HOUSTON: Oil rose above $60 a barrel on Wednesday after government data showed a surprise draw in US crude stocks and as the prospect of deeper output cuts by OPEC and its allies offered support.

US crude stocks fell by 1.7 million barrels last week as refineries hiked crude runs by 429,000 barrels per day (bpd), the Energy Information Administration said. Analysts had expected an increase in US inventories of 2.2 million barrels.

Brent crude futures were up 44 cents, or 0.74%, to $60.14 a barrel at 10:13 a.m. CDT . West Texas Intermediate (WTI) crude futures for December delivery were up 48 cents, or 0.88%, to $54.96 per barrel.

Oil prices had fallen earlier in the session on data from industry group the American Petroleum Institute showing US stocks rising more than analysts had expected, by 4.5 million barrels to 437 million barrels.

The US Energy Department’s report “has put some buyers in the market, but it will be interesting to see if it lasts. While this will distract from demand destruction, the market will eventually come back to it,” said Gene McGillian, vice president of market research at Tradition Energy in Stamford, Connecticut.

The draw in US oil stocks appeared to have been caused by temporary market factors including higher refinery runs, rather than a fundamental firming of oil demand, and investors are still concerned about the global economy following reports of slowing growth in China and Europe, McGillian added.

A larger-than-expected decline in US gasoline stocks also supported prices, analysts said. Gasoline stocks fell by 3.1 million barrels, compared with analysts expectations of a 2.3 million-barrel drop.

“The continued decline in product inventory makes for a bullish report,” said John Kilduff, a partner at Again Capital LLC in New York. “Gasoline numbers are summer-like; that’s endemic of a good economy (in the US) and people driving to work.”

Also helping to underpin prices, the Organization of the Petroleum Exporting Countries is mulling whether to deepen production cuts amid concerns of weak demand growth next year.

OPEC and other oil producers including Russia, a group known as OPEC+, have pledged to cut production by 1.2 million barrels per day (bpd) until March 2020. OPEC and other non-members are scheduled to meet again Dec. 5-6.

“With the headwinds of strong US producer hedging and high freight rates fading, we expect stronger Brent timespreads and higher prices in coming weeks, with upside risk to our year-end $62 per barrel forecast,” Goldman Sachs said in a note.

The investment bank expects Brent prices to continue trading around $60 a barrel in 2020.

Oil rises on surprise draw in US stocks, prospect of OPEC action

Oil rises on surprise draw in US stocks, prospect of OPEC action

- OPEC, allies to mull deeper production cuts

- Weak demand growth outlook weighs on sentiment

How AI will unlock billions of dollars in economic value for Saudi health sector

- AI and machine learning are revolutionizing patient outcomes and healthcare service efficiency

- Integration of AI in medical administration to revolutionize resource allocation, optimize hospital operations

RIYADH: Saudi Arabia’s health-tech sector is undergoing substantial transformation driven by artificial intelligence, promising significant economic and operational benefits.

A McKinsey & Co. analysis forecasts that by 2030 AI could unlock $15 to $27 billion in economic value for the Kingdom’s medical sector.

This can be achieved by automating up to 40 percent of healthcare tasks, enhancing efficiency and reducing manual workload.

Such advancements align with Saudi Arabia’s ambition to emerge as a regional technology hub, with the medical sector being a key division benefiting from this digital transition.

Crown Prince Mohammed bin Salman has highlighted the potential of this revolution, and is quoted as saying: “We are living in a time of scientific innovation, unprecedented technology, and unlimited growth prospects. These new technologies, such as artificial intelligence and the Internet of Things, if used optimally, can spare the world many disadvantages and can bring enormous benefits to the world.”

Time of transformation

In a recent interview with Arab News, Nadine Hachach-Haram, a surgeon and co-founder of the health-tech platform Proximie, shared her observations about the transformative applications of AI. She said this could be used for enhancing patient safety, communication, and service efficiency across Saudi Arabia’s healthcare sector.

“AI use allows the automation of necessary but time-consuming and tedious administrative processes,” Hachach-Haram said. “AI implementation will help minimize errors, optimize efficiency, revolutionize patient care, and improve global healthcare accessibility.”

She also underscored the government’s approach to fostering AI, including initiatives such as the National Data Bank and cloud infrastructure to support public and private sector collaboration.

Hachach-Haram explained that AI and machine learning are revolutionizing patient outcomes and healthcare service efficiency in the Kingdom as the nation embraces these technologies to align with the Saudi Health Sector Transformation Program.

