commitment to an inclusive, Yemeni-led and comprehensive political process.

But the Saudi political analyst Hamdan Al-Shehri told Arab News the attacks showed the Houthis were not interested in a political solution. “These targets make it clear that the Houthis are determined to represent a danger to the security of international navigation, in addition to the global economy,” he said.