DUBAI: Saudi Arabian and international investors have subscribed to the initial public offering of Saudi Aramco in huge numbers, with demand for shares in the world’s most profitable company exceeding the number of shares on offer.

Financial advisers to the biggest IPO in history announced that bids to the value of $44.3bn (166.275bn riyals) have been received in total from institutional and private investors for the $25.6bn worth of shares on offer.

With the order books open to institutions until next Wednesday, that means the IPO will definitely be the biggest in financial history, and should, in theory, lead to a jump in the share price when trading starts on Tadawul the following week.

Institutional demand for the shares even bigger than from private individuals. Corporates in the Kingdom account for more than half (54 percent) of the bid value, with Saudi funds and investment institutions comprising another big chunk (24.1 percent).

Non-Saudi investors are looking for 10 percent of the offer - a comparatively big figure given the fact the IPO was not marketed outside the region.

Rania Nashar, deputy chairman of Samba Capital, one of the advisers, said the IPO was “a source of pride” for the Kingdom.

“It is an indication of success and a signal of confidence, further bolstering the reputation and prestige of a company that has unrivaled standing globally in the energy sector. This success corroborates the foresight and depth of the strategic decision behind this landmark moment not just in Aramco’s history, but also in the development of the Kingdom’s economy,” she added.

Sarah Al Suhaimi, chief executive officer of NCB Capital and chair of the Tadawul where Aramco will be listed, said: “The success of the retail tranche is mirrored in the institutional tranche where bids reflect strong demand coming from across the spectrum of investor categories, reflective of Saudi Aramco’s compelling investment proposition.

“We are confident that this will be maintained throughout the remainder of the institutional book-building period. This institutional demand also speaks well of the depth and diversification of the Saudi capital markets and its investor base,” she added.

‘Source of pride’ as investors scramble for Saudi Aramco shares

‘Source of pride’ as investors scramble for Saudi Aramco shares

- Institutional orders in the IPO included 54% from Saudi cooperates, 24.1% from Saudi funds and 10.5% from non-Saudi investors

- The subscription period for institutional investors remains open to Dec. 4

Deals worth $8bn signed at World Defense Show 2026

- Five-day event brought together 1,486 exhibitors from 89 countries and attracted 137,000 visitors

- Andrew Pearcey: We look at the industry and the trends, and see other new features that we can bring to the show

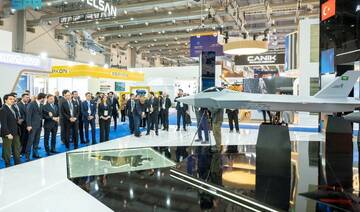

RIYADH: More than 60 military and defense deals worth SR33 billion ($8.8 billion) were signed at the third edition of the World Defense Show, which ended on Thursday in Riyadh.

The flagship defense exhibition is part of Saudi efforts to expand its military industries sector.

Organized by the General Authority for Military Industries, the five-day event brought together 1,486 exhibitors from 89 countries and attracted 137,000 visitors, according to official figures announced at the closing media briefing on Thursday.

Ahmad Al-Ohali, governor of the General Authority for Military Industries, said the event reflects broader efforts to localize defense spending under Vision 2030.

“When we started in 2018, the percentage of military spending from within the Kingdom of Saudi Arabia was 4 percent of total spending; by the end of 2024, it jumped to 25 percent,” he said.

Al-Ohali added that number of national cadres working in the sector increased from 25,000 male and female employees in 2020 to 34,000 — a rise of 40 percent.

Beyond attendance and displays, the exhibition served as a venue for commercial and government agreements.

The number of agreements signed reached 220, including 93 government-to-government agreements and 127 partnership agreements with companies.

Al-Ohali said the deals include technology transfer and local manufacturing projects aimed at strengthening domestic supply chains.

Aerial and static displays included 63 aircraft, alongside more than 700 pieces of military equipment exhibited across indoor and outdoor platforms. Maritime and unmanned systems were also showcased through dedicated demonstration areas.

Andrew Pearcey, CEO of the World Defense Show, said that planning for the next edition had already begun.

“So, what we do is we take stock of our successes, so we’re now starting to see what worked, and we also learned that some things that didn’t work,” Pearcey told Arab News.

“Over time, one of the key things is to try and grow; the demand for this show is huge, so we want to try and accommodate that.

“So, we need to try and build more space. Then we look at ways we brought new features to this show. So, we look at the industry and the trends, and see other new features that we can bring to the show.”

The event also introduced a “Future Talent Program” during its final two days, inviting students aged 16 to university level to explore career opportunities in the defense sector.

“The future talent program is where we invite youngsters, so from 16 up to university level, to come and look at the show, understand what career opportunities there are in the defense industry, sit and do some content programs, and meet the exhibitors that want to demonstrate some of their things,” Pearcey said.

“So, we bring around 4,000 to 5,000 students to the show. So, that’s bringing that next generation through.”