ISLAMABAD: President Dr. Arif Alvi said on Sunday that Pakistan was on the tipping point of socioeconomic development, and it was high time that all the citizens played their role to uplift the country’s poor by providing them education, health and other opportunities.

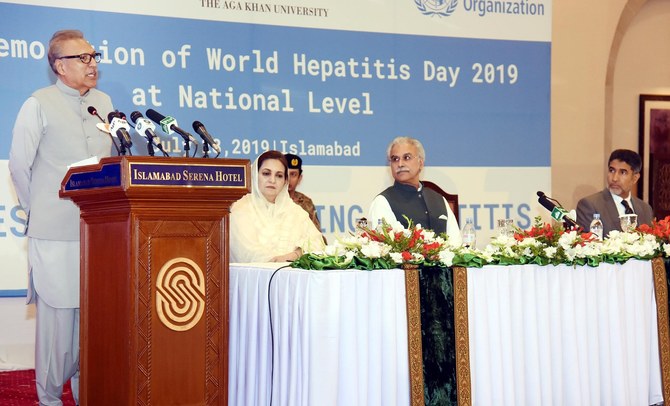

Addressing a National Conference themed ‘Invest in Eliminating Hepatitis from Pakistan’ in connection with the World Hepatitis Day that is annually observed on July 28, the president said the prevalence of hepatitis B and C in 15 to 20 million people of Pakistan was alarming.

Radio Pakistan adds: He added that Pakistan was trying to deal with the challenge of hepatitis despite its limited resources.

Alvi said that dissemination of awareness about the disease was also the responsibility of doctors and they should also be engaged to create greater awareness about hepatitis among the general public.

The president said that Pakistan was also facing malnutrition, stunted growth and other health problems for which a comprehensive policy needed to be devised.

He also asked the government to redesign the national hepatitis policy while urging private institutions to join hands with the government to meet health challenges since such complicated problems could not be resolved without the assistance of private sector.

Pakistan on tipping point of socioeconomic development: President Alvi

Pakistan on tipping point of socioeconomic development: President Alvi

- Says the country’s affluent citizens must play their role to help the poor

- Asks the government to redesign the national hepatitis policy

Pakistan launches privatization process for five power distributors under IMF reforms

- Power-sector losses have pushed circular debt above $9 billion, official documents show

- Move is tied to IMF and World Bank conditions aimed at cutting subsidies and fiscal risk

KARACHI: Pakistan has appointed financial advisers and launched sell-side due diligence for the privatization of five electricity distribution companies, marking a long-awaited step in power-sector reforms tied to International Monetary Fund (IMF) and World Bank programs, according to official documents shared with media on Monday.

The five companies, namely Islamabad Electric Supply Company (IESCO), Faisalabad Electric Supply Company (FESCO), Gujranwala Electric Power Company (GEPCO), Hyderabad Electric Supply Company (HESCO) and Sukkur Electric Power Company (SEPCO), supply electricity to tens of millions of customers and have long been a major source of financial losses for the state.

Pakistan’s power sector has accumulated more than Rs2.6 trillion (about $9.3 billion) in circular debt as of mid-2025, driven largely by distribution losses, electricity theft and weak bill recovery, according to official government data cited in the documents. The shortfall has repeatedly forced the government to provide subsidies, adding pressure to public finances in an economy under IMF supervision.

“The objective is to reduce losses, improve efficiency and limit the government’s fiscal exposure by transferring electricity distribution operations to the private sector,” the documents said, adding that sell-side due diligence for five distribution companies is under way as a prerequisite for investor engagement.

Two utilities, the Quetta Electric Supply Company and Tribal Areas Electric Supply Company, are excluded from the current privatization phase due to security and structural constraints, the documents said.

Power-sector reform is a central pillar of Pakistan’s IMF bailout program, under which Islamabad has committed to restructuring state-owned enterprises, improving governance and reducing budgetary support. The World Bank has also linked future energy-sector financing to progress on structural reforms.

Electricity distribution companies in Pakistan routinely report losses exceeding 20 percent of supplied power, far above international benchmarks, according to official figures. These inefficiencies have been a persistent obstacle to economic growth, investment and reliable power supply.

Previous attempts to privatize power distributors have stalled amid political resistance, labor union opposition and concerns over tariff increases. While officials have not announced a timeline for completing transactions, the launch of due diligence marks the most concrete step taken in years. International lenders and investors will now be closely watching whether Pakistan can translate this phase into completed sales, a key test of its ability to deliver on IMF-backed reforms.

In a related development in Pakistan’s privatization agenda, the government last month concluded the long-delayed sale of a 75 percent stake in national flag carrier Pakistan International Airlines (PIA) in a publicly televised auction. A consortium led by the Arif Habib Group emerged as the highest bidder with a Rs135 billion ($482 million) offer for the controlling stake, in a transaction officials have said will end decades of state-funded bailouts and inject fresh capital into the loss-making airline.