This undertaking is a pivotal element of the Ministry of Health’s strategy under Vision 2030, which aims to enhance medical care access and modernize facilities to ensure the well-being of the populace.

Proximie, a global healthcare platform, is at the forefront of this shift, playing a critical role in the SEHA Virtual Hospital’s efforts to overcome geographical constraints, enhance patient safety, and facilitate the sharing of medical expertise across Saudi Arabia.

Hachach-Haram highlighted the use of AI in a medical setting. “The hospital utilizes AI to triage caseloads and employs the latest imaging technologies to aid in remote scan interpretations.”

This evidence demonstrates tangible benefits, with Proximie instrumental in supporting cardiology surgeries at regional hospitals, thereby minimizing the need for patient referrals and travel, Hachach-Haram said.

“The hospital has the capacity to treat over 400,000 patients a year. It uses AI to triage caseloads and makes the latest imaging technologies available to support the interpretation of scans remotely,” she added.

She shared a poignant illustration of this impact in the case of Noura Saleh, 70, from Tabuk, who required urgent surgery following stroke-induced heart failure.

The operation was successfully executed at a local hospital, with the SEHA Virtual Hospital’s cardiology team providing remote guidance through Proximie.

Hachach-Haram said: “It’s a great example of how distance is no longer an obstacle to receiving the best care promptly.”

Improved access and care

Speaking to Arab News, Rania Kadry, co-founder of the Egyptian health-tech platform Almouneer, shared her prediction of the Kingdom’s transformation over the next decade.

Kadry envisions AI significantly impacting medical diagnostics, treatment planning, and personalized medicine in Saudi Arabia.

“This will lead to improved patient outcomes, reduced healthcare costs, and enhanced efficiency in healthcare delivery,” she said.

She added that AI-driven telemedicine platforms and remote-monitoring systems are expected to become more prevalent, particularly in rural areas, increasing access to healthcare services nationwide.

“Moreover, AI will continue to be integrated into healthcare administration processes, optimizing resource allocation, and improving overall healthcare management,” she added.

Hachach-Haram addressed a crucial aspect of AI in healthcare: patient trust and data privacy. She acknowledges the apprehension many patients feel about the use of their health data. However, she believes that proper communication about the benefits of healthcare innovation and knowledge-sharing might encourage patients to become proactive proponents of AI.

“Many patients are understandably nervous about the use of their sensitive health data, but if the benefits of healthcare innovation and knowledge-sharing are clearly explained, patients may embrace becoming ambassadors about the benefits of using and sharing data — helping the entire ecosystem,” she said.

Furthermore, the integration of AI in healthcare administration is predicted to revolutionize resource allocation and optimize hospital operations.

Kadry added: “One example could be the widespread implementation of AI-powered predictive analytics systems in Saudi Arabian hospitals.” This would leverage patient data to forecast healthcare needs and enhance service delivery, she added.

Kadry also underscored the Kingdom’s commitment to health tech and AI innovation, referencing Saudi Arabia’s ambitious plan to allocate 2.5 percent of its gross domestic product, approximately $16 billion by 2040, to research and development, with a focus on aging and chronic diseases.

“Can you imagine how much the country will progress under the young and progressive leadership?” She highlighted the launch of the Hevolution Foundation, a $20 billion Saudi Arabia initiative dedicated to advancing human health and extending life expectancy globally.

Despite being in its early stages, the utilization of AI technology holds immense potential to positively influence patient outcomes across the Arab world.

Rotana to double Saudi-based workforce to 5k employees as it expands offering

RIYADH: Rotana Hotels is planning on more than doubling its workforce in Saudi Arabia to 5,000 staff as it expands its outlets to 15, the company’s CEO has told Arab News.

Speaking on the sidelines of the Future Hospitality Summit in Riyadh, Philip Barnes highlighted the diverse nature of hotels in terms of size and staffing, indicating that the current portfolio in the Kingdom employs around 2,000 people.

He said that between eight and nine hotels are under development and set to open within the next two to three years, and the firm has “a number of others coming.”

Barnes expressed his desire to expand the company’s presence in various parts of Saudi Arabia, not just in the holy cities of Madinah and Makkah.

Reflecting on the increase in workforce needed, he said: “I think you’d be looking at 4,000 to 5,000 people by the time we get to that 15 hotel.

“It ranges between 200 to 300 people per property as we go forward depending on the size of the property.”

Rotana is seeking opportunities across a broader range of locations within Saudi Arabia, and Barnes believes that being a UAE-based company gives it an insight into the tourism landscape that other firms may lack.

