TEHRAN, Iran: Stay-at-home mom Maryam Alidadi used to lead a comfortable middle-class life. The 35-year-old and her husband, a mechanic, could afford a spacious rental apartment in a central neighborhood of Tehran, along with a car, occasional restaurant meals and holidays abroad.

Now they are barely hanging on, even after drastically cutting spending.

Like most Iranians, the family was hit hard by the collapse of the national currency, accelerating inflation and eroding wages — fallout from unprecedented US sanctions.

Perhaps most devastating for Iran’s large middle class has been the sharp spike in housing prices, more than double in a year. That has uprooted tenants and made home ownership unattainable for most.

The Alidadis sold their car and borrowed from friends and family to buy a smaller apartment in a less desirable area on the outskirts of Tehran — in hindsight a smart move, since they’ve been priced out of their old neighborhood by now.

“Right now, this is the most difficult period ever,” said Alidadi’s 58-year-old mother, Shahla Allahverdi, reflecting on the Islamic Republic’s 40-year history as she shared a park bench with her daughter.

Iranians worry about the future as tensions between Iran and the West continue to rise.

The escalation — triggered by the Trump administration’s withdrawal last year from Iran’s 2015 nuclear deal with world powers — seems unstoppable, and European mediators trying to defuse the situation keep coming up short.

The showdown between Washington and Tehran has upended the lives of Iranians as they try to survive on less. A bride borrowed a wedding dress because she couldn’t afford to buy or even rent one. More newlyweds move in with their families to save money. Visa requests are up at foreign embassies, with young Iranians eager to leave.

Some wonder how far Washington is willing to push its “maximum pressure” campaign.

The Trump administration says the sanctions are aimed at getting Iran to renegotiate the nuclear deal, which offered sanctions relief in exchange for curbs on Iran’s nuclear program.

Washington denies its ultimate aim is to end the rule of Shiite Muslim clerics — though John Bolton, an architect of the pressure campaign, called for regime change before he became Trump’s national security adviser.

Some say Washington’s actions appear to have strengthened the paramilitary Revolutionary Guard and other hard-liners at the expense of President Hassan Rouhani, once the nuclear deal’s most prominent champion.

The Guard has been able to deepen its role in the economy, domestic politics and foreign policy under the guise of security, said Ellie Geranmayeh, a senior fellow at the European Council on Foreign Relations.

Despite the economic upheaval, there have only been sporadic protests.

Iran analyst Adnan Tabatabai said he believes Iranians are “reluctant to take their grievances to the street” for now, amid fear of further chaos and pushback by the authorities.

The economy contracted by 4.9% from March 2018 to March 2019. It is expected to shrink by an additional 5.5% in the year ending March 2020, according to Iranian figures. The official inflation rate has risen to 35%, up from 23.8% in the March 2018 to March 2019 period.

The housing and construction sector, which makes up about one-quarter of the economy and is the top destination for savings and investments, has been thrown out of balance.

Property owners are reluctant to sell and landlords are sharply raising rents because of the currency collapse, said Ali Dadpay, a finance professor at the University of Dallas. He said an estimated 490,000 homes stand empty in and around the capital, including more than 40,000 units added this year.

At the same time, construction lags far behind the need of 1.2 million new homes a year nationwide, said Hesam Oghabaei, deputy head of the Tehran association of real estate agents. He said about 25% of Tehran’s residents live in rented apartments, and the vast majority cannot afford the price increases.

The Peyman family — elderly parents and eight adult children — own a 110 square meter (1,180 square feet) apartment in Tehran’s District 12, a poor area plagued by drug addiction and other social problems. More than a decade ago, the Peymans rented the apartment, and used the extra income to move to a nicer area.

Now they are back in District 12, renovating the old apartment after being squeezed out of the good neighborhood by a rent hike.

“We have to come here because we have no other choice,” said the patriarch, Muslim, 65. Four unmarried children will live with him and his wife. Across-the-board price increases put marriage out of reach.

One of Tehran’s newest areas, District 22, is under construction on the northwestern edge of the city. It consists of apartment high-rises and shopping malls arranged around an artificial lake called Chitgar.

