TOKYO: There is a genuine interest among Japanese companies to invest in Saudi Arabia’s rapidly growing entertainment and tourism industries, with some planning to set up their own operations in the Kingdom soon, according to Saudi officials.

Avex, a major Japanese company in the entertainment industry, is planning on “launching its own office in Saudi Arabia and start its own entertainment calendar for it,” Muhannad Abanmy, general manager for entertainment infrastructure development at the Kingdom’s General Entertainment Authority (GEA), told Arab News Japan in an exclusive interview.

“We’ve locked a meeting with Avex (on Thursday) to seal (the deal) with them to open their office in Saudi Arabia,” Abanmy said on the sidelines of the Saudi-Japan Vision 2030 Business Forum in Tokyo on Wednesday.

Avex is one of Japan’s top entertainment conglomerates, founded and led by Max Matsuura. It specializes in the audiovisual business as well as anime, video games, live music events and fireworks, among other entertainment-related industries.

Matsuura, who attended Wednesday’s event, spoke of the successful collaboration between Avex and Saudi authorities during the Saudi National Day in Jeddah, and said the company plans to expand its efforts in the Kingdom.

FASTFACTS

● Total trade volume between both countries is $38 billion.

● The Saudi entertainment industry to generate up to $67 billion in 10 years.

● The Kingdom plans to attract 2 million visitors by 2022.

● Thousands of e-visas have been issued since the launch of Saudi Arabia’s tourism e-visa in September.

Saudi officials are banking on the good relations their country has with Japan, including economic ties.

They say the size of business cooperation between them can grow further with the new entertainment and tourism sectors opened.

Total trade volume between both countries is $38 billion. But “Japan has a lot to offer in terms of expertise,” Sultan Mofti, deputy governor for investment attraction at the Saudi Arabian General Investment Authority (SAGIA), told Arab News Japan.

“Looking at the size of investments in Saudi Arabia by Japanese companies tells you that there’s a lot of room to grow,” he said.

“The creation of the Saudi-Japan Vision 2030 program, the inauguration of the Riyadh office and the launch of the Tokyo office will help a lot in bridging the gap in communicating opportunities to Japanese businesses,” he added.

“That’s what we offer at SAGIA, by offering a portfolio of 20 services to Japanese businesses that are willing to invest in Saudi Arabia,” Mofti said.

“Investors won’t come until they know the return on their investment is high,” but it will be very rewarding to invest in Saudi Arabia, he added.

The Kingdom has great potential in terms of its purchasing power, with nearly 7 million people residing in each of two cities: Riyadh and Jeddah.

One entertainment event saw nearly 400,000 people attend, to the extent that the organizers had to refuse entry to many due to congestion, said officials.

They expect the entertainment industry to generate up to $67 billion in 10 years and create hundreds of thousands of jobs as it grows.

Despite being the new kid on the block in the entertainment industry, Saudi Arabia has managed so far to create a buzz worldwide with jaw-dropping festivals and star-studded events. But as with all new things, challenges are bound to emerge.

“It’s challenging because it’s new, but the future is there,” said Abanmy, adding that the few handicaps that have been faced, including lack of regulation at one point, usually get sorted by the GEA.

The Saudi government is adamant on supporting its adolescent entertainment industry and the tourism sector, sparing neither cash nor effort to achieve the goal of becoming a global tourist destination.

Some SR5 billion ($1.33 billion) have been spent over the past two years to launch and support the entertainment industry in Saudi Arabia, attracting millions visitors from within the Kingdom and the wider Arab Gulf, said Abanmy.

Sports events are part of the attraction. In December, Saudi Arabia will host the world heavyweight boxing championship.

A world-class tennis tournament will follow suit in mid-December, which has generated a lot of interest among tourists from near and far, Abanmy said. “Recently, we had some 3,600 tourists arriving at King Khalid Airport at the same time,” he added.

This would not have happened had the Saudis not opened up their country to attract investors, officials say.

Thousands of e-visas have been issued since the launch of Saudi Arabia’s tourism e-visa in September, Majid Al-Ghanim, tourism and quality of life managing director at SAGIA, told Arab News Japan on Wednesday.

The Kingdom plans to attract 2 million visitors by 2022, and to see revenue generated from the sector reaching $2 billion by 2030.

Up to 1 million jobs from direct and indirect tourism-related businesses will be available to Saudis in the next seven years, said Al-Ghanim.

This is part of the sustainability approach that the government is planning and that helps increase employment, he added.

Nearly “75 percent of those jobs will be in the private sector, while the government can fulfill the rest,” he said.

Like Abanmy, Al-Ghanim said the Kingdom is targeting Japanese nationals and investors, adding: “Japan is one of the main target countries when it comes to tourists. We’d like to attract tourists from Japan to Saudi Arabia. We want to target and attract the Japanese.” The two countries share similarities in terms of heritage and tradition, he added.

From tourism visas to fun-filled and adrenalin-generating adventures, the Kingdom can offer it all and much more, said Al-Ghanim.

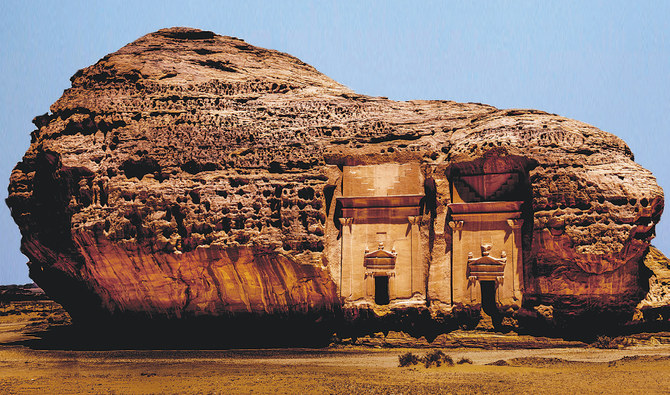

He added that Saudi Arabia is one large open-air museum, offering a testimony to past civilizations, 2,000 years of human heritage and a diverse ecology.

This is manifested in its “large formation of rocks,” archaeological sites, traditional markets, mild weather on one side of the country and a desert on the other, Al-Ghanim said.