“We see ourselves as being able to come into the Kingdom in a way that others can’t because we are recognized as that brand that is from the region. We can go into destinations that maybe aren’t the premier destinations as other people see them, everybody wants to be in Riyadh, everybody wants to be in Jeddah,” Barnes said.

He added: “We have a lot of things happening, but we have further developments coming online in Egypt over the course of the next two years. We’ve got more coming on board in Qatar.”

He also stated that the company is also exploring new territories, with recent moves into Pakistan, which Rotana views as a promising and emerging market

Additionally, he further explained the group’s plans for expansion by exploring opportunities in Eastern Europe, though not on a large scale. Turkiye is also a focus, with two hotels opened in the past year and more development expected.

“We’re also opening two hotels in London, not in central London. We’re opening one hotel in Kingston, which is a suburb of London, 20 minutes from downtown,” Barnes said.

He continued: “I personally am hoping that that will then be a springboard into six or seven or eight other Centros around the UK in places like Liverpool or Leeds or, Manchester etc. because I see it as being a brand that has tremendous legs, and we've already got a number of those properties here in this part of the world.”

Marriott International reveals that majority of its guests in Saudi Arabia are local

RIYADH: Marriott International has revealed that the majority of the hotel’s guests in Saudi Arabia are local, indicating the importance of internal tourism in the Kingdom.

Speaking in an interview with Arab News on the sidelines of the Future Hospitality Summit, taking place in Riyadh from April 29 to May 1, Chadi Hauch, the hotel’s regional vice president of development, explained that the local market has driven leisure tourism in Saudi Arabia.

“At this stage right now, obviously the majority of the guests are local, but you have to take into consideration as well that, in Saudi, tourism has been majorly local,” Hauch said.

He underscored that COVID-19 was a significant experience that opened the eyes of the Ministry of Tourism and the local Saudi market.

“During COVID-19, when the whole country closed down, the Saudis were super excited to visit their own countries. They were pushed within their own country because they needed to get out of the cities such as Riyadh and Jeddah and they started visiting secondary cities like Abha,” the VP said.

Consequently, Hauch added that this was when they noticed the nation had much more to offer.

“But obviously as the destination grows and obviously this is this is what the government is pushing for, we will definitely start seeing international travelers trying to visit these destinations that is trying to position itself kind of like a Maldives destination,” he said.

Hauch also explained that Marriott International currently has 38 open properties operating in the Kingdom and is planning for 40 more.

During the interview, the VP tackled how Marriott International Inc. and Al Qimmah Hospitality, a subsidiary of BinDawood Trading, signed an agreement to bring the JW Marriott brand to Jeddah.

Located on the Jeddah Corniche, the hotel is expected to become a prime destination for luxury-seeking travelers who desire a waterfront escape, he underlined.

“The beauty about this project is that it’s a mixed-use project that will have office space and will have retail. So, it’s quite a sizable project that will take a little bit of time. We expect hopefully to open in the next five to six years, depending on how fast the construction goes,” Hauch disclosed.

The VP also highlighted the announcement a few days earlier that the company had signed an agreement with NEOM to open its second Ritz-Carlton Reserve in Saudi Arabia.

The hotel will be located in Trojena, a year-round mountain destination situated in the country’s northwest region.

The resort is expected to feature 60 expansive one- to four-bedroom villas. Plans also include a spa, swimming pools, and multiple culinary venues.

Additionally, Hauch discussed how Marriott has two different main operating models.

“We either do management agreements or we do franchisee agreements. Usually when we do operate these hotels in these models, we don’t get involved in the investment of the hotel. Usually, it is the owner who develops the hotel, and it depends on the location and, positioning of the hotel. These construction costs vary; they vary quite a lot between a five-star, a three-star, four-star or the luxury positioning,” the VP emphasized.

More than 1,200 global investors are expected to have attended the FHS. The event, held at Al Faisaliah Hotel, focused on sustainable tourism and technology-driven hospitality under the theme, “Invest in Tomorrow: Today, Together.”

Valor Hospitality ventures into Saudi Arabia with luxury hotel in Abha

RIYADH: Abha, a city in Saudi Arabia’s Asir region, is poised to welcome its first luxury lifestyle hotel through an upcoming deal with American operator Valor Hospitality.

The company, which has overseen a portfolio of major brand hotels including Intercontinental, Marriott, Hilton, Radisson, Wyndham, and Hyatt, also aims to enter secondary and tertiary markets. While major brands concentrate on large-scale developments, Valor aims to cater to “outer regions.”