Maryam Alidadi and her husband bought an 82-square-meter (880 square feet) apartment here in December, downsizing by a third from their rented home in a more affluent area.

“Our standard of living has dropped considerably,” she said, adding that she now regrets having quit her government job four years ago when her son Rami was born.

The US sanctions have proven particularly devastating for Iran’s large middle class, said Dadpay, the finance professor. “This is the economic class that depends on the global economy, depends on their skillsets, and most of them are earning fixed incomes,” he said.

The economic freefall could shape Iran’s domestic politics, with parliament elections in February posing the first test. Middle class voters have traditionally favored reformist candidates but might sit out voting because of a lack of alternatives, inadvertently boosting hard-liners.

Pro-reform politicians who favor a greater opening to the West are closely linked to the nuclear deal.

With the deal faltering, the hard-liners, including the Revolutionary Guard, are becoming more entrenched, said Geranmayeh, the analyst.

The Guard, she said, “is going to be a force to be reckoned with for many years to come.”

US sanctions squeeze Iran middle class, upend housing sector

US sanctions squeeze Iran middle class, upend housing sector

- Most Iranians were hit hard by the collapse of the national currency, accelerating inflation and eroding wages

- Perhaps most devastating for Iran’s large middle class has been the sharp spike in housing prices, more than double in a year

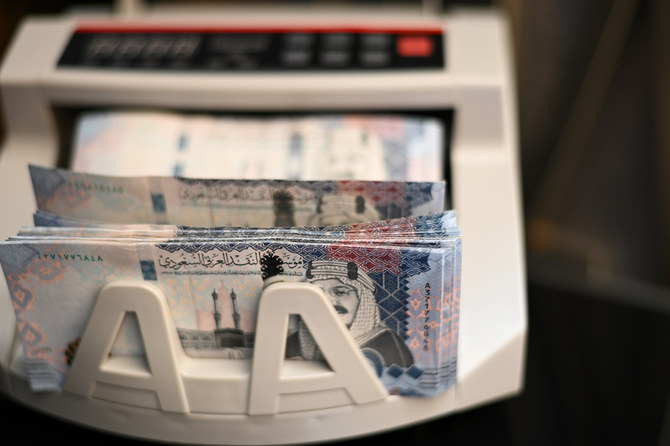

Saudi Arabia’s Q1 budget deficit aligns with expectations; non-oil revenues rise by 9%

RIYADH: Saudi Arabia recorded a budget deficit of SR12.4 billion ($3.3 billion) in the first quarter of 2024, comprising 16 percent of the annual deficit forecast set by the Ministry of Finance at the end of the previous year.

This suggests that it aligns with expectations, showcasing the Kingdom’s progress in accelerating spending related to Vision 2030 implementation, alongside its careful fiscal management.

The Ministry’s quarterly performance report also revealed an annual 9 percent boost in its non-oil revenues to reach SR293.43 billion, primarily driven by increased taxes on goods and services.

Report data showed these taxes surged by 11 percent to approximately SR70 billion in the specified period. This income source constituted nearly a quarter of total government revenues and approximately 63 percent of non-oil income.

This typically refers to taxes imposed on particular products or services, rather than on individuals or businesses as a whole. Examples include Excise Tax, Value-Added Tax, and specific levies such as those targeting expatriates.

The percentage share of non-oil revenues from the overall government income increased to 38 percent, up from 36 percent in the same quarter of 2023.

The second largest factor driving the non-oil revenue growth is categorized as Other Revenues, which, as per the Ministry’s report, includes income from a variety of sources.

These encompass revenues from other public government units, including the Saudi Central Bank, sales conducted by other entities such as income from advertising and fees from port services, administrative fees, fines, penalties, and confiscations.

Conversely, oil revenues experienced a 2 percent uptick, reaching SR181 billion. However, their percentage share decreased from 64 percent in the same quarter the previous year to 62 percent. This brought total government revenues to SR293.43 billion.

