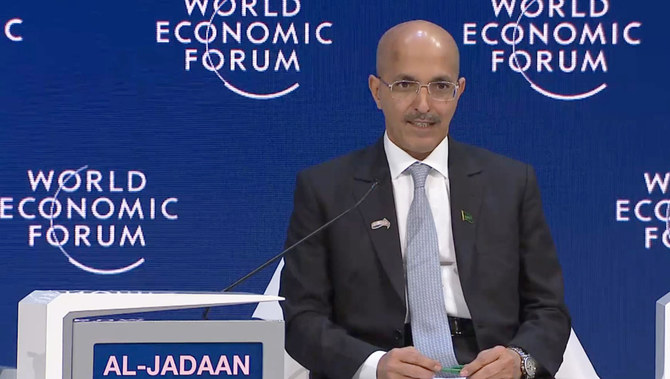

DAVOS: The G20 summit to be held in Saudi Arabia later this year will help the world resolve some of its biggest challenges in geopolitics, climate change and social issues, Mohammed Al-Jadaan, the Kingdom’s finance minister, told delegates at the World Economic Forum in Davos.

“Fortunately, the world is becoming more connected as well, and that means we can think about solutions through consensus,” he said at a special session on the Kingdom’s strategic priorities ahead of the G20.

Al-Jadaan said that the top three priorities for the summit were empowerment, the environment and technological change.

“We have to continue empowering people — women, young people, small- business people,” he said.

Another big priority was “protecting planet Earth, and at the centre of that is climate change,” but the “most ambitious” was the search for “new frontiers in technology and innovation that is shaping the world,” he said.

G20 summits in the past have played a big role in stabilizing global financial systems, especially during the crisis of 2009. Al-Jadaan said that would be a “very significant element” of the Saudi presidency, and he highlighted sustainable growth, debt vulnerabilities and the prospect of digital taxation as three financial focal points for the Riyadh G20 Summit.

Energy Minister Prince Abdul Aziz bin Salman said that Saudi Arabia was not a newcomer to the G20. “We have been involved for some time, and that is in recognition of the Kingdom being a vital part of the modern world,” he said.

He added that the Saudi energy industry — Saudi Aramco being the biggest oil company in the world — played a key role in the global economy and was therefore a crucial member of the G20. “There is only one country in the world that has excess capacity in the oil market, and that is being used to mitigate the problems we face from wars, conflict and disasters.”

Davos delegates also heard that women in Saudi Arabia had gender equality with men in the workplace after recent advances in employment across the country.

Iman Al-Mutairi, assistant minister for commerce and investment, said that the Kingdom was the top performer in a recent World Bank survey of employment and that it had reached the average global level of gender equality. “We have gender equality now. Women can be builders, welders, fireman and lots of other professions. We are serious about inclusiveness,” she said.

Al-Mutairi was speaking at a special session of the WEF on the strategic priorities of the Kingdom

She said that the progress made by Saudi Arabia sent a strong message to the Arab and Islamic world about Saudi Arabia’s modernization plans, but more remained to be done. “We have to keep reskilling women, especially in finance, artificial intelligence and other STEM subjects.

“Saudi Arabia has to act immediately and spread this ‘good virus’ to our neighbors,” she added.

Other Saudi members of the top level panel reinforced her comments about importance of inclusion as an element of the G20 agenda. Mohammed Al-Tuwaijri, the Kingdom’s minister of economy, said that making progress towards the UN’s sustainable development goals (SDGs) would also be a big priority. “Every one of the 17 SDGs is addressed in the G20 agenda. We want the summit to take action and be practical,” he said.

He was uncertain whether the world could meet all of the SDGs by the target date of 2030, though. “We will achieve a lot by 2030, but much depends on how other global institutions deal with policymaking and financial aspects of the SDG targets,” he said.

Abdullah Alswaha, the Kingdom’s minister for communications and information technology, said that the biggest challenge of the G20 presidency was with regard to new technology.

“How do we make sure that artificial intelligence and new technology acts in the interest of human kind?” he asked, adding that the digital world was a major potential source of employment.

The digital world was also a “social equalizer, but the analog world is polarized, so it needs to come together in the digital world.”

Al-Swaha highlighted the need for cyber-resilience in modern technology. “In a few years’ time quantum computers will be able to decrypt most of the encryption mechanism that are in place today,” he said.

Prince Abdul Aziz said that the environment remained a top priority for the Saudi energy industry. “We have to provide energy for the world, and still deal with climate change. If we’re going to be good G20 hosts, we have to have ideas and suggestions on these issues.”

He added that the G20 would highlight the role of the energy industry in reducing harmful emissions and utilizing the potential for carbon capture technologies. It would also showcase the Neom mega-project, and its emphasis on renewable energy and hydrogen fuels, as well as developments in climate-friendly fuels.

Al-Jadaan said the success of the G20 would be judged according to how it implemented existing policy initiatives, advanced new concepts being developed in the Kingdom, and showcased Saudi Arabia as a destination for tourists and business visitors.