Speaking to Arab News at the Future Hospitality Summit in Riyadh, Julien Bergue, the co-founder and managing partner of the company, highlighted that Valor has signed a deal to break ground on a “very different” upscale property in Abha, with details to be announced within a month.

Bergue said: “Saudi Arabia is a very specific market. We’re very excited about Saudi Arabia. We’ve been excited about it for five years. We’re watching, we’re learning. We signed our first property in Abha in the Asir region. I’m very proud of it. But we will make it public in about a month’s time; it is the first lifestyle hotel in Abha.”

Expressing excitement about the deal, he called it a “great asset, with a very great owner as well.”

“We’re excited about it. Our plans in Saudi Arabia is to tackle secondary and tertiary regions at the moment. While all the big brands are very focused on mega developments, we are helping now the outer region,” he added.

The company’s future plans in the Kingdom also include collaborating with the Ministry of Tourism and the Tourism Investment Fund to “see how we can position better investment throughout the secondary tertiary region.”

This includes rolling out a training academy for young Saudis in the sector, the executive said, with plans to launch within the next year and a half.

The academy will leverage the operator’s expertise to bridge the gap between the upcoming surge in the hospitality industry and the human capital needed to fulfill those goals.

“In a year and a half, we should be ready to roll out the academy here with a much deeper structure behind it. This is super important for the ecosystem of our own business in Saudi Arabia and for the other players in the space. So, it's a very good initiative,” he said.

The executive revealed that they are planning to implement shorter programs. “So we are not aiming toward management training. We are going to really aim toward technical training skills, such as housekeeping and other core stuff required for running operations.”

This training program aims to enroll a thousand participants every month through an “aggressive short-term program.”

By 2030, Valor’s ultimate goal is to manage properties with 6,000 to 7,000 keys under their management.

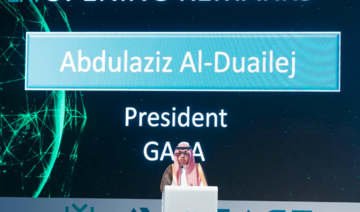

Saudi airports awarded customer experience accreditation, elevating travel services

RIYADH: Customer service offerings at 16 Saudi airports have been recognized with a prestigious global award.

The Airports Council International’s Customer Experience Accreditation for 2024 has recognized facilities operated by the Kingdom’s Cluster2 Airports Co., which include Abha International Airport, Al-Jouf Airport, and Al-Qurayyat Airport.

Additionally, they consist of Bisha Airport, Dawadmi Airport, and Hail International Airport, as well as King Abdullah bin Abdulaziz Airport, King Saud bin Abdulaziz Airport, and Najran Airport.

“This accomplishment is not merely a testament to the quality and efficiency that we deliver; it also underscores our persistent dedication to enhancing the journey of each customer who passes through our gates,” the company said in an X post.

The ACEA program assists airports in enhancing customer experience management by guiding them through a comprehensive review and training process, which emphasizes stakeholder and employee engagement, as well as staff development, according to its website.

Other airports to receive this accreditation include Prince Abdul Mohsen bin Abdulaziz International Airport, Prince Nayef bin Abdulaziz Airport, and Rafha Airport.

Moreover, they include Sharurah Airport, Taif International Airport, Turaif Airport, and Wadi Al-Dawasir Airport.

The achievement of these airbases is a testament to the robust support and consistent oversight provided by the General Authority of Civil Aviation and the company, the Saudi Press Agency reported.

These airports have been acknowledged by ACI for their ongoing commitment to delivering exceptional services for travelers.

Ali Masrahi, CEO of Cluster2 Airports Co., expressed his satisfaction with this achievement, emphasizing the company’s focus on three key areas: understanding customer needs, strategic planning tailored to traveler requirements, and continuous improvement through monitoring key performance indicators across all aspects of the passenger.

Masrahi emphasized his company’s dedication to excellence and improving the airport travel experience.

The company added in its post that three of its airports received the same accreditation in 2023: “Today, we are proud to witness this number grow to encompass more of our airports, marking a remarkable achievement that underscores the progress and development we aim to accomplish.”

The firm further explained that obtaining accreditations from the ACI is the outcome of the team’s persistent efforts and unwavering dedication to ensuring an unforgettable travel experience.

ACI’s first Asia-Pacific and Middle East office was inaugurated in Riyadh in September 2023. Saudi Arabia’s Transport Minister and General Authority of Civil Aviation Chairman Saleh Al-Jasser, dignitaries and top officials from 49 countries attended the event.

ACI is an organization of airport authorities that aims to unite industry practices for airport standards by working with governments, regional members, experts, and international groups.