The tightening of oil revenues can be linked to the voluntary oil production cuts adopted by members of the Organization of the Petroleum Exporting Countries and their allies, known as OPEC+. Saudi Arabia announced in March the extension of its 1 million barrels per day cut, initially implemented in July 2023, until the end of the second quarter of 2024.

Government expenditure

Expenditures surged by 8 percent during this period, reaching SR305.82 billion, with non-financial capital expenditure, often referred to as CAPEX, driving much of this growth.

This category saw a substantial 33 percent increase, totaling SR34.5 billion, and it encompasses investments in physical assets like buildings, machinery, and infrastructure, aimed at enhancing the Kingdom’s capacity and capabilities.

The Ministry had indicated in its budget statement in December for the fiscal year 2024 that there will be increased spending during the coming years to expedite the implementation of key programs vital to the objectives of Saudi Vision 2030. Therefore, the quarterly deficit remains within expectations, reflecting prudent fiscal management.

The second most significant factor driving the increase in expenditure is the utilization of goods and services, which surged by 12 percent during this period, reaching SR60.7 billion. Accounting for 20 percent of total expenditure, their substantial share amplified their impact.

This category represents the total amount spent on acquiring goods and services by the government for various purposes, such as operational activities or resale. It reflects the government’s consumption or investment in resources necessary for its operations, excluding any changes in inventory levels.

In third place was the compensation of employees, making up the largest portion of the total at 45 percent, reaching SR137.5 billion. However, its growth during this period was only 3 percent.

According to the Ministry’s report, this refers to the compensation received by an employee for the work they perform, which can be in the form of cash or non-monetary benefits. It includes any social security contributions that the government unit pays on behalf of its employees.

Although subsidies account for a small portion of government spending, at 3 percent, they experienced the highest growth rate, reaching SR8.33 billion, highlighting the Kingdom’s dedication to investments in education, health, and social protection programs.

Additionally, the data revealed that health and social development were the second-largest contributors to expenditure growth, increasing by 20 percent to reach SR60.5 billion, following municipal services.

The Ministry’s report indicated that the deficit will be covered entirely through borrowing. Domestic debt accounted for 60 percent, or SR665.03 billion, of the end-of-period debt balance, while the remaining 40 percent came from external debt, totaling SR450.8 billion.

Compared to advanced economies or G20 countries, Saudi Arabia’s public debt as a percentage of GDP remains relatively low. Additionally, it is well-covered, with government reserves totaling around SR392 billion in the first quarter of this year.

This robust reserve level provides a substantial buffer against any potential financial challenges or economic downturns, enhancing the Kingdom’s fiscal stability and ability to meet its financial obligations.

Startup Wrap – Regional collaboration flourishes in effort to boost digital transformation

CAIRO: Digital transformation is on the cusp as regional companies join hands to further boost this technological development across the Middle East and North Africa.

On top of this week’s partnerships, Saudi Arabia’s Alraedah Digital Solutions, the innovation arm of Alraedah Digital Group, inked a deal with regional fintech ABHI to boost financial inclusion in the Kingdom.

Under the terms of the agreement, Alraedah Digital Solutions will harness ABHI’s advanced technological capabilities to introduce a range of innovative financial services tailored to the Saudi market.

The collaboration will focus on leveraging Alraedah’s deep knowledge of local market dynamics to launch new financing products collaboratively.

Additionally, Alraedah has committed to a substantial financial investment, pledging access to $200 million over three years to support the development and localization of ABHI’s products for the Kingdom.

“We are excited to join forces with ABHI to revolutionize the financial landscape in Saudi Arabia. This partnership underscores our commitment to fostering innovation and driving economic empowerment through strategic collaborations. Together, we aim to redefine access to financial services and empower individuals and businesses across the region,” Paul Melotto, CEO at Alraedah Digital Solutions, said.

Founded in 2021, ABHI specializes in earned wage access, invoice factoring, small and medium sized enterprise working capital, revenue-based financing, and payroll solutions.

To date, ABHI claims to have supported over 1,000 companies, enhancing financial stability for approximately 750,000 employees and processing over $300 million in loans across different regions.

The company is backed by notable investors including Y Combinator, VEF, SpeedInvest, Venture Souq, Global Ventures, and Zayn Capital.

Abu Dhabi’s Comera Financial Holding joins hand with Egypt’s Beltone Holding

Comera Financial Holding, an Abu Dhabi-based group with interests in technology and fintech, has joined forces with Beltone Holding, a prominent financial services provider in Egypt, to enhance digital transformation and customer experience in the North African country.

The strategic partnership focuses on knowledge transfer and the introduction of new digital solutions across the region.

Together, Comera and Beltone aim to develop and deploy advanced products that will elevate customer experiences in various financial sectors, including payments, consumer finance, SME finance, and supply chain financing.

“This collaboration represents a pivotal step forward in our commitment to enhancing digital access and improving financial services for our customers,” Dalia Khorshid, Group CEO of Beltone Holding, said.

The collaboration will leverage both companies’ expertise to introduce cutting-edge technological solutions not only in Egypt but also in other Middle East and North Africa countries.

MoneyHash partners with Visa

US-based, MENA-focused fintech MoneyHash has announced a new collaboration with digital payments firm Visa.

This partnership aims to deliver secure and enhanced digital payments experiences across the region.

By collaborating with Visa, MoneyHash will gain access to an extensive array of Visa’s digital payment solutions, enhancing its service offerings with advanced technologies like network tokenization.

Additionally, this partnership allows MoneyHash to tap into Visa’s vast global reach, capabilities, and renowned security infrastructure.

These elements are crucial to Visa’s mission of connecting the world through an innovative, reliable, and secure payment network, now extending further across the MENA region.

This strategic alliance is set to significantly boost MoneyHash’s capacity to serve its customers with payment solutions.

Dubizzle acquires Drive Arabia

Dubizzle Group, a leading online classifieds platform in the Middle East, has further cemented its position in the automotive sector across the MENA region with the acquisition of Drive Arabia.

Known for its strong brand presence over the past two decades, especially in the UAE and Saudi Arabia, Drive Arabia brings valuable expertise and a loyal customer base to Dubizzle Group.

This acquisition enables Dubizzle Group to enhance its automotive advertising services, introduce innovative new products, and expand its market reach.

The integration of Drive Arabia is expected to significantly bolster Dubizzle Group’s capabilities in meeting the evolving needs of automotive customers across the region.

Egypt’s Swypex secures $4m in seed round

Swypex has announced its emergence onto the financial technology scene with a $4 million seed investment round led by US venture capital fund, Accel.

This investment marks Accel’s first foray into the fintech sector in the region and includes contributions from Foundation Ventures, the Raba Partnership, and several leading industry angel investors.

Licensed by the Central Bank of Egypt, Swypex aims to become the first comprehensive platform aimed at eliminating financial inefficiencies and maximizing business potential in the country.

The platform integrates payments, invoice management, and smart corporate cards into a single system designed to streamline financial operations.

Swypex’s products are tailored to simplify financial management for businesses, allowing them to automate workflows and facilitate easy payments.

The corporate cards offered by Swypex are specifically designed for Egyptian businesses to help reduce costs, enhance operational efficiency, and support scalable growth.

Monsha’at graduates 25 startups from Qassim University

Saudi Arabia’s Small and Medium Enterprises General Authority, also known as Monsha’at, has announced the successful graduation of 25 startups from Qassim University’s business incubator, as part of the University Startups Initiative Program.

The business incubator is designed to facilitate the transition of creative ideas and university graduation projects into market-ready startups capable of securing investments.

During their time in the incubator, the startups managed to increase their client base by 35 percent and successfully secured two investment rounds totaling around SR500,000 ($133,317).

Since its inception in 2023, the University Startups Initiative Program has graduated 75 startups in collaboration with three government universities located in Riyadh, Al-Ahsa, and Qassim.

April startup funding sees sharp decline

Startup funding in the MENA region experienced a sharp decline in April, with only 19 startups raising $55 million.

This represents a 78 percent drop month-on-month from $254 million raised in March, although it marks an 87 percent increase year-on-year, according to Wamda’s Monthly report.

The largest funding amount in April was awarded to Fortis, a UAE-based fintech startup, which secured $20 million in a series A round.

This was followed by WEE, which raised $10 million in a pre-series A round, and Tunisia’s Qodek, which garnered $8 million in its series B round.

Geographically, UAE-based startups led the funding charts with $32 million distributed across six deals, while Egyptian startups received $8.7 million over five deals.

In contrast, Saudi startups saw a noticeable decrease in investment, attracting only $4.8 million across three deals.

Sector-wise, fintech remained the most funded, with four companies raising $25.7 million, $20 million of which was allocated to Fortis alone.

E-commerce startups received $10.5 million across two funding rounds, and an AI firm, Qodek, raised $8 million. Additionally, three Software-as-a-Service providers collectively raised $3.5 million.

In terms of gender representation in funding, disparities remain significant.

Only one female-founded firm managed to secure $100,000, in stark contrast to the $43 million received by male-founded companies, highlighting ongoing challenges in achieving gender parity in the startup ecosystem.

Oil Updates – crude set for weekly gain as demand signs, geopolitics seen as positives

SINGAPORE: Oil rose on Friday, set for a weekly gain, as data this week from the US and China, the world’s two largest crude users, pointed to higher demand and continuing uncertainty over the Gaza war supported prices, according to Reuters.

Falling US crude inventories spurred by higher refinery runs coincided with data released on Thursday showing China’s oil imports in April were higher than last year on signs of improving trade activity.

Negotiations to halt the fighting between Israel and Hamas have yielded no results, keeping alive concerns of potential Middle East supply disruptions.

Brent futures rose 58 cents, or 0.6 percent, to $84.41 a barrel 8:14 a.m. Saudi time and are set for a weekly gain of 1.7 percent. US West Texas Intermediate crude climbed 58 cents, or 0.7 percent, to $79.84, set for a weekly increase of 2.2 percent.

China’s exports and imports returned to growth in April after contracting in the previous month, signalling an improvement in demand.

“Ongoing signs of strength in demand in China should see commodity market remain well supported,” ANZ Research said in a note.

Israeli forces bombarded the city of Rafah in the Gaza Strip on Thursday, Palestinian residents said on Thursday, while an Israeli official said indirect negotiations with Hamas had ended. As the conflict continues, it raises the potential for other Middle Eastern countries to become involved, particularly Hamas’ main supporter Iran, a key producer.

“Israel’s groundwork for an intervention in Rafah and growing tensions on its Northern border are a reminder that geopolitical risks could persist through all of Q2 2024, at least,” Citi analysts said in a note.

Still, the bank’s analysts see prices easing through 2024, with Brent averaging $86 a barrel in the second quarter and $74 in the third quarter amid looser supply and demand fundamentals as there are signs that global oil demand growth “appears to be moderating.”

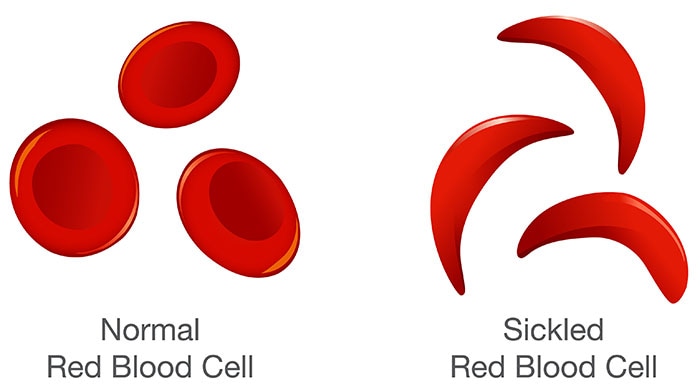

How a Saudi start-up hopes to beat sickle cell disease with an AI-trained gene-editing biorobot

- Sickle cell disease is a genetic blood disorder in which red blood cells are crescent shaped and rigid

- Riyadh-based NanoPalm is combining AI-trained models and nanotechnology to remove faulty genes

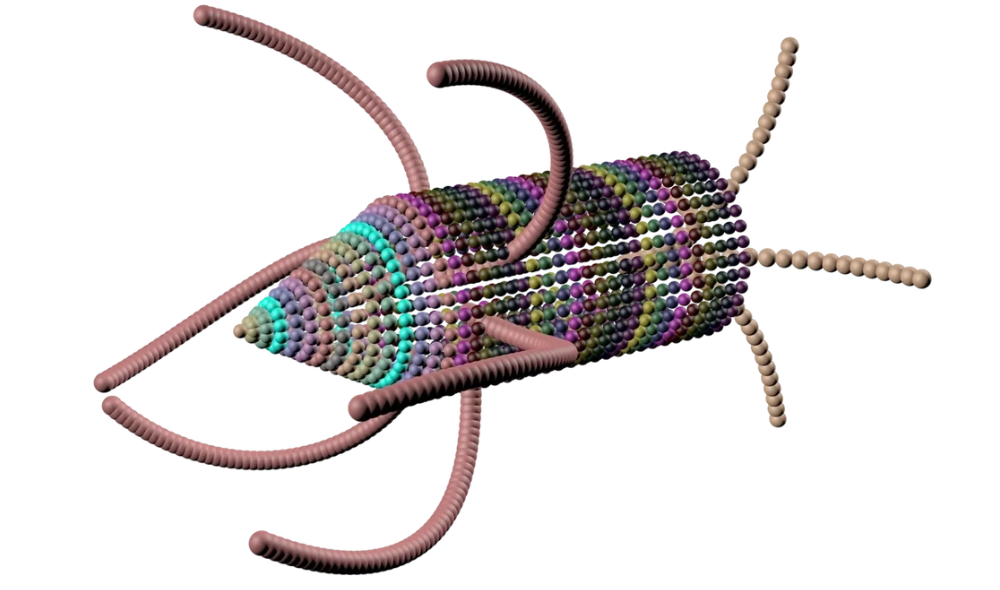

RIYADH: Saudi-based biotechnology company NanoPalm is developing a biorobot using a unique blend of artificial intelligence, nanotechnology, and gene therapy to find a solution for patients with sickle cell disease.

Affecting approximately 20 million people worldwide, sickle cell disease is a genetic blood disorder in which red blood cells are crescent shaped and rigid. Patients with sickle cell experience blocked blood vessels, pain, fatigue, and anemia, impacting their well-being.

Founded in 2022, and headquartered in Riyadh, NanoPalm began life at the King Abdulaziz City for Science and Technology (KACST) before it was incubated by the NextEra initiative.

The biotechnology company is run by the Ministry of Communication and Information Technology in partnership with The Garage — once a car park, now a 28,000-square-meter space that can accommodate 300 startups.

Ali Al-Hasan and Samar Al-Sudir, the founders of NanoPalm, have used their expertise to develop a product that goes beyond treating the symptoms of sickle cell. Their aim is to remove the gene from a patient’s body altogether.

With Al-Hasan’s knowledge of nanomedicine and Al-Sudir’s background in chemistry, the pair were able to bring their combined expertise to bear.

The NanoPalm team spent more than a year collecting data to feed into artificial intelligence models, Al-Hasan told Arab News.

“We explored AI and we found it was a long journey where we needed to create our own data and generate the data that will be used to train AI models,” he said.

“It will predict the best gene therapy and predict its safety, its effectiveness, and cut down the duration of the therapy, while making it affordable.

“Discovery is at the heart of any drug development process in any pharma company. Now it has become digitized and AI enabled.”

In the development of their product, NanoPalm uses three technologies: AI to model and predict, nanotechnology to create the medicine, and gene therapy to edit genetic material.

“We use the manufacturing recipe from the AI and then go to the lab to build a lipid biorobot,” said Al-Hasan.

Opinion

This section contains relevant reference points, placed in (Opinion field)

“It’s like a vehicle. And those lipid biorobots encapsulate genetic materials such as mRNA and other RNA molecules, which act like scissors to remove the gene that we want to remove.

“When patients come to the clinic, they usually get an IV infusion of biorobots encapsulating genetic materials for four hours and then go home. The biorobots will then navigate their body and find where the disease is. They go after cells responsible for sickle cell.”

NanoPalm has set out to revolutionize the biotech industry. Al-Hasan said the company’s mission is to make treatment more cost-effective.

“As we dove into this problem, we found two important facts,” he said. “Sickle cell disease is not the only genetic disease. There are 6,000 other genetic diseases that have no known cures.

“The second problem is that the current gene therapies are ineffective. They are super expensive. The patients would have to be rich to afford gene therapies, for example, because sickle cell patients would have to pay $2.2 million to get one injection.”

NanoPalm is collaborating with KACST, King Saud University, and the National Guard Hospital to treat 15 sickle cell patients from Saudi Arabia.

Al-Hasan says some 42,000 Saudis stand to benefit from NanoPalm’s product when it is launched in 2030.

China’s exports and imports return to growth

- Shipments from the country grew 1.5 percent last month by value: data

RIYADH: China’s exports and imports returned to growth in April after contracting in the previous month, signaling an encouraging improvement in demand at home and overseas.

The data suggests a flurry of policy support measures over the past several months may be helping to stabilize fragile investor and consumer confidence.

Shipments from China grew 1.5 percent year on year last month by value, customs data showed on Thursday, in line with the increase forecast in a Reuters poll of economists. They fell 7.5 percent in March, which marked the first contraction since November.

Imports for April increased 8.4 percent, beating an expected 4.8 percent rise and reversing a 1.9 percent fall in March.

“Export values returned to growth from contraction last month, but this was mainly due to a lower base for comparison,” said Huang Zichun, China economist at Capital Economics.

“After accounting for changes in export prices and for seasonality, we estimate that export volumes remained broadly unchanged from March,” she added.

In Q1, both imports and exports rose 1.5 percent year on year, buoyed by better-than-expected trade data over the January-February period. But the weak March figures prompted concerns that momentum could be faltering again.

Crude oil imports

China’s crude oil imports rose on the previous year in April, as refiners prepared for a fully recovered Labor Day holiday travel season, official data showed on Thursday.

Crude imports in April totaled 44.72 million tonnes, or about 10.88 million barrels per day, according to data from the General Administration of Customs.

That represented a 5.45 percent increase from the relatively low 10.4 million bpd imported in April 2023.

China saw more than 1.3 billion passenger trips over the five day Labor Day holiday that began on May 1, up 2.1 percent from a year earlier, state media outlet Xinhua reported.

Highway traffic was up 2.1 percent while air trips surged 8.1 percent, Xinhua said.

Domestic airline seat capacity in April was up 1.3 percent on last year, data from consultancy OAG showed.

China’s manufacturing sector continued to see muted recovery in April.

Natural gas imports for April rose 14.7 percent from a year earlier to 10.30 million tonnes, data showed.

Prices of liquefied natural gas for Asia at the end of April were down 11.3 percent on the same period last year, and down 43 percent from last year’s peak in October.

Customs data also showed exports of refined oil products, which include diesel, gasoline, aviation fuel and marine fuel, were up 21.46 percent from a year earlier at 4.55 million tonnes.

Coal imports

China’s coal imports rose in April fueled by lower domestic production and greater buying by power generators to swell stockpiles ahead of the peak summer demand season.

Shipments of coal into the world’s largest consumer of the fuel were 45.25 million tonnes last month, up 11 percent from 40.68 million a year earlier.

That was up by 9.4 percent from March and 2 million tonnes less than December’s record of 47.3 million tonnes.

The boost in imports is partly because domestic coal production has not increased to meet demand, said Feng Dongbin, an analyst with consulting firm Fenwei.

China’s coal output fell 4 percent on the year during the first quarter, the most recent data shows, in part because of a string of deadly accidents that forced mines in the top coal-producing province of Shanxi to halt operations for safety